🚨How YC Raises Seed

🚀 How to Save 10+ Hours Weekly

In This Edition:

- 🔥Seed vs Series A vs Growth changes everything

- 🚀 How to Save 10+ Hours Weekly

- 👥 Built on Belonging, Not Travel

- 💰The $1B Fundraising Playbook

- 🚨 How YC Raises Seed

🔥Seed vs Series A vs Growth changes everything

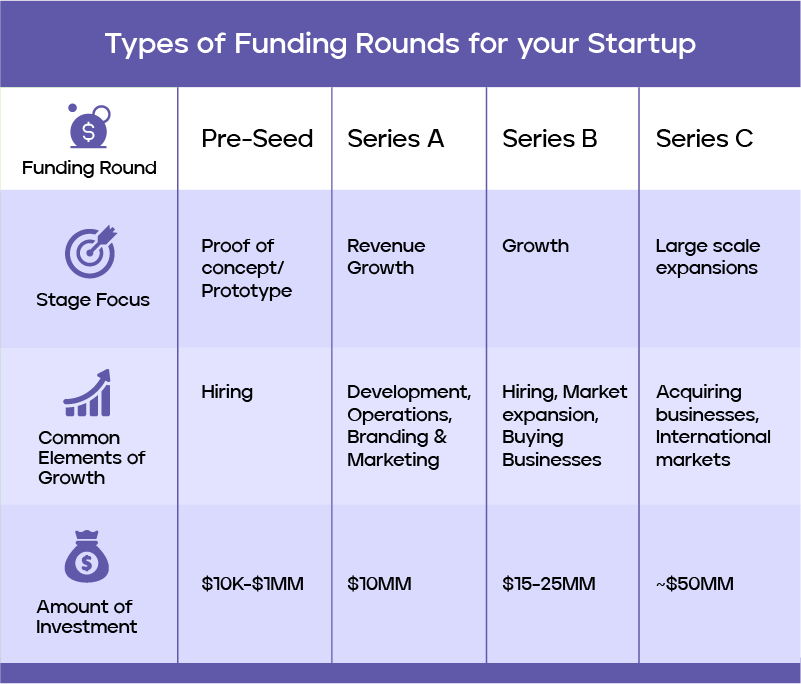

🚀Your Startup Job Depends on This One Factor

Before joining a startup, one decision matters more than most people realize: its stage.

Seed-stage startups are fast, risky, and scrappy. Small teams, broad roles, lower salaries—but massive learning and equity upside.

Series A companies have a working product and early traction. They’re hiring key builders across engineering and go-to-market to find scale.

Growth-stage startups (Series B/C) have product-market fit. The focus shifts to scaling users, revenue, and teams—with compensation nearing big tech.

Scale-stage startups (Series D+) look more like established tech companies: stability, specialization, and IPO readiness.

Each stage offers very different trade-offs—from risk and learning to compensation and role clarity.

Before applying or interviewing, ask yourself: Which stage aligns best with your goals right now?

👉 Curious which stage fits your skills, risk appetite, and career goals best? Click through to explore the differences more deeply.

🚀 How to Save 10+ Hours Weekly

🚀 What if you could save 10+ hours every week—without new hires or expensive software?

Most growing teams are stretched thin: juggling marketing, sales, follow-ups, reports, and tools that don’t talk to each other. The real cost isn’t just time—it’s missed leads, slow decisions, and burnout.

HubSpot’s free Growth Marketing and Sales Toolkit brings everything under one roof: CRM, automation, lead management, landing pages, reports, chatbots, scheduling, and AI-powered insights. No credit card. No trial limits. Just a connected system that replaces spreadsheets, manual work, and guesswork.

The result?

• Faster execution

• Cleaner data

• Better follow-ups

• More time for strategy

And when combined with modern AI productivity tools, even small teams can operate like much larger companies.

