|

|

|

In This Edition:

|

|

|

|

|

|

|

|

VC INSIGHTS

|

Is Your Startup

Ready for a Seed

Round?

|

|

|

|

Raising a seed

round is a crucial

step for startups,

typically

involving raising

between $1 million

to $4 million to

support

early-stage

growth. This

funding stage is

essential for

transforming an

idea into a viable

business, and it

often includes

various types of

investors such as

angel investors,

seed funds, and

venture capital

firms.

|

Key

Considerations

for Raising a

Seed Round

|

-

Understanding

Seed

Funding: Seed

funding is

the initial

capital

raised by

startups to

develop

their

product and

validate

their

business

model. It

can come in

the form of

equity or

convertible

securities

like SAFEs

(Simple

Agreements

for Future

Equity) and

is generally

used for

product

development,

hiring,

marketing,

and

operational

costs.[Link]

-

Preparation

and

Strategy: Founders

should have

a clear

strategy in

place before

approaching

investors.

This

includes

building a

robust

investor

list,

preparing

necessary

documentation,

and creating

a compelling

pitch deck

that

outlines the

business

model,

market

opportunity,

and

financial

projections.[Link]

-

⏳ Timeline

for

Fundraising: The

process of

raising seed

capital can

take

anywhere

from three

to nine

months. A

common

approach is

to spend one

month

preparing,

three months

actively

pitching to

investors,

and one

month

closing the

round.[Link]

-

⏳ Investor

Composition: Most seed

rounds

consist of a

mix of

larger lead

investors

and smaller

angel

investors or

funds. It’s

important to

choose

investors

who not only

provide

capital but

also add

strategic

value to the

startup

through

mentorship

or industry

connections.[Link]

-

Dilution

Considerations: Founders

should aim

for around

20% dilution

during their

seed round,

with a

typical

range being

15% to 25%.

This

dilution

reflects the

percentage

of ownership

that

founders

give up in

exchange for

investment.

-

Types of

Investors: Seed

funding

sources

include:

-

Angel

Investors:

Wealthy

individuals

who

invest

their

own

money.

-

Seed

Funds:

Specialized

funds

that

focus on

early-stage

investments.

-

Venture

Capital

Firms: Some

VC firms

participate

in seed

rounds

but

often

prefer

companies

with

more

traction.

-

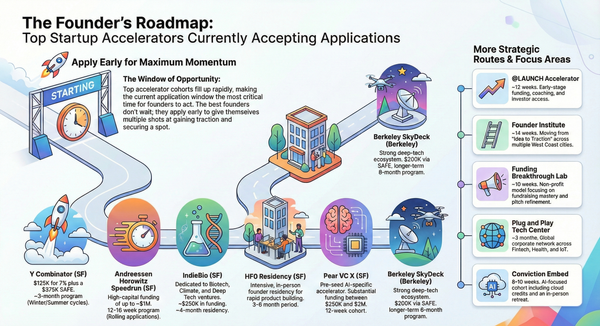

Accelerators/Incubators:

Programs

that

provide

funding

along

with

mentorship

and

resources.[Link]

-

Best

Practices:

-

Build

relationships

with

potential

investors

well

before

the

fundraising

process

begins.

-

Communicate

regularly

with

updates

about

company

progress.

-

Be

prepared

for due

diligence

and

negotiation

once you

receive

interest

from

investors.

-

⚠️ Common

Challenges: Startups

often face

difficulties

in proving

their market

viability at

this stage,

as many are

still in the

process of

developing

their

minimum

viable

product

(MVP) or

gaining

initial

traction.[Link]

|

|

By understanding

these components,

founders can

better navigate

the complexities

of raising a seed

round and increase

their chances of

securing the

necessary funding

to propel their

startup

forward.

|

|

Navigating the

venture capital

landscape is

tough, but with

the right

approach, it can

set your startup

up for success. If

you’re preparing

for a seed round, check out the

valuable

resources

below

for expert

insights and

strategies to

secure funding and

propel your

business forward.

|

-

A Guide to

Seed

Fundraising

(Link)

-

Raising a

Seed Round

101 (Link)

-

Seed

Funding

for

Startups:

Our

Complete

Guide (Link)

-

How

Startup

Fundraising

Works (Link)

|

|

|

Carta's First

VC Fund

Performance

Report is Here –

Surprising

Insights

Await!

|

|

Carta's Q1 2024

VC Fund

Performance Report

examines the

challenges facing

venture capital

markets due to

rising interest

rates since 2022.

Fundraising has

slowed, liquidity

has decreased, and

competition for

limited partner

(LP) funds has

intensified.

The report, based

on data from 1,803

U.S. venture funds

managed through

Carta, focuses on

small funds and

direct venture

investors from

2017-2022.

|

|

|

|

It aims to

provide greater

transparency in

assessing VC fund

performance,

particularly for

funds over $100

million.

|

Key

Insights:

|

-

Slow

capital

deployment:

Funds in the

2022 vintage

have

deployed

about 43% of

their

committed

capital at

the 24-month

mark, the

lowest share

of any

analyzed

vintage.

