🔥The 6 Truths Startups Learn Too Late

😬 A Bad Investor Costs More Than Equity

In This Edition:

- ✅ 🧠 Belief > Strategy (Here’s Why)

- 🤖 No AI Strategy? Good Luck in 2026

- 🤝 Choose Investors Like Co-Founders

- 📉 More Slides = More Friction

- 🔥 500+ Angels + 530+ Networks

🧠 Belief > Strategy (Here’s Why)

🔥The 6 Truths Startups Learn Too Late

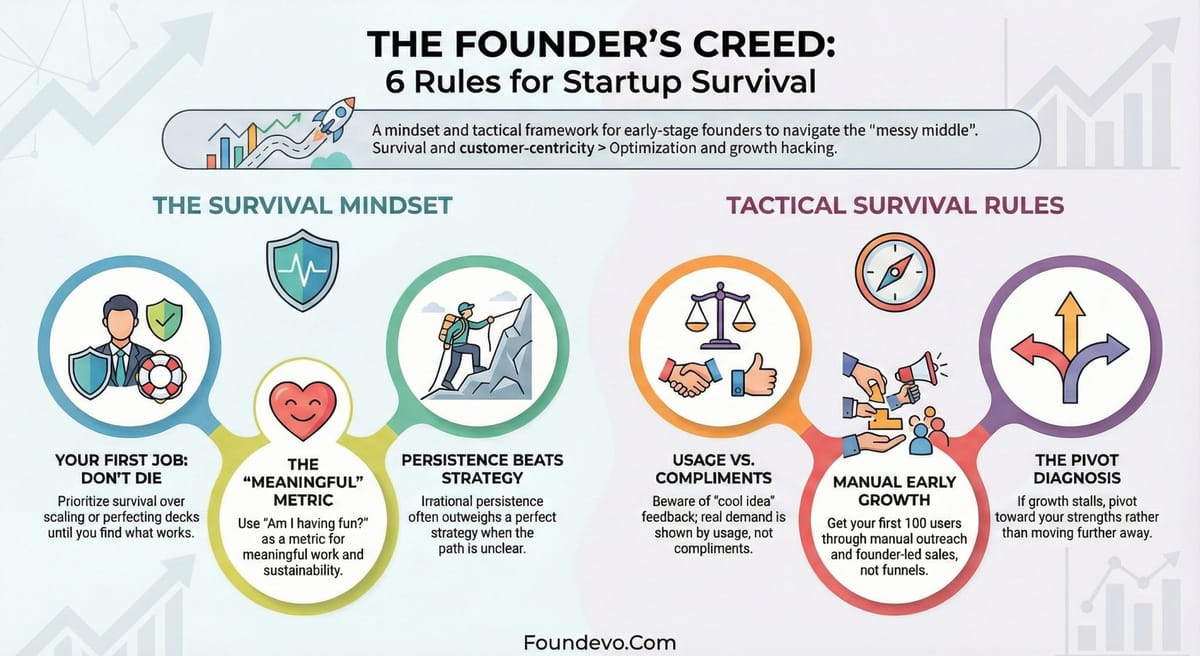

Most startups don’t shut down because the idea was weak.

They shut down because belief quietly expires.

The early-stage job isn’t to look impressive. It’s to survive long enough to discover what actually works. When growth stalls, the smartest move isn’t panic—it’s diagnosis: are there still untested growth paths, or is the product asking for a pivot?

Also worth remembering: compliments aren’t demand.

“Cool idea” means nothing without usage.

The founders who win usually aren’t the smartest in the room—they’re the ones who stay closest to customers, do the uncomfortable outreach, and keep ownership where it matters: product + users.

One simple check-in that reveals more than any dashboard:

Is the work still meaningful?

Not easy. Meaningful.

If this feels like the messy middle… that’s not failure. That’s where real companies are built.

(A quick scroll through today’s pick might spark one useful move for the week ahead.)

