🏆 Why Founders Raise Wrong

🔥 Fundraising Secrets VCs Hide

In This Edition:

- 🏆 Why Founders Raise Wrong

- 🔥 Fundraising Secrets VCs Hide

- 🚀 AI Sales Competitive Edge

- 📐 Fundraising Is Pure Math

- 🔥 Blueprint Behind Fundable Startups

- 🏆 Founders Choose Ownership

🏆 Why 99% of Founders Raise the Hard Way

🔥 How Top Founders Engineer Fundraising Momentum

What if your startup isn’t stuck because of the idea—but because of a broken fundraising process?

Brett Adcock—founder of Figure AI, Archer Aviation, and Vettery—has raised $1B+ across multiple companies. His biggest insight is surprisingly simple:

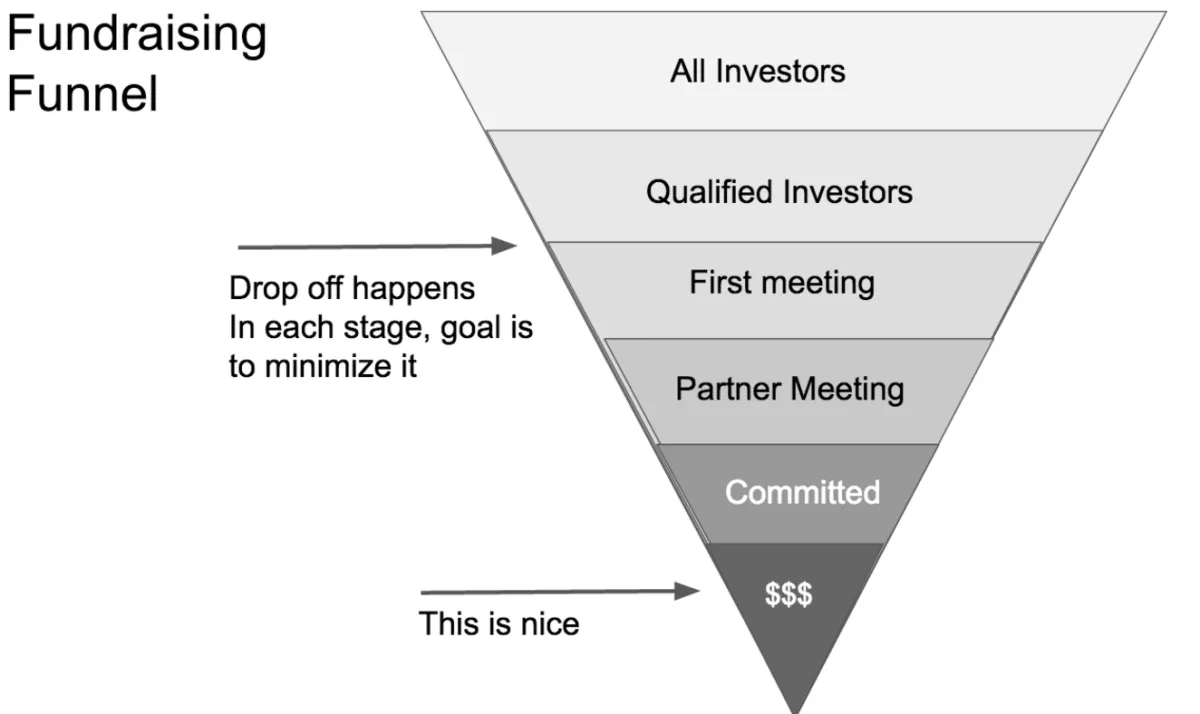

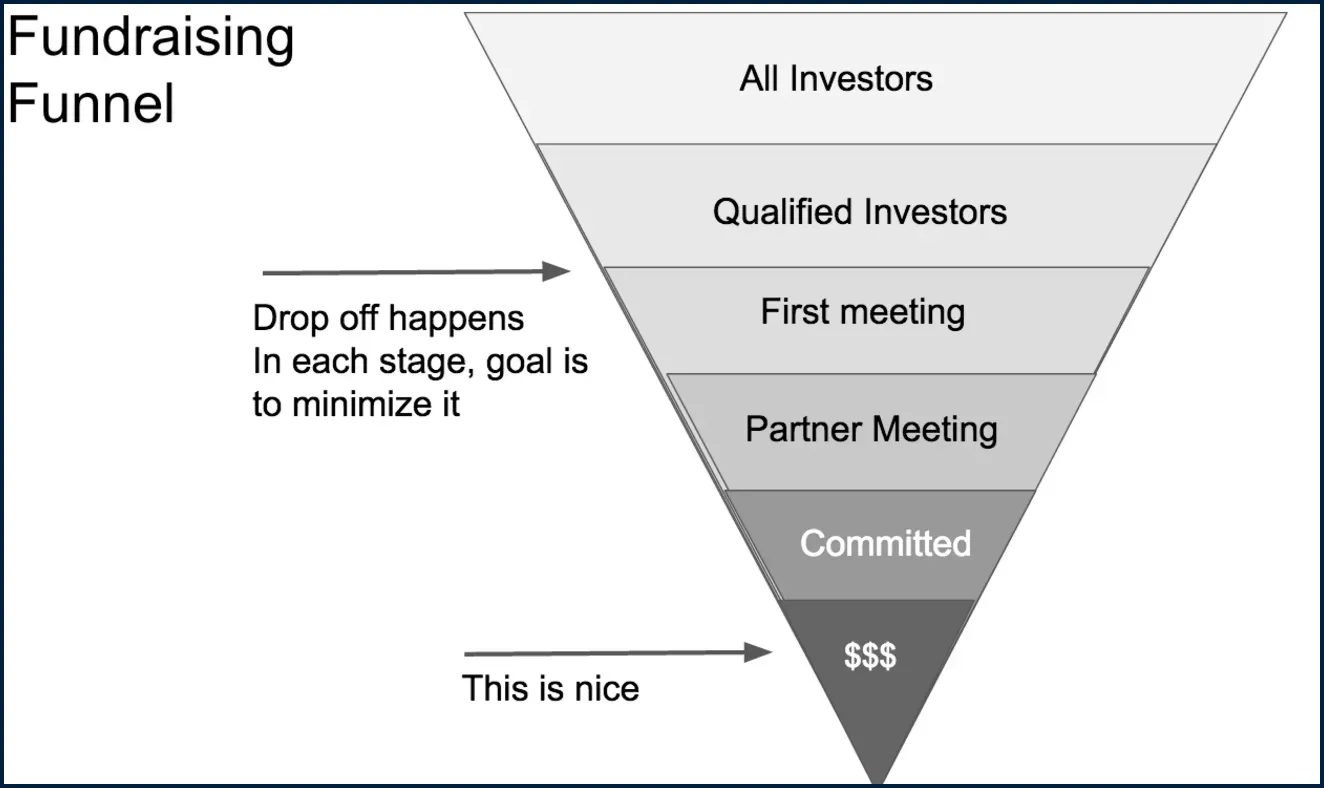

Fundraising isn’t magic. It’s math.

📐 The Core Formula

Fundraising =

(Qualified Investors) × (Outreach) × (Brand & Idea) → Investor Meetings

Most founders fail here—not due to weak products, but weak systems.

💡 What Actually Moves the Needle

- Max investor coverage wins

Don’t rely only on warm intros. Map every qualified investor. More coverage = more chances. - Outreach is a sales function

Cold emails, DMs, intros—track everything. Optimize like a growth funnel. - Narrative beats noise

A sharp story + clear pitch deck dramatically improves conversion. - Expect brutal conversion rates

This is normal. Fundraising often means 200 conversations to get one “yes.”