Prior

vintages

ranged from

47%-60%

after 24

months.

-

Graduation

rates

declining:

30.6% of

companies

that raised

a seed round

in Q1 2018

made it to

Series A

within two

years. Only

15.4% of Q1

2022 seed

startups did

so in the

same

timeframe.

-

Distributions

back to

LPs remain

elusive:

Less than

10% of 2021

funds have

had any DPI

after 3

years.

|

|

Unlock deeper

insights into the

shifting landscape

of venture capital

by downloading Carta's Q1

2024 VC Fund

Performance

Report. Dive into key

data from 1,803

U.S. venture

funds, uncover

performance

trends, and learn

how small funds

are navigating

fundraising

challenges amidst

rising interest

rates.

Whether you're an

LP, a fund

manager, or an

investor, this

report offers

essential analysis

to help you make

informed

decisions.

Don't miss

out—download the

full report

now

to stay ahead of

the curve!

|

|

|

VC Fund

Performance

report.pdf

4.98 MB •

PDF File

|

|

Download

|

|

|

|

|

|

|

|

|

|

|

|

-

How US

Startups Are

Securing

Seed Rounds

in 2024 (Link)

-

JPMorgan’s

Perspective:

Why ‘Founder

Mode’ Isn’t

Enough to

Build a

Billion-Dollar

Business (Link)

-

Who Should

Advise

Entrepreneurs?

Vinod

Khosla’s

Take on

Expert

Guidance (Link)

|

|

|

Vinod

Khosla

on

How

to

Build

the

Future

|

|

|

-

How to

Become Your

Own Niche: 4

Powerful

Steps for

Personal

Branding (Link)

-

How to

Avoid Common

Legal

Pitfalls

When

Planning

Your

Business

Exit (Link)

-

10 Minutes

of

Game-Changing

Entrepreneurial

Advice from

Sabastian

Enges (Link)

-

Is Passion

Enough to

Succeed?

Alexis

Ohanian’s

Bold Take on

Entrepreneurship (Link)

-

What It

Takes to

Turn a

Fintech Idea

into

Reality:

Adam

Sharpe’s

Journey (Link)

-

Leading

with an

Entrepreneurial

Mindset: How

to Innovate

and Inspire (Link)

-

Surviving

AI’s

Disruption:

What

Entrepreneurs

Need to Know (Link)

-

What Does

It Take to

Build a $1M

SaaS in 3

Months? (Link)

|

|

|

I

Built

A

$1M

SaaS

In

87

Days

|

|

|

|

|

|

|

|

|

-

From

Network

Stress to

Network

Success: How

AI Is

Transforming

Wireless

Systems (Link)

-

Amazon

Unveils

Project

Amelia: The

AI Assistant

That’s

Changing the

Seller

Landscape (Link)

-

Alibaba's

Latest AI

Models:

Transforming

Text into

Video with

Cutting-Edge

Technology (Link)

-

YouTube

Announces

Exciting New

Features for

Creators in

2024 (Link)

-

Google

Unveils AI

Funding

Initiative

to Empower

Schools and

Classrooms (Link)

-

Northwestern

University

Launches

Groundbreaking

AI Research

for

Astronomy

with $20

Million

Grant (Link)

-

Global

Leaders to

Gather in

San

Francisco

for AI

Safety Talks

After U.S.

Election (Link)

-

Snap's New

AI Tool

Makes Video

Creation

Easier for

Creators (Link)

|

|

|

|

|

-

Fathom

Raises $17

Million

to Improve

AI-Powered

Note-Taking (Link)

-

AI Media

Platform FÁL

AI Gets $23

Million

from a16z

and

Investors (Link)

-

AI Platform

WeGrow

Secures €7M

to Simplify

Business

Innovation (Link)

-

Jus Mundi

Raises $22

Million

to Advance

Legal

Research

Technology (Link)

-

AI Startup

Raises Funds

to Simplify

Gig Worker

Hiring (Link)

-

Timefold

Raises €6

Million

to Improve

Planning

Optimization

Software (Link)

-

Financial

Services

Startup Knit

Raises $9

Million

in Latest

Round (Link)

-

Cudis Gains $5

Million

to Enhance

AI-Powered

Wearable

Health Ring (Link)

-

ContextSDK

Raises $4

Million

to Empower

Developers

with New

Tools (Link)

-

Rep AI

Gains $7.5

Million

to Develop

AI-Powered

Digital

Sales

Representatives (Link)

|

|

|

|

|

|

NEW JOBS

|

36 Remote Job

Opportunities at

Startups

|

|

|

|

Explore exciting

opportunities with

36 innovative

startups that are

currently hiring

for remote roles!

With small teams

of fewer than 50

people, these

companies are

making a

significant impact

across various

industries. Check

out their

offerings and find

your next career

move!

|

|

|

|

Some jobs might

have location

restrictions, so

be sure to review

the details.

|

|

Ready to find

your next

remote

opportunity?

|

|

Check out

these 36

startups

hiring

now

and apply to find

your perfect fit!

Don’t wait—start

your application

today and take the

next step in your

career.

|

|

|

|

|

|

|

|

|

|