🧠 No AI Strategy? Good Luck in 2026

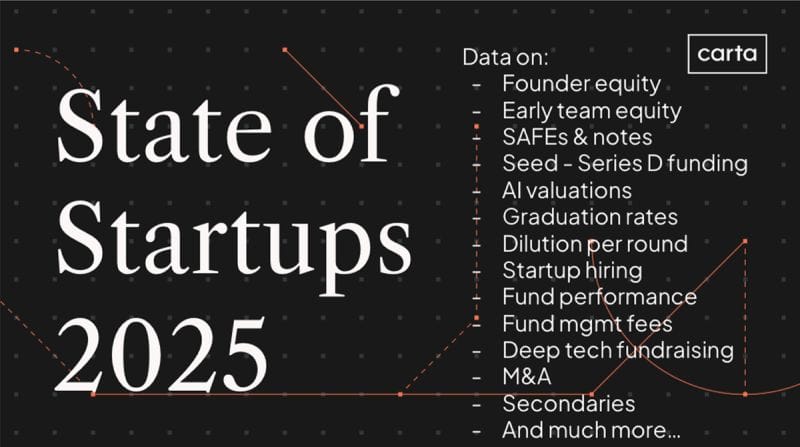

🚨 145 Slides + 5 Trends = A Serious Warning for 2026

A fresh 145-slide deep dive into U.S. startups + venture capital reveals one thing clearly: 2026 will reward builders who pick the right game early.

AI captured ~44% of invested capital—and jumps to 61% in software, making “no AI strategy” a real disadvantage. At the same time, pre-seed equity is all over the place, because the hottest founders are setting terms while everyone else fights for attention.

The bar also moved higher: Series A B2B companies are hitting ~3× higher ARR than 2021, with $3M median and $7M at the 75th percentile—speed matters now more than ever.

On the team side, startups are hiring leaner, and new hires are getting ~50% less equity than 2022, except for standout AI/ML talent. Even VCs are shifting terms, with some funds pushing beyond the traditional 2-and-20 into 25–30% carry.

The real takeaway: venture money isn’t automatically the best move anymore.

For outcomes that demand a $1B exit or IPO, VC may fit. For many businesses, capital-light growth may win.

(Worth skimming the full deck once—one chart alone could reshape the next funding decision.)