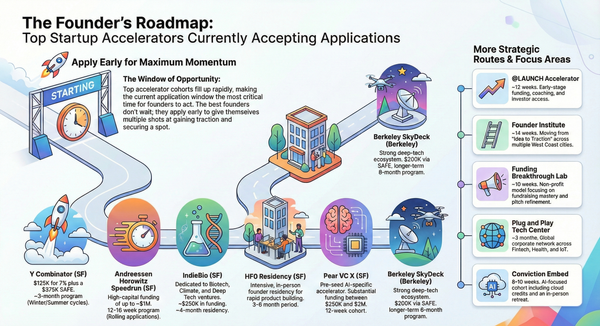

🧩 The Brett-Style Execution Plan

- 30 days: Build a complete, qualified investor list

- Next 30–60 days: Run outreach + meetings in parallel

- 10 days: Secure a fast-moving lead investor

- 30 days: Close the entire round with momentum

🚀 What Founders Usually Miss

- 80% of meetings should come from outbound, not intros

- Slow investors = low interest (hot deals move fast)

- Momentum is the real currency—protect it at all costs

Fundraising is a repeatable, structured process, not a gamble.

Master the system, and your odds of raising capital—quickly—increase dramatically.

👉 Want the full breakdown? Dive into the attached playbook and upgrade your fundraising strategy today.👇

🚀 AI Sales = Competitive Edge

🔥AI Sales Tools Power Faster Growth

Most sales teams think they need more leads.

But the truth?

They need better systems.

AI sales assistants are quietly becoming the edge that top-performing teams rely on — automating prospecting, personalizing outreach, and even coaching reps live during calls.

🧩 What’s changing the game? Game-changing tools to watch:

- Clay – Builds ultra-qualified lead lists in minutes.

- Reply.io – Sends human-like outreach across email, calls, and social.

- Humanlinker – Creates hyper-personalized messages with buyer insights.

- Attention & Oliv AI – Coach reps live during calls with real-time cues.

- Piper – Auto-captures call notes, action items, and summaries.

- Unify – Enriches and prioritizes leads instantly.

AI isn’t replacing your sales reps — it’s removing the busywork so they can close deals faster. Teams using these tools now will outperform everyone still stuck in manual workflows.

👉 Don’t wait for your competitors to get ahead. Explore the full list of game-changing AI sales assistants and choose the one that can elevate your sales engine today.

🔥 ICYMI: Funding Gold You Shouldn’t Miss

Missed these founder-favorites? Catch up before everyone else does — these resources are powering smarter fundraising, tighter pitch decks, and faster checks.

- 🚀 Fundraising Resources 2.0 — Updated tools every founder should bookmark.

- 🎤 VC Questions & How to Answer Them — The ultimate guide to acing partner meetings.

- ⚙️ 40+ Time-Saving AI Tools for Founders — Automate the busywork, focus on the build.

- 🏦 Best VC Firms for Startups — Curated list of partners who actually write checks.

- 💳 22 Startup Programs With Free Credits & Trials — Save $$$ and extend your runway.

- 🧰 The Ultimate Fundraising Toolkit — What top founders secretly use.

- 🧩 YC Founder’s $4.5M Pitch Decks — Open-source inspiration for your next raise.

- 📘 The Pre-Seed Playbook — Nail your very first raise like a pro.

- 👼 2,500+ Angel Investors in AI & SaaS — Verified & ready to back founders.

- 💸 Costly Fundraising Mistakes From a $13M Raise — Avoid these before you burn cash.

- 📊 490+ Real Startup Pitch Decks — Actual decks that closed funding.

- 🎓 Harvard’s Startup Guide — Turn ideas into real-world impact.

- 📚 Ultimate Fundraising Resource Stack — Everything you need in one place.

- 📅 2025’s Unmissable Startup Funding Opportunities — Apply before deadlines hit.

- 🔑 The Most Overlooked Key to Fundraising Success — Fix this to unlock investor trust.

- 🔥 Paul Graham’s ‘Small, Intense Fire’ — The founder mindset that attracts capital.

