🤖 20,000 McKinsey “Employees” Aren’t Human

🚨 Where OpenAI Hires From

In This Edition:

- 🤖 McKinsey Hired 20,000 AI Agents

- 🚨 Where OpenAI Hires From

- 🚀 How Smart Web3 Founders Apply

- 🤯 Google Enters the $4T Club

- ⚡ How Startups Are Winning the AI Race

🚨 VC Deal Flow

💰 Massive Funding Rounds You Shouldn’t Miss

Big checks, bold bets, and clear signals on where capital is flowing:

- Aikido Security (Ghent, Belgium)

Raised $60M Series B at a $1B post-money valuation

Led by: DST Global

Also participating: PSG Equity, Notion Capital, Singular

Total raised: $84M+ - Alpaca (San Mateo, CA)

Raised $150M Series D at a $1.15B valuation

Led by: Drive Capital

Also participating: Citadel Securities, Kraken, BNP Paribas Ventures - Mirador Therapeutics (San Diego)

Raised $250M Series B

Investors include: T. Rowe Price, Adage, Fidelity, ARCH, OrbiMed, Point72, Farallon, Venrock, and more

Total raised: $650M+ - Novee (Israel)

Raised $51.5M Seed + Series A

Investors: YL Ventures, Canaan Partners, Zeev Ventures - Skild AI (Pittsburgh)

Raised a massive $1.4B at a $14B valuation

Led by: SoftBank

Also participating: NVentures, Bezos Expeditions, Salesforce Ventures, Samsung Electronics - Wasabi Technologies (Boston)

Raised $70M at a $1.8B valuation

Led by: L2 Point Management

Also participating: Pure Storage, Fidelity

Total raised: $600M+ - WitnessAI (Mountain View, CA)

Raised $58M

Led by: Sound Ventures

Also participating: Fin Capital, Forgepoint, Qualcomm Ventures, Samsung Ventures

Total raised: $85M+

🚀 Looking for Investors?

I maintain a curated list of 2,100+ active investors across stages and sectors.

If you’re raising for your startup and want access to the right investors:

👉 Click the button below to get the investor list 👇

🤖 McKinsey Hired 20,000 AI Employees

🤖 20,000 McKinsey “Employees” Aren’t Human

Consulting just hit a tipping point.

McKinsey & Company now operates with 40,000 humans and 20,000 AI agents—meaning nearly 33% of its workforce isn’t human.

This isn’t a pilot. It’s the new operating model.

Managing partner Bob Sternfels confirmed the firm is rapidly scaling AI, with a bold goal:

👉 1 AI agent for every human by 2026

What AI agents are doing today:

- Automating research and data synthesis

- Drafting slides, charts, and first-pass analyses

- Powering internal tools like Lilli, McKinsey’s AI knowledge assistant

AI already drives 40% of the firm’s business and saves 1.5M hours annually—work once handled by junior staff.

Humans aren’t gone. Their roles are shifting:

- Less execution

- More judgment, strategy, and client leadership

📖 Read the full story to get all the details on how McKinsey is scaling AI across its workforce!

