👀 What Top Founders Actually Watch

💰Stop Pitching the Wrong Investors

In This Edition:

- 👀 What Top Founders Actually Watch

- 📈 From Zero to $1.4B

- 💰Stop Pitching the Wrong Investors

- 🎯 Who Still Gets Funded

- ⚡AI Tools Running Sales

👀 What Top Founders Actually Watch

⚡The Conversations Behind Iconic Companies

Building a startup in 2026 demands more than speed—it requires judgment shaped by real experience. The most valuable lessons aren’t found in threads or headlines, but in long-form conversations with founders and operators who’ve faced high-stakes decisions firsthand.

This curated watchlist brings together rare interviews and talks from leaders who built category-defining companies and navigated scale, failure, power, and reinvention. These sessions reveal how great companies are actually built, what breaks during growth, how decision-making evolves under pressure, and which mindset shifts separate early traction from long-term dominance.

From Elon Musk and Sam Altman to Paul Graham, Jensen Huang, and Mark Zuckerberg, each conversation offers practical insight founders can apply immediately.

- Elon Musk: How to Build the Future

- Sam Altman: How to Build the Future

- Paul Graham: Before the Startup

- Ben Horowitz: Foundation 23

- Mark Zuckerberg: Joe Rogan Experience

- Neal Mohan: CEO of YouTube

- Marc Andreessen: Joe Rogan Experience

- Don Valentine (Sequoia Capital): Target Big Markets

- Marissa Mayer: Scaling Google and Yahoo

- Peter Thiel: PayPal, Politics & the Importance of Being Individual

- Jensen Huang: Founder and CEO of NVIDIA

📈 From Zero to $1.4B

🔥From Pivot Hell To $1.4 Billion Unicorn

Most startups never escape their first idea. PostHog escaped six.

This Founder Firesides episode breaks down how PostHog went from a last-minute YC W20 application to a $1.4B unicorn—not by chasing trends, but by staying obsessively close to users and leaning into radical transparency.

What stands out in James Hawkins’ journey:

🚧 Surviving Pivot Hell

Six months of failed ideas nearly broke momentum—but persistence created clarity.

🔓 The Open-Source Breakthrough

Open-source analytics unlocked trust, adoption, and a wedge into a crowded market.

📈 Momentum Over Perfection

Progress came from shipping, listening, and adjusting fast—not waiting for certainty.

🎯 Brand as a Growth Lever

Humor, honesty, and a distinct voice helped PostHog stand out in a sea of sameness.

The core takeaway:

Enduring companies aren’t built by avoiding chaos—they’re built by navigating it with speed, customer closeness, and conviction.

Building, pivoting, or stuck in between? This conversation is required viewing. Watch it, share it, and take notes—before the next pivot forces clarity anyway.

MarketBeat releases Top 10 Stocks to own report

While the crowd’s chasing yesterday’s headlines, the real money’s brewing in the shadows.

2025’s megatrends - AI’s takeover, consumer empires doubling down, aerial taxis rewriting travel - are already here.

And Wall Street’s too busy navel-gazing to notice.

Our 10 Stocks Set to Soar in 2025 report cracks the code on those megatrends, giving you the name and ticker of the companies at the forefront of each one.

MarketBeat’s analysts sifted the chaff to deliver these 10 picks…

And they could very well be your ticket to profits the masses will miss.

Free today, after that, it’s strictly for paid members.

Act now or watch from the sidelines later!

Get your report here!