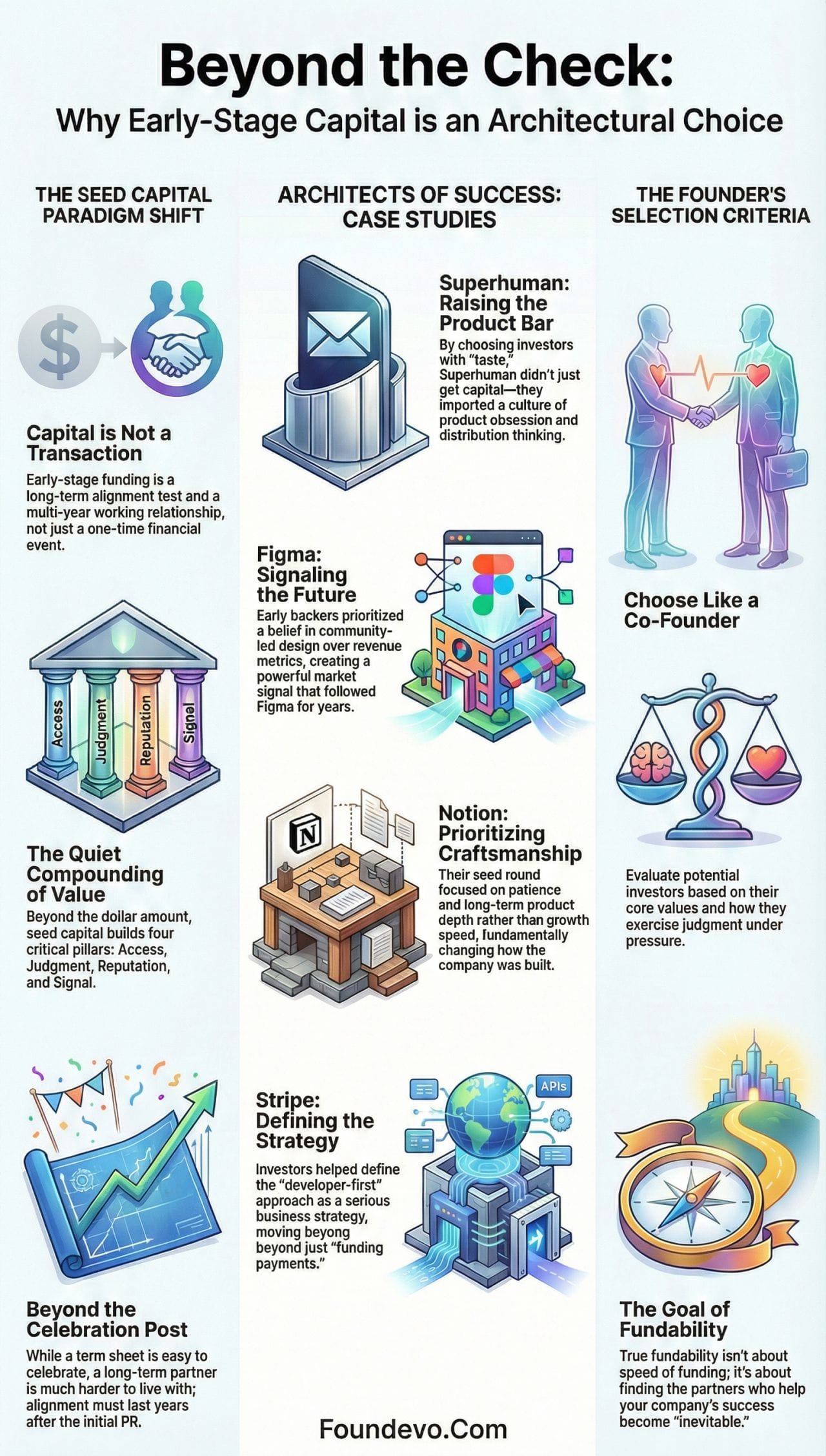

🧠 Choose Investors Like Co-Founders

😬 A Bad Investor Costs More Than Equity

Early-stage capital isn’t a transaction.

It’s a long-term partnership test.

A term sheet is easy to celebrate.

A long-term partner is much harder to live with.

At seed, money quietly compounds into four things that don’t show up in the headline number:

→ Access

→ Judgment

→ Reputation

→ Signal

That’s why the best founders don’t just “raise funds”… they raise leverage.

The strongest case studies prove the same pattern:

- Superhuman raised taste, product obsession, and distribution thinking.

- Figma raised belief in bottoms-up design, long before revenue mattered.

- Notion raised patience and craftsmanship over speed.

- Stripe raised developer-first strategy, not just payments capital.

Great seed investors don’t only fund outcomes.

They shape the decisions that create them.

So the real question isn’t who wires the check first —

it’s who helps make the company inevitable.

❌ More Slides = More Friction

🧠 Founders Know Everything… Investors Know Nothing

Fundraising rarely moves on clarity alone.

It moves when clarity becomes conviction.

After 100+ startup pitches, the biggest deal-breaker isn’t product, traction, or market size.

It’s information asymmetry:

Founders know everything.

Investors know nothing.

That gap creates a common mistake—over-explaining.

More slides. More metrics. More stories.

But more isn’t clarity.

More is friction.

Fundability isn’t about saying everything.

It’s about choosing the right signals that reduce uncertainty:

⚔️ Team → unfair edge + execution ability

📈 Traction → consistent momentum, not spikes

🏰 Moat → what compounds + becomes harder to copy

🔥 Narrative → human inevitability, not just slide logic

💰 GTM → one working channel + scalable unit economics

🎯 Investor Fit → aligned capital, not available capital

Fundability isn’t perfection.

It’s certainty with fewer words.

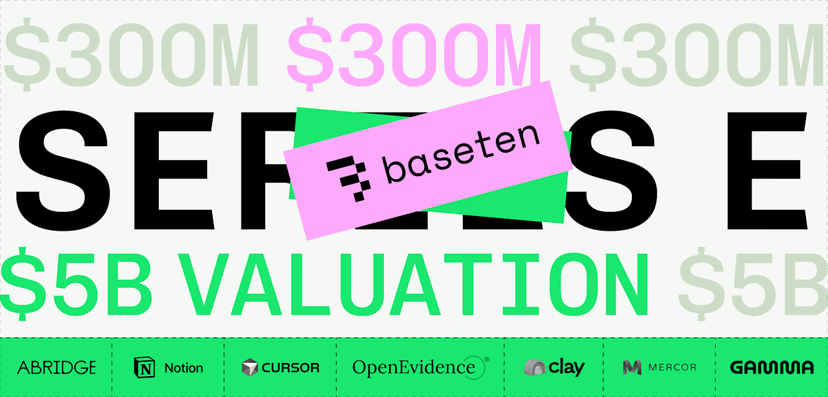

🚨 A $5B Wake-Up Call for AI Startups

🚀 Baseten Hits $5B Valuation (Series E!)

Baseten just raised a $300M Series E at a $5B valuation 🚀

In just six years, it’s become a category leader in inference infrastructure—powering teams building some of the most talked-about AI products today, including Abridge, Clay, Cursor, Notion, OpenEvidence, and more.