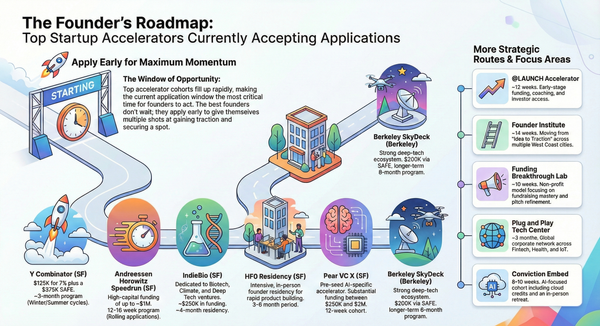

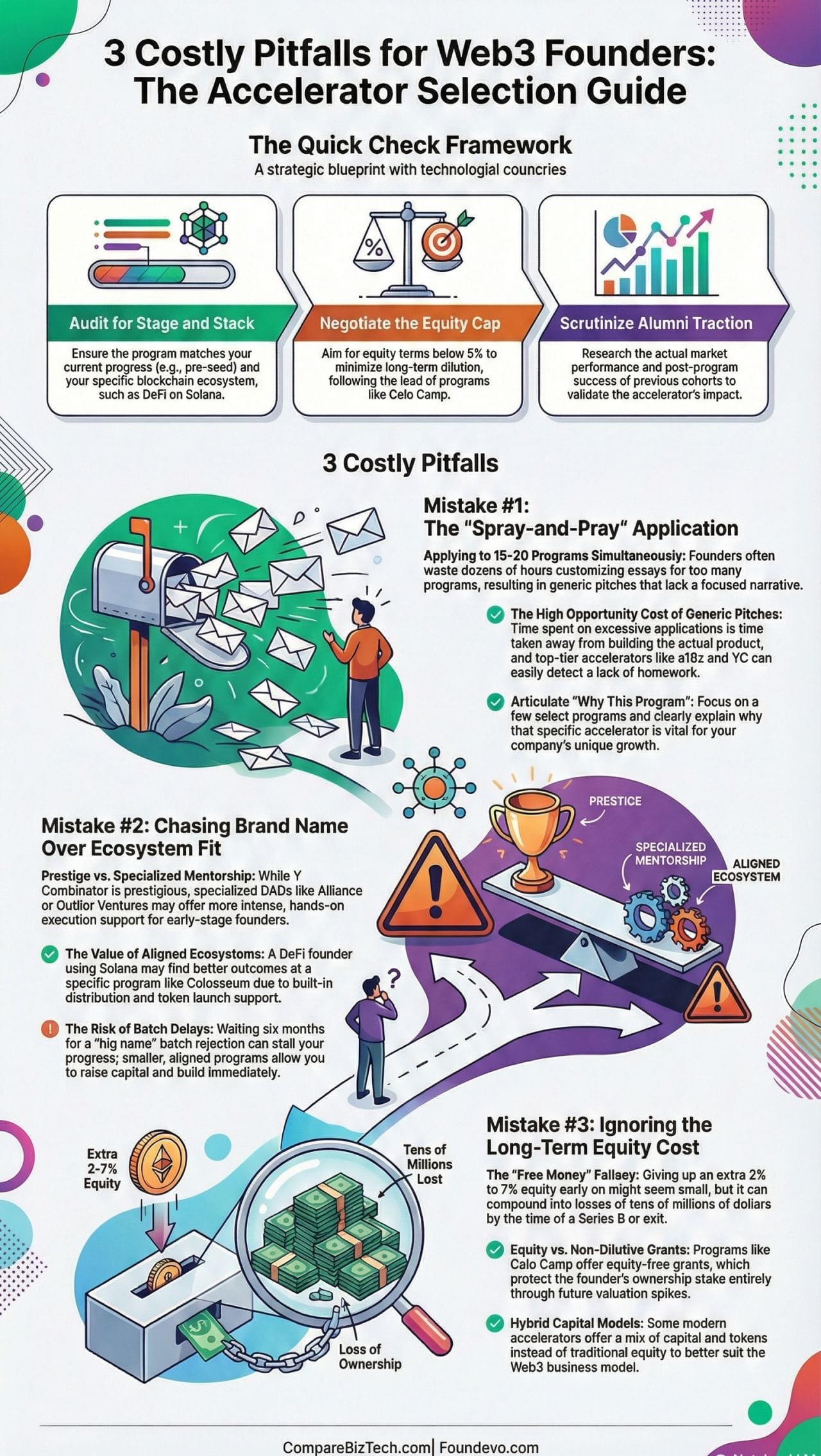

🚀 How Smart Web3 Founders Apply

🧠 Smart Web3 Founders Apply Differently

Web3 startups don’t stall because of bad ideas.

They stall in the accelerator application phase.

Wrong timing. Wrong pitch. Wrong programs.

And suddenly, 6 months are gone.

Smart founders play this differently.

What they do instead:

- 🎯 Customize the pitch — every accelerator has a bias

- ⏱️ Timing beats hype — apply when your stage actually fits

- 🔍 Study accelerator signals — mentors, cohorts, demo day results

- 🧠 Strategic stacking — 3–5 aligned programs > 20 random shots

- 🗺️ Respect timelines — most top programs take 3–6 months to start

Choosing the right accelerator tier matters:

- Elite: Y Combinator, a16z Crypto Startup School

- Specialists: Techstars Web3, Outlier Ventures

- Protocol-backed: Polygon Labs, Starknet Foundation

The best founders don’t chase acceptance.

They design alignment.

🚀 Want to get into the right accelerator without wasting months? Click below to access our proven strategy guide and curated list of top programs for Web3 founders!

