🔥Why Good Ideas Still Fail

🎯 Most startups don’t die from bad ideas

In This Edition:

- 🎯 $10B AI Checks Are Back

- 💰 2026 Funding Signal Founders Miss

- 🧠 The Zero-to-One Blindspot

- ⚡ Build Apps Inside Chat

- 🔥 Why Good Ideas Still Fail

- 📈 Why 30% Growth Gets Ignored

🎯 $10B Checks, $350B Valuations, and a New AI Reality

💰 If You’re Raising in 2026, Read This Funding Signal

Capital is moving fast—and in very different directions this week:

- Anthropic is reportedly raising $10B at a $350B valuation, nearly doubling its value in just four months. GIC and Coatue are leading the round, signaling continued mega-check conviction in frontier AI.

- Character.AI and Google have agreed to settle lawsuits with families of teenagers harmed after using the chatbot. The cases could become landmark precedents around AI safety and liability.

- Warner Bros. Discovery rejected Paramount’s $108B debt-heavy bid, calling it “illusory,” and reaffirmed support for Netflix’s $82.7B offer, underscoring how capital structure now matters as much as headline valuation.

Healthcare & Biotech Funding Highlights

- Corsera Health (Boston) raised an $80M Series A, co-led by Forbion and Population Health Partners, to advance preventive RNAi medicines for cardiovascular disease.

- Soley Therapeutics (South San Francisco) secured a $200M Series C, led by Surveyor Capital, to develop first-in-class oncology drugs using cell stress sensing.

- Spiro Medical (Irvine, CA) closed a $67M Series A, co-led by Andera Partners, Omega Funds, and Sherpa Healthcare Partners, to treat asthma via pulmonary neuromodulation.

Global SaaS

- Swap (London) raised a $100M Series C, co-led by DST Global and ICONIQ Capital, to unify global e-commerce operations across shipping, returns, inventory, tax, and compliance. Total raised: $149M.

Looking for early believers to back your startup? 👇

⚡Build Apps Inside Chat (No Code)

🚀 Claude Now Lets You Build Apps Inside Chat — No Code Required

Claude now lets founders build, host, and share interactive apps directly inside the chat—no coding, no subscriptions, just prompts.

How it works (2 minutes):

- Go to claude.ai and sign in

- Click Artifacts

- Enable the feature

- Hit Create new artifact

- Pick a category and start building

Example App You Can Build Instantly

- Interactive Content Calendar Generator

Create a drag-and-drop calendar for social teams to:- Choose content types (video, carousel, thread)

- Tag platforms (Instagram, LinkedIn, TikTok)

- Add quick captions

- Get day-of-week post ideas via tooltips

- See a weekly summary view

Why it matters for founders

- Prototype tools without engineers

- Turn ideas into shareable demos in minutes

- Validate workflows before building full products

This quietly turns chat into a lightweight app builder—perfect for MVPs, internal tools, and fast experiments.

The Zero-to-One Lesson Founders Ignore

What Zero-to-One Founders Understand That Others Don’t

Most startups don’t fail because of bad execution.

They fail because they think inside the same mental boxes as everyone else.

Peter Thiel’s core insight still holds in 2026: breakout companies are built by founders who move from zero to one, not from one to slightly better one.

That means:

- Creating something genuinely new, not copying what already works

- Owning a niche before chasing scale

- Building monopolistic advantages through differentiation, not competition

- Treating distribution as a core product decision, not an afterthought

- Thinking in decades, not funding cycles

The biggest risk today isn’t moving too slowly.

It’s building the same thing with better branding.

Founders who win don’t play defense.

They act on insights others overlook—long before the market agrees.