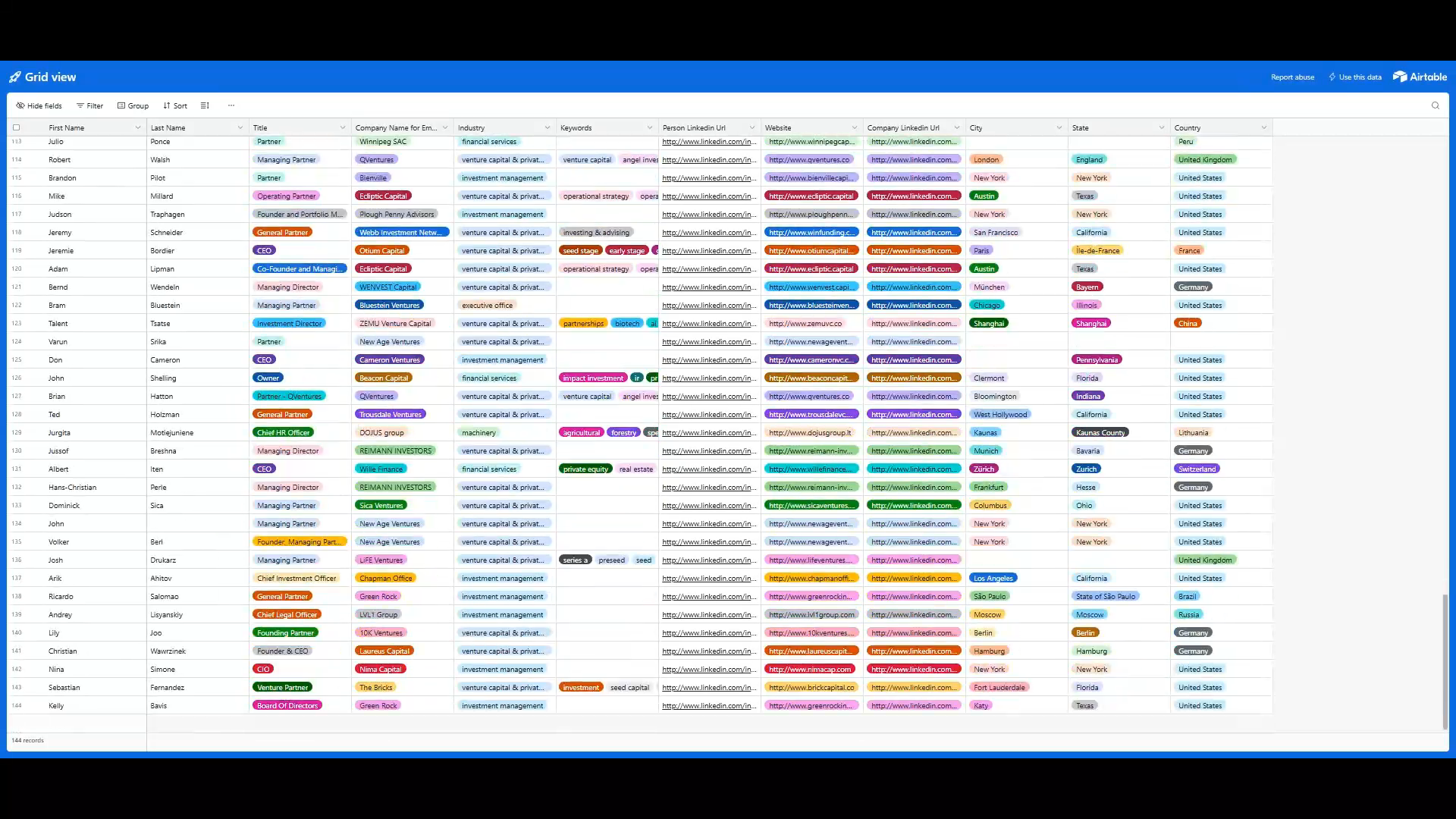

💰Stop Pitching the Wrong Investors

🚀 Stop Pitching the Wrong Investors

Most founders burn weeks pitching investors who were never going to move fast. Long VC cycles, committee approvals, and rigid fund rules quietly slow momentum during a raise.

Family offices play a different game.

They invest on conviction, think long-term, and often write early-stage checks without forcing founders through months of process. Many bypass partner meetings entirely and focus on alignment, trust, and upside.

That’s why smart founders are shifting outreach toward family offices that actively deploy capital at pre-seed and seed.

A curated list of 1,000+ family offices—complete with decision-makers, focus areas, and direct contact paths—can eliminate guesswork and compress fundraising timelines dramatically.

Raising right now? Stop chasing maybes. Get in front of real check-writers—before your competitors do. 👉 Explore the full list.