🚨 Where OpenAI Hires From

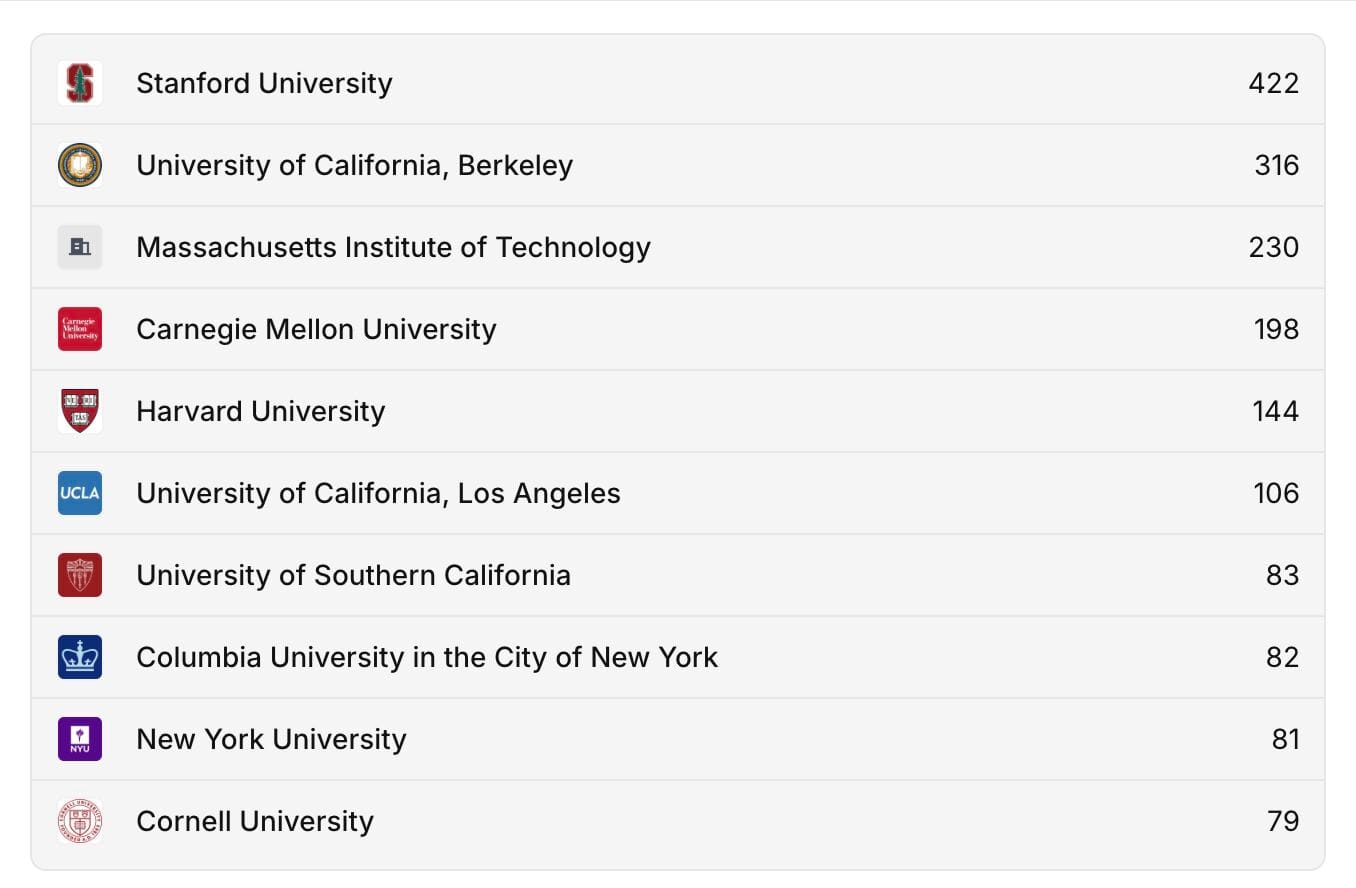

🚨 Where OpenAI’s Talent Actually Comes From (The Data Says Everything)

Everyone knows OpenAI has one of the most elite teams in tech.

What’s more revealing is where that talent was trained.

Looking at OpenAI’s 4,000+ employees, a clear pattern emerges.

Top universities feeding OpenAI 🎓

- Stanford — 422

- UC Berkeley — 316

- MIT — 230

- Carnegie Mellon — 198

- Harvard — 144

- UCLA, USC, Columbia, NYU, Cornell follow close behind

Stanford + Berkeley alone account for 15%+ of OpenAI’s entire workforce.

This signals a major shift in the AI talent pipeline.

Forget FAANG.

The new path looks like:

Stanford, Berkeley, MIT, CMU → OpenAI, Anthropic, xAI, Mistral

AI’s future is being built by deep academic hubs, not traditional Big Tech pipelines.

Data powered by Harmonic.

🤯 Google Enters the $4T Club

🚀 Alphabet Joins the $4 Trillion Club — AI Seals the Deal

Alphabet just crossed a major milestone, becoming the fourth company ever to hit a $4 trillion market cap.

Shares rose after Apple confirmed it will use Google’s Gemini to power the next generation of Siri. The stock closed at $331.86, pushing Alphabet over the line.