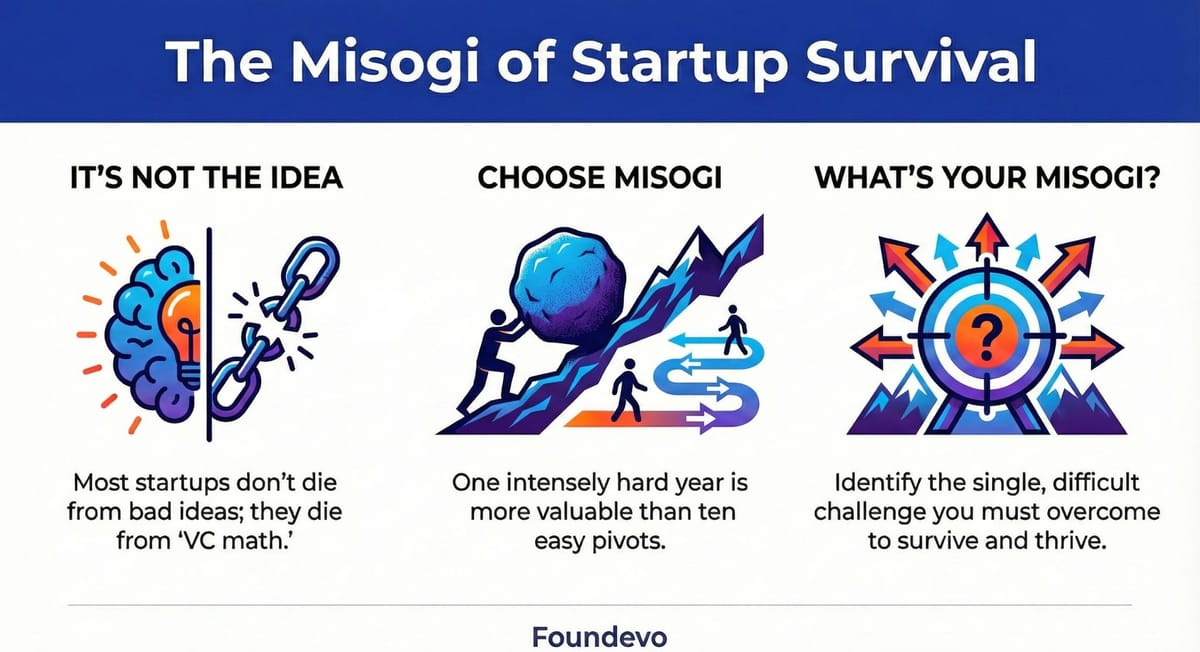

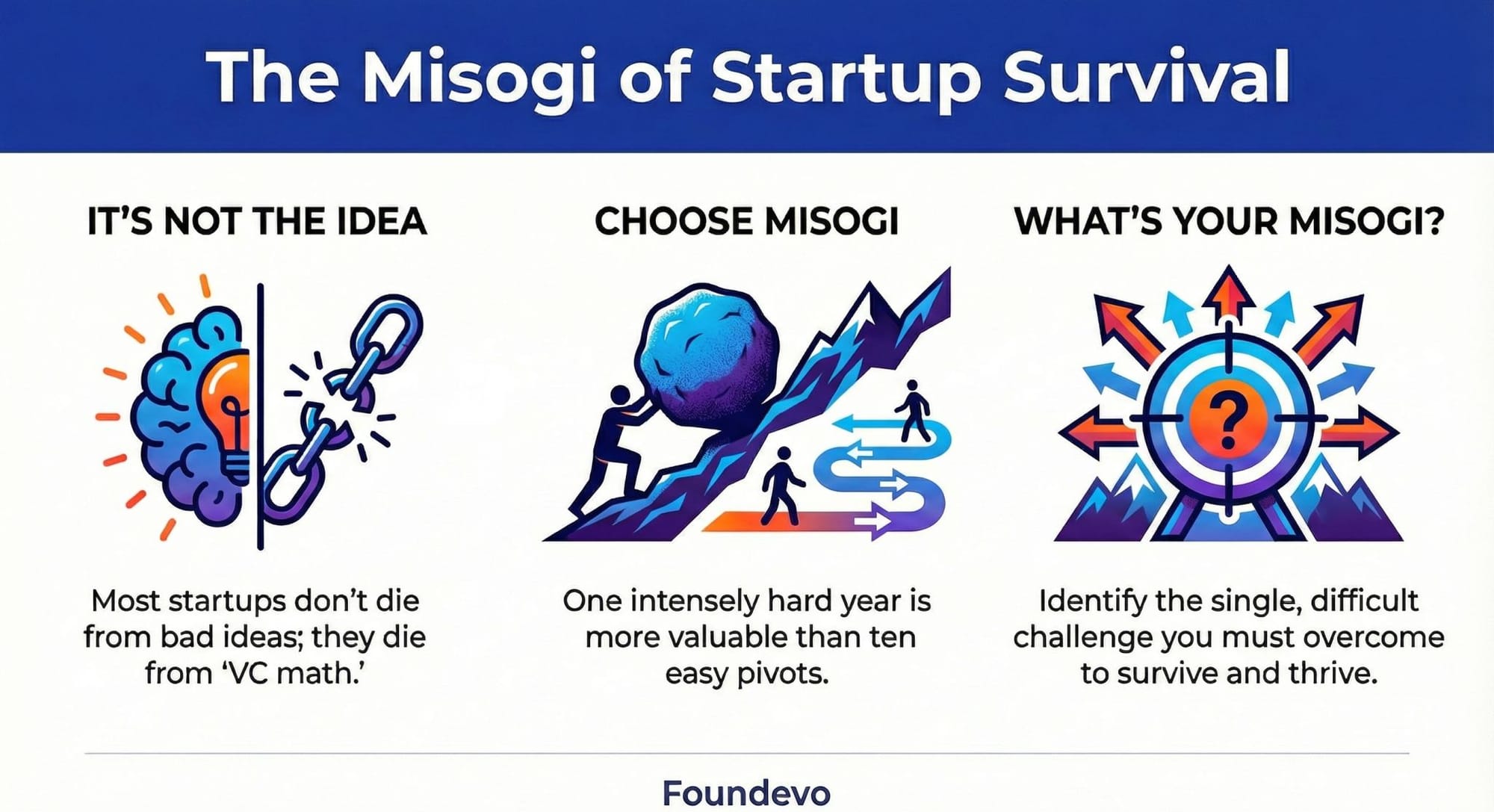

🎯 Most startups don’t die from bad ideas

🎯 Why “Good Ideas” Still Kill Startups

Most startups don’t fail because the idea is bad.

They fail because the idea can’t scale fast enough to satisfy VC math.

Gumroad is the rare counterexample.

After early hype, strong traffic, and top-tier funding, growth stalled—but burn didn’t. Instead of chasing vanity metrics, Sahil Lavingia made the unpopular call: shrink the team, slow ambition, and rebuild for sustainability.

That decision became a founder misogi—one hard, uncomfortable year focused on survival, not storytelling.

No growth hacks.

No pretending.

Just serving customers who were already paying.

Years later, Gumroad crossed $10M+ ARR with a tiny, profitable team.

Founder lesson:

Sometimes the smartest way to scale… is not scaling at all.

One honest year can permanently change how you build.

🎯 Startups Buzz

⭐Why Smart Founders Keep Building Bad Startup Ideas

A classic founder trap: great people + weak ideas.

While reviewing hundreds of early-stage applications, a familiar pattern emerged—talented founders building things that feel interesting, but not things customers will actually pay for. This usually happens because founders:

- Fall in love with the first idea they think of

- Confuse what’s cool with what’s commercial

- Avoid big markets out of fear of competition

- Choose “safe” ideas instead of painful, valuable problems

The biggest insight?

Time invested ≠ idea quality.

Just because you’ve worked on something for weeks doesn’t make it worth pursuing.

The winning shift happens when founders stop asking:

“Is this interesting?”

…and start asking:

“Is this the most valuable problem we could solve right now?”

“A hacker who has learned what to make, and not just how to make, is extraordinarily powerful.”https://t.co/0cf8SXcIjk pic.twitter.com/1w11tS7dqV

— Y Combinator (@ycombinator) December 24, 2025

Startups win when exceptionally smart people work on unglamorous, high-value problems. Or as the timeless mantra goes:

👉 Make something people want.