This round is another strong signal that the next AI wave won’t be won only by flashy apps…

It’ll be won by the infrastructure layer that makes models run faster, cheaper, and reliably at scale.

As demand for inference accelerates, companies enabling production-grade AI are starting to look less like “tools”… and more like foundational rails for the entire ecosystem.

(Worth a quick glance at the details—this deal says a lot about where the AI stack is headed next.)

🎯 Startups Buzz

🔥 500+ Angels + 530+ Networks (One Pack)

Fundraising shouldn’t feel like walking into a VC maze without a map.

Yet most founders still waste months pitching the wrong rooms, the wrong investors, at the wrong time.

This new Investor Pack for 2026 removes the guesswork with curated, founder-friendly lists across the categories actually getting funded right now: AI, SaaS, Fintech, Deep Tech, Blockchain, and more.

Inside the pack:

- Stage + category-matched investor lists (so outreach starts targeted)

- 49 AI startups that raised $100M+ (to reverse-engineer positioning + timing)

- 500+ active angels + 530+ angel networks (all in one place)

- 50+ real pitch decks that worked (to model structure + storytelling)

It’s not just data. It’s fundraising leverage—compressed into one playbook.

🎯 The “Founder-First” Angels List

Some angels don’t just invest early.

They spot founders before the market notices — and help them win faster.

This isn’t the usual “spray-and-pray” list of names.

It’s 8 forward-deployed angels who get in the trenches with founders: sharpening go-to-market, tightening the story, unlocking distribution, and accelerating momentum in ways most funds can’t match.

The backgrounds are stacked: ex-Google AI researchers, Thiel Fellows, Brex operators, exited founders, and early builders from companies like Airbnb, Yelp, Flexport, Atlassian, and Facebook.

These angels don’t just write checks.

They bring taste, distribution instinct, and operator-level execution—the kind that compounds from day one.

If the next raise depends on more than capital…

this is the kind of backing that actually moves the needle.

(The full list is worth a quick look—one name could be the most valuable intro of the year.)

🔥WEB PICKS

🧑💻 Synthesia Hits $4B Valuation, Lets Employees Cash In

Synthesia has reached a $4B valuation after a new round led by GV (Google Ventures), with participation from major returning investors like Kleiner Perkins, Accel, NEA, NVentures, Air Street Capital, and PSP Growth, alongside new entrants including Evantic and Hedosophia. The company is also enabling an employee secondary sale through Nasdaq’s private markets facilitation, giving team members a structured way to access liquidity while Synthesia remains private.

🚒 This Founder Cracked Firefighting—Now He’s Building an AI Gold Mine

A startup founder is turning “dumb” firefighting hardware into smart, connected equipment, expanding beyond nozzles into monitors, valves, overhead sprinklers, and pressure devices. The company is also launching new flow-control products like Stream IQ, powered by custom circuit boards packed with sensors and computing—transforming real-world emergency infrastructure into a data-driven platform with massive AI potential.

🤖 ChatGPT Is Pulling Answers From Elon Musk’s “Grokipedia”

ChatGPT has reportedly begun pulling answers from Elon Musk’s Grokipedia, raising questions about how AI systems select sources and what happens when those sources are controversial or not broadly verified. The development is fueling renewed debate around credibility, transparency, and misinformation risk—especially as AI assistants become default tools for everyday search and decision-making.

🧠 Humans& Says Coordination Is AI’s Next Frontier—and It’s Training a Model to Prove It

Humans& is building an AI model focused on coordination and collaboration, aiming to act as “connective tissue” across organizations by understanding people’s skills, motivations, and needs. The startup plans to train the system using approaches like long-horizon reinforcement learning and multi-agent reinforcement learning, pushing beyond chatbot-style answers toward AI that can plan, follow through, and optimize outcomes over time.

🎭 Science Fiction Writers and Comic-Con Say Goodbye to AI

Two major forces in creative culture are taking harder positions against generative AI. The Science Fiction and Fantasy Writers Association (SFWA) revised its rules to make works created wholly or partially using generative LLM tools ineligible for the Nebula Awards, while San Diego Comic-Con reportedly updated art show rules to disallow AI-generated material entirely.

📱 Apple Will Reportedly Unveil Gemini-Powered Siri in February

Apple is reportedly preparing to unveil a Gemini-powered Siri assistant in February, hinting at a major leap in Apple’s AI strategy and voice assistant capabilities. If confirmed, the move could mark a more direct battle for AI assistant dominance—bringing next-gen conversational intelligence deeper into Apple’s ecosystem.