👥 Built on Belonging, Not Travel

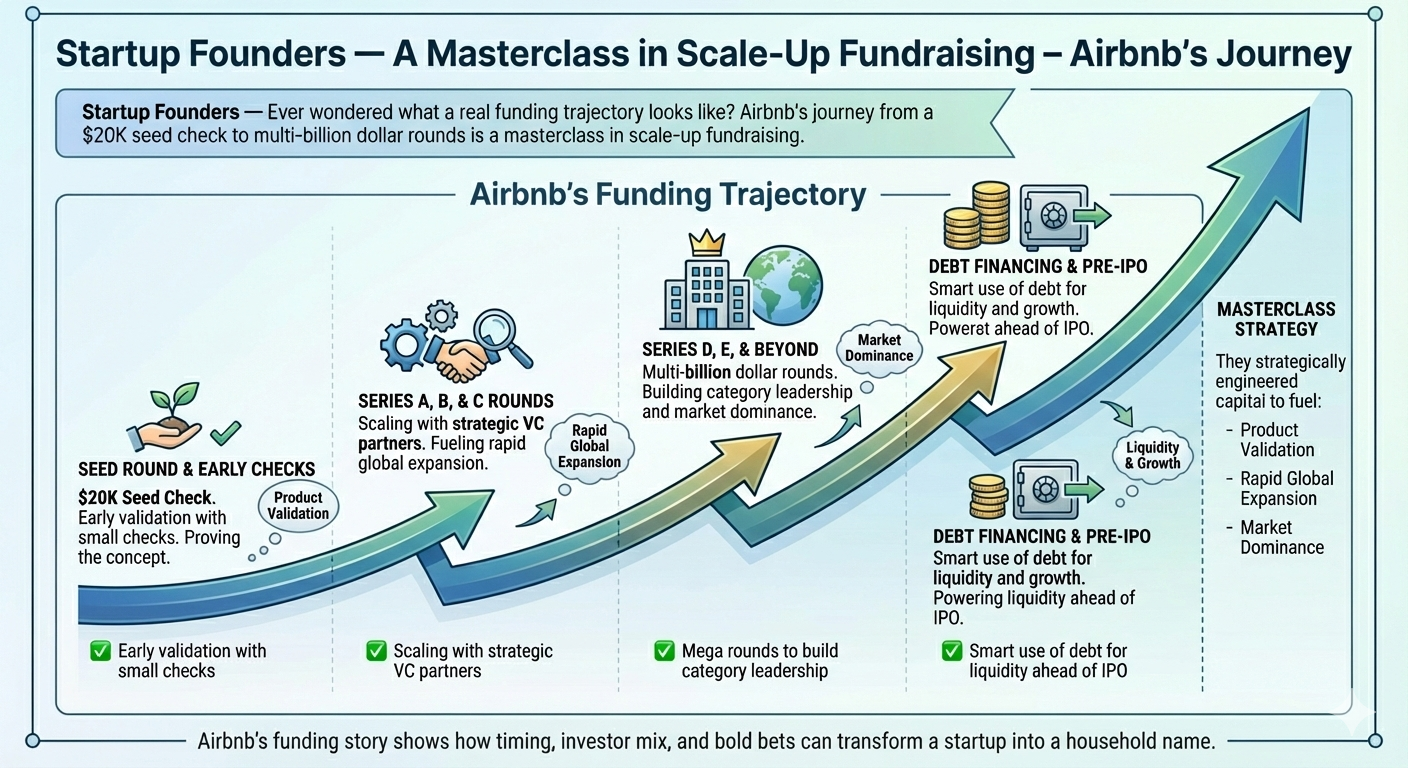

🏠 How Airbnb turned human connection into a $100B moat

What started as three air mattresses in a San Francisco apartment didn’t scale because it was cheaper than hotels. It scaled because it solved a deeper problem: people don’t want places—they want belonging.

Brian Chesky’s design-first mindset reshaped travel into lived experience. Airbnb focused on trust, culture, and host–guest relationships long before optimizing growth metrics. From professional photography to human-first crisis decisions during COVID, the company treated culture as a product feature, not a slogan.

The result? A $100B platform that redefined how people experience cities, work remotely, and feel at home anywhere.

For founders, the lesson is clear: the most enduring companies don’t just optimize workflows—they redefine the problem around human needs.

💰The $1B Fundraising Playbook

💰This founder raised $1B+—and his fundraising playbook is refreshingly simple.

Brett Adcock (Figure AI, Archer Aviation, Vettery) doesn’t treat fundraising as luck or storytelling alone. He treats it like a repeatable process.

His core idea:

Fundraising = Qualified investors × Outreach × Clear narrative

That means building a complete investor list (not waiting for intros), running outreach like sales, and refining a pitch that moves meetings toward a term sheet. Expect low conversion rates—serious founders talk to hundreds of investors to find the right one.

The timeline is equally structured: prepare in 30 days, meet investors over the next 60, move fast once a lead emerges, and close quickly. Momentum matters—slow investors usually pass.

Fundraising is noisy. Systems cut through it.

Want the full breakdown, templates, and execution details? The attached playbook goes deeper. 👇

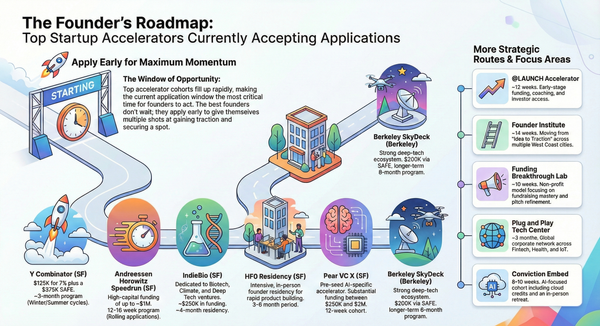