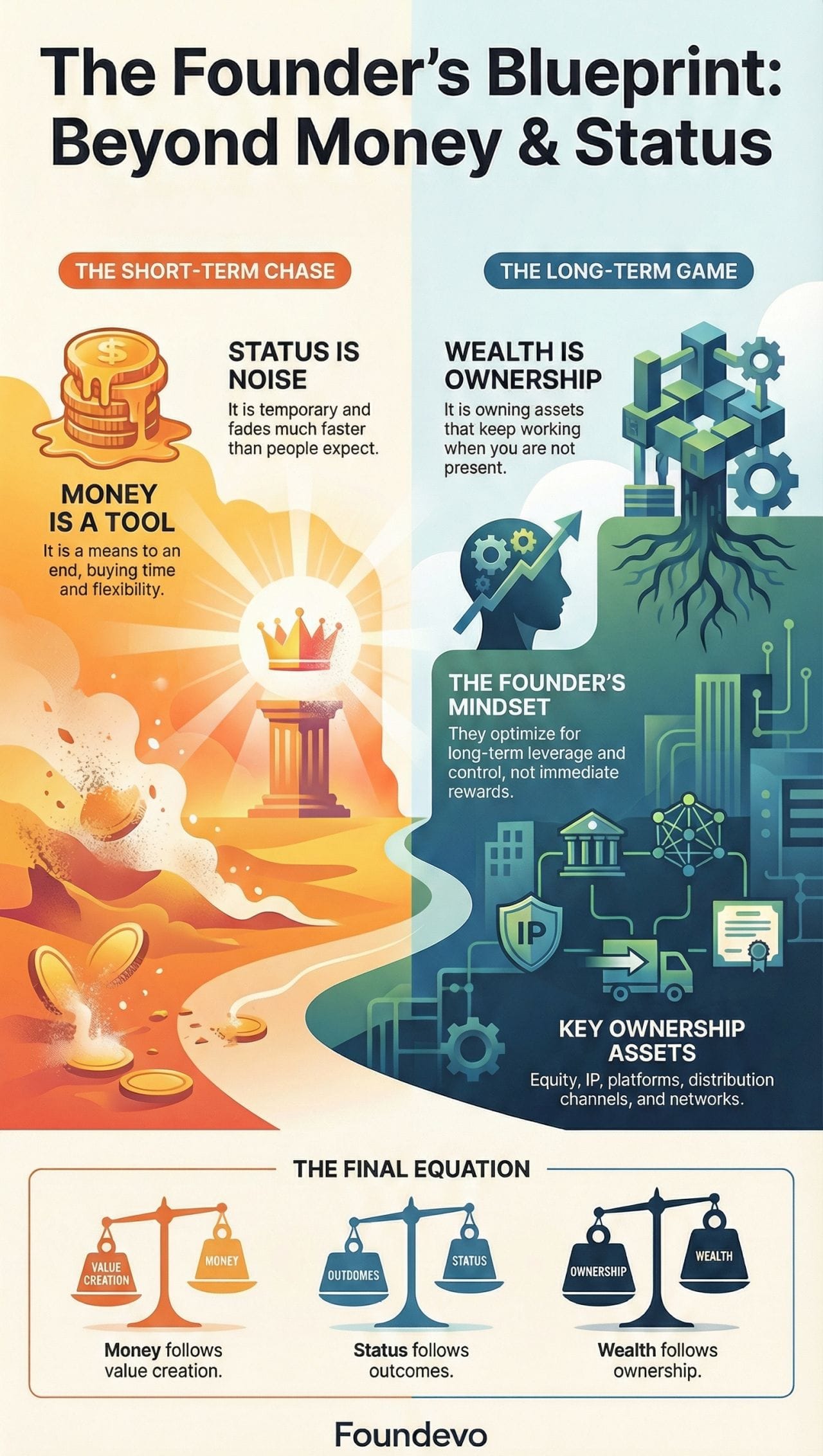

🏆 Why Founders Choose Ownership

🚀 The Founder’s Blueprint: Beyond Money & Status

Most people chase money.

Some chase status.

The best founders focus on ownership.

After watching startups grow—from early traction to unicorn scale—one truth keeps showing up: lasting wealth isn’t built through salaries or applause. It’s built by owning assets that compound over time.

Money is just a tool.

Status is temporary.

Ownership creates leverage.

Equity, IP, platforms, distribution, and defensible networks are what turn small beginnings into enduring companies. The founders who win long-term are willing to earn less early, stay invisible longer, and make decisions that only pay off years later.

They’re not optimizing for income.