Alphabet now joins an elite group alongside Nvidia, Microsoft, and Apple.

The surge caps a strong AI comeback:

- Shares jumped 65% in 2025

- New AI chip Ironwood challenges Nvidia

- Gemini 3 earned strong early reviews

- 70% of Google Cloud customers now use its AI tools

Despite competition from OpenAI’s ChatGPT and Sora, analysts say Google’s full-stack AI advantage is still underappreciated.

🎯 Startups Buzz

🛑 Why Scaling Early Is Dangerous

Most startups don’t fail because the idea is bad.

They fail because the idea can’t scale fast enough to satisfy VC math.

Gumroad is the rare exception.

After early hype, strong traffic, and top-tier funding, growth slowed—but burn didn’t. Instead of chasing vanity metrics, Sahil Lavingia made an unpopular call: shrink the team, lower ambition, and rebuild for sustainability.

It became a founder misogi—one brutally honest year focused on survival, not storytelling.

- No growth hacks

- No pretending

- Just serving customers who were already paying

Years later, Gumroad crossed $10M+ ARR with a tiny, profitable team.

Founder lesson:

Sometimes the smartest way to scale… is not scaling at all.

One honest year can permanently change how you build.

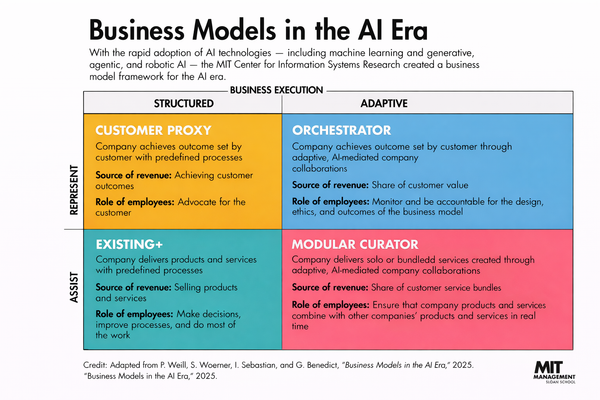

🚀 How Startups Are Winning the AI Race—Without AI Hires

Big Tech is spending millions to win AI talent wars.

Startups are winning by changing the rules.

Elite AI talent is expensive, scarce, and built for scale—not speed. Instead of chasing $200K+ PhDs, smart founders are focusing on AI leverage, not AI headcount.

Here’s what’s working:

- AI literacy across teams, not isolated experts

- Hybrid skill sets that blend domain knowledge with AI tools

- Tool-first execution that compounds output fast

- Lean teams shipping faster with lower burn

The result?

Small teams quietly outperforming companies 10× their size.

The real advantage isn’t who you hire—it’s how well your team can wield AI.

👉 We broke down 6 leverage points founders are using to win the AI era.

One shift could redefine how you hire, train, and scale in 2026.

🔥WEB PICKS

🧠 Talent Back to AI Giants

Two co-founders from Mira Murati’s Thinking Machines Lab are returning to OpenAI, including key leadership roles less than a year after the startup’s launch. The shift highlights ongoing talent competition in AI as founders and researchers navigate between scrappy startups and deep-pocketed incumbents.

📐 AI Is Solving Hard Math

AI models are starting to crack high-level mathematics problems once thought out of reach for LLMs, demonstrating deeper reasoning by solving complete proofs and formal results—hinting at a leap in capabilities for scientific and technical domains.

🚨 Musk Denies Grok Issues Amid Probe

Elon Musk says he’s unaware of any Grok chatbot generating underage explicit images, even as the California Attorney General investigates xAI over nonconsensual sexually explicit content generated by Grok, drawing global regulatory scrutiny.

I not aware of any naked underage images generated by Grok. Literally zero.

— Elon Musk (@elonmusk) January 14, 2026

Obviously, Grok does not spontaneously generate images, it does so only according to user requests.

When asked to generate images, it will refuse to produce anything illegal, as the operating principle… https://t.co/YBoqo7ZmEj

🤝 OpenAI Secures $10B Compute Deal

OpenAI signed a reported $10 billion deal with Cerebras Systems to secure massive computing capacity through 2028—signaling how infrastructure arms races are shaping AI competitiveness.

🎙️ Netflix Debuts Original Video Podcasts

Netflix is launching its first original video podcast slate, featuring cultural figures like Pete Davidson and Michael Irvin—a push into long-form social media-style content blending entertainment and personality-driven formats.

📲 App Downloads Drop, Spending Soars

Global app downloads declined again in 2025, yet consumer spending hit nearly $156 billion, suggesting a maturing mobile ecosystem where quality and monetization outpace sheer install volume.