🎯Above 30% Growth, Investors Stop Understanding the Story

Why markets still underprice elite growth

According to David George from Andreessen Horowitz, once a company crosses ~30% growth, the market still doesn’t fully reward it.

Not because growth isn’t valuable—but because it’s hard to model.

Investors struggle to build 5–10 year forecasts where high growth persists. Even iconic companies like Google or Visa would’ve looked “unrealistic” on a spreadsheet if someone had modeled them growing 15–20% for decades.

Founder takeaway:

Markets are conservative. Breakout companies are not.

If you’re compounding at high growth, don’t expect instant validation from public multiples—the real value often shows up later, not when the growth first appears.

🔥WEB PICKS

🚀 LinkedIn’s Artisan AI Ban Was Real — But It’s Back Online

AI sales-agent startup Artisan was briefly banned by LinkedIn over platform usage concerns. After making compliance changes, the company is back.

A sharp reminder of how fragile distribution is for AI startups building on big platforms.

linkedin just deleted a $46M funded company

— paolo trivellato (@paolo_scales) January 6, 2026

artisan. 35+ employees. company page gone. founding team profiles deleted. all of it.

💰 Shopify Challenger Swap Raises $100M in Just 6 Months

E-commerce platform Swap secured $100M only months after a $40M raise.

Investors are betting big on AI-powered tools that simplify global commerce and operations.

🎯 Where VCs Believe AI Startups Can Still Win vs OpenAI

Investors argue startups don’t need to outbuild OpenAI — they need to out-focus it. Consumer workflows, niche use cases, and service-driven experiences remain open ground.

🌡️ How Quilt Cracked a Major Heat Pump Bottleneck

Climate startup Quilt used dense sensor data and software updates to improve heat-pump efficiency.

A strong example of AI-driven insight transforming physical infrastructure.

🎙️ Consumer AI Bets OpenAI Is Unlikely to Kill

Investors discuss which consumer AI products can survive alongside dominant platforms.

The takeaway: differentiation, UX, and niche value still matter.