They’re building assets.

The takeaway: value creation comes first.

Money follows. Status comes later.

👉 Want to think like enduring founders? Study how ownership, not status, creates lasting wealth.

🎯 Startups Buzz

🔥 The Fundraising Secrets VCs Never Admit

What if the biggest reason investors aren’t funding you… is something you haven’t even noticed yet?

Most founders believe fundraising boils down to a crisp pitch deck and a good story. But Marc Andreessen—co-founder of Andreessen Horowitz—says the truth runs far deeper. In one of his most insightful Stanford talks, he reveals the hidden strategies elite founders use to raise capital faster, with fewer mistakes, and with far more leverage.

Here are the 5 rules Marc insists every founder must master:

- They’re your rehearsal room—helping refine your narrative before you face partner-level scrutiny.

- Momentum creates leverage. Desperation kills deals instantly.

- Real traction, sharp insights, and mastery of your market convert far better than hype ever will.

- Fast fundraising isn’t luck—it’s familiarity. The best founders are already known when they start raising.

- If you’re scrambling when interest appears, you’re already signaling chaos.

Great fundraising isn’t guesswork—it’s a skill. And the founders who understand these rules simply win more often.

🔥 The Hidden Blueprint Behind Fundable Startups

What if fundability isn’t luck, timing, or charisma—but a structure top founders deliberately engineer?

Naval Ravikant has long argued that great startups don’t win because they’re loud. They win because they’re designed to be irresistible to investors. And his Founder Showcase keynote reveals the five foundations that quietly determine whether a startup becomes fundable—or forgotten.

Here’s the condensed playbook every founder should internalize:

🚀 Traction That Proves You Can Execute

Investors ignore theory and chase evidence. Retention, conversions, revenue curves, product stickiness—your metrics tell a story long before you pitch.

👥 Teams Investors Trust With Capital

The most fundable teams aren’t perfect—they’re resilient. They learn fast, ship fast, and adapt faster than competitors.

🤝 Social Proof That Accelerates Trust

A single respected intro or endorsement can collapse investor skepticism instantly. In a noisy world, signal beats volume.

🛠️ Product as Your Silent Pitch

Investors don’t remember decks—they remember products they can feel. Build something undeniably useful and it sells itself.

🎯 Markets Where You Can Truly Win

The strongest founders enter markets big enough to scale but focused enough to dominate. The Goldilocks zone is how you create inevitability.

The truth: Fundable startups aren’t born—they’re architected. Designed with intention. Engineered for proof, trust, and momentum.

👉 Want the full blueprint? Watch Naval’s keynote and start architecting a startup investors can’t ignore.

🔥WEB PICKS

- OpenAI Makes a $100M Healthcare Bet

OpenAI is reportedly acquiring a one-year-old AI healthcare app that connects medical records with fitness data—signaling a deeper push into consumer health platforms. - Elon Musk Slams Apple–Google AI Alliance

Elon Musk criticized the integration of Google’s Gemini-powered Siri with Apple, calling it an “unreasonable concentration of power” in consumer AI. - Mastercard Launches Agent Pay for AI Shoppers

Mastercard unveiled Agent Pay, a new payment infrastructure that allows AI agents to autonomously make purchases on behalf of consumers. - Thermo Fisher and NVIDIA Team Up on AI Labs

Thermo Fisher Scientific and NVIDIA announced a strategic partnership to build AI-driven lab automation systems that can design experiments, run tests, and analyze results autonomously. - JUPITER Supercomputer Reaches Human-Brain Scale

Researchers at Jülich Research Centre demonstrated that the JUPITER supercomputer can simulate 200B neurons and 100T synapses—approaching the scale of the human cerebral cortex. - Humanoid Robots Learn from Internet Videos

1X Technologies introduced its World Model AI, enabling NEO humanoid robots to learn real-world physical tasks directly from online videos—without labeled training data. - AI Breakthrough Solves Decades-Old Imaging Problem

Scientists at Brookhaven National Laboratory developed PFITRE, an AI-powered X-ray tomography method that overcomes long-standing limits in nanoscale 3D imaging.