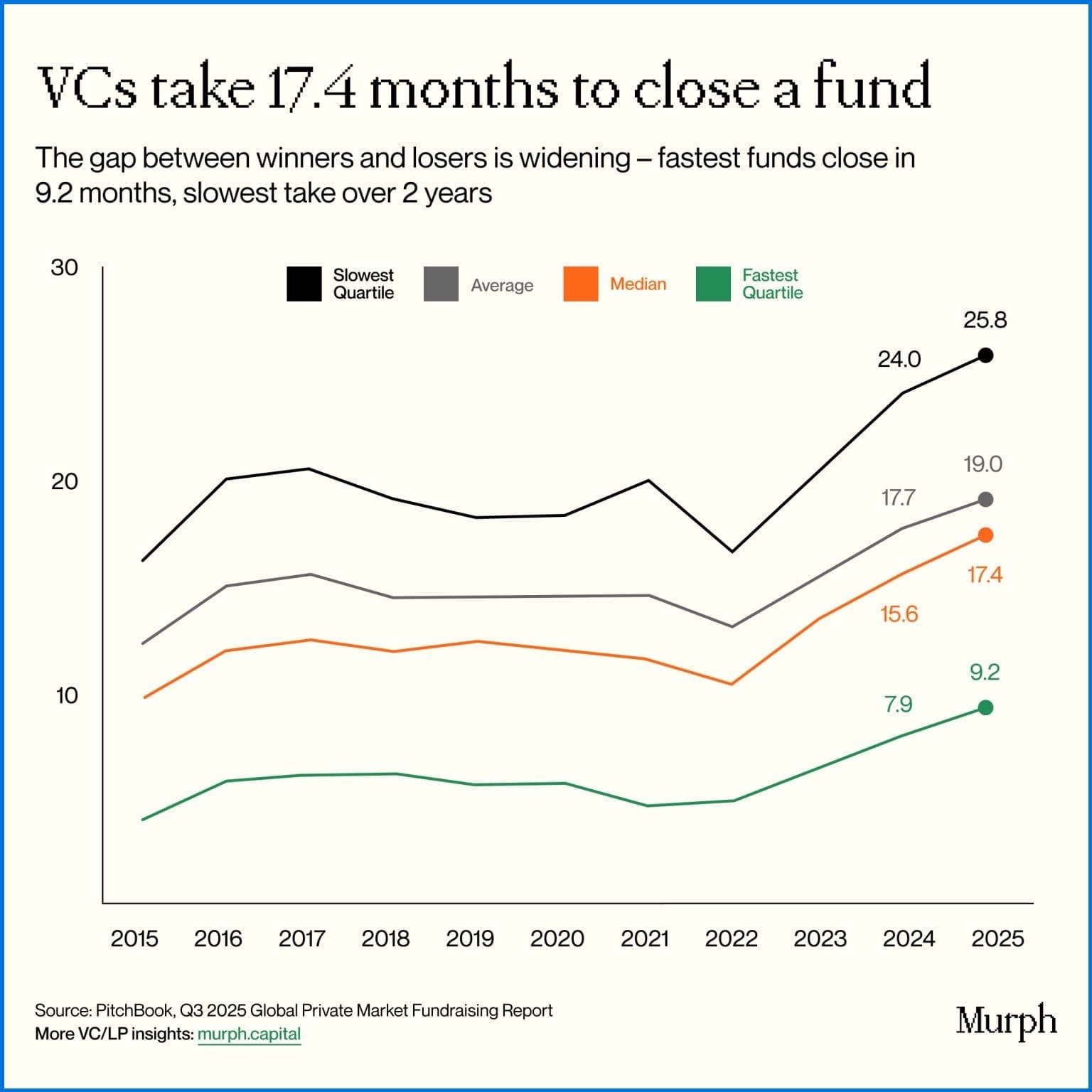

🎯 Who Still Gets Funded

💰Venture capital industry update/fundraising market analysis

VC fundraising is slowing to a crawl—and the data explains why. In 2025, funds are taking 17.4 months on average to close, marking the longest sustained downturn in over a decade. Capital is concentrating at the top, with a handful of mega-firms absorbing billions while mid-sized managers struggle through multi-year raises.

Behind the numbers, a broken exit cycle has frozen LP re-ups, widened the gap between fast and slow fundraises, and reshaped global capital flows back toward the U.S. Only two models are winning right now: proven giants and sharply focused emerging funds. Everyone in the middle is getting squeezed.

For GPs eyeing 2026, entitlement is gone—edges matter.

Raising a fund or backing one? Read the full breakdown before the market leaves you behind.

⚡AI Tools Running Sales

🧠AI Sales Funnel: Tools Replacing Manual Hustle

Modern sales teams aren’t scaling by hiring more reps—they’re scaling by fixing the funnel with AI. From pipeline visibility to deal coaching and buyer intent, these tools quietly remove friction across every stage of revenue.

Here’s a snapshot of AI tools reshaping the sales funnel end to end:

🔹 Breakcold – Social selling + CRM in one

🔹 Leadbright – AI-powered lead discovery

🔹 CaliberMind – GTM analytics and attribution

🔹 Penny – AI copilots for sales conversations

🔹 DealCoach – Deal strategy and coaching

🔹 Conversica – AI assistants that follow up at scale

🔹 Alore.io – Outbound automation and sequencing

🔹 Salesbox AI – Predictive sales acceleration

🔹 Factors – Buyer intent and account intelligence

🔹 Twik – Website personalization for conversions

🔹 RevSure – Revenue operations and forecasting

The takeaway? Sales velocity today is less about effort—and more about systems.

Building or upgrading a sales stack? Explore these tools before competitors automate your pipeline first.

🔁 ICYMI — Founder Favorites You Shouldn’t Miss

These high-impact guides, investor lists, and fundraising playbooks continue to help founders sharpen strategy, close capital, and build with clarity. Each one unlocks insights that ambitious operators rely on to stay competitive.

🔥 The Ultimate Fundraising Resource Stack

A complete toolkit to level up your fundraising workflow.

👉 Explore the full resource stack

⚡ The Most Overlooked Key to Fundraising Success

YC’s hidden mental model that top founders use to win early.

👉 Learn the YC mindset shift

💡 What Sam Altman Wants Every Founder to Know

A concise playbook for building in the AI era.

👉 See Altman’s founder principles

📊 Venture Math Demystified — How VCs Really Value Startups

Understand valuation the way investors actually do.

👉 Break down VC math

🏦 100+ VCs & Accelerators You Should Know

A high-signal directory of investors actively backing high-growth founders.

👉 See the full investor list

🔥 Ben Horowitz’s High-Stakes Leadership Playbook

How elite founders lead under pressure and build resilient teams.

👉 Study the leadership framework

💰 29 Angels & VCs Funding AI Startups Right Now

A curated list of investors currently writing AI checks.

👉 Find AI-focused investors

📈 50 Recently Funded B2B Startups

A signal-rich snapshot of emerging trends and fresh opportunities.

👉 See recently funded startups

👼 Top 300 Angel Investors Database

A curated list of high-signal angels across sectors.

👉 See the top 300

🔥 Top 500 Active Angel Investors Globally

A global view of the investors writing the most checks.

👉 Browse the top 500

💎 Top 100 Angel Investors Database

A focused list of the most influential early-stage angels.

👉 Explore the top 100

📊 Top 200 Most Active Angel Investors

A high-leverage directory for serious fundraising outreach.

👉 View the top 200

Dive into these high-value resources, bookmark the ones that sharpen your strategy, and share the list with founders in your network who are raising, building, or scaling. The right insight at the right moment can change everything.

🔥WEB PICKS

Sam Altman said OpenAI will prioritize enterprise adoption in 2026, marking a shift from impressive models to fully sellable workflows. Separately, OpenAI also plans to launch an “adult mode” capable of generating erotica in Q1 2026—likely not part of the same enterprise push.

Google rolled out a beta of live, speech-to-speech translation that works with any headphones via Translate for Android, now live in the U.S., Mexico, and India.

Intel is reportedly in advanced talks to acquire AI chip startup SambaNova in a deal valued around $1.6B, including debt.

OpenEvidence is reportedly raising at a $12B valuation after hitting $150M in annualized ad revenue—up 3× since August.

OpenAI revealed that a four-engineer team shipped Sora for Android in just 28 days using Codex, reached #1 on Google Play, and saw users generate over 1M videos in the first 24 hours.

Every shared five patterns from building with Claude Opus 4.5, arguing the real unlock is end-to-end project completion—and that taste, not syntax, is now the bottleneck.

Howard Marks noted AI can be both real and overheated, warning that leverage—not innovation—is where bubbles become dangerous.

Anand Sanwal argued AI cheating is now normalized, meaning education must rethink assessment rather than attempt stricter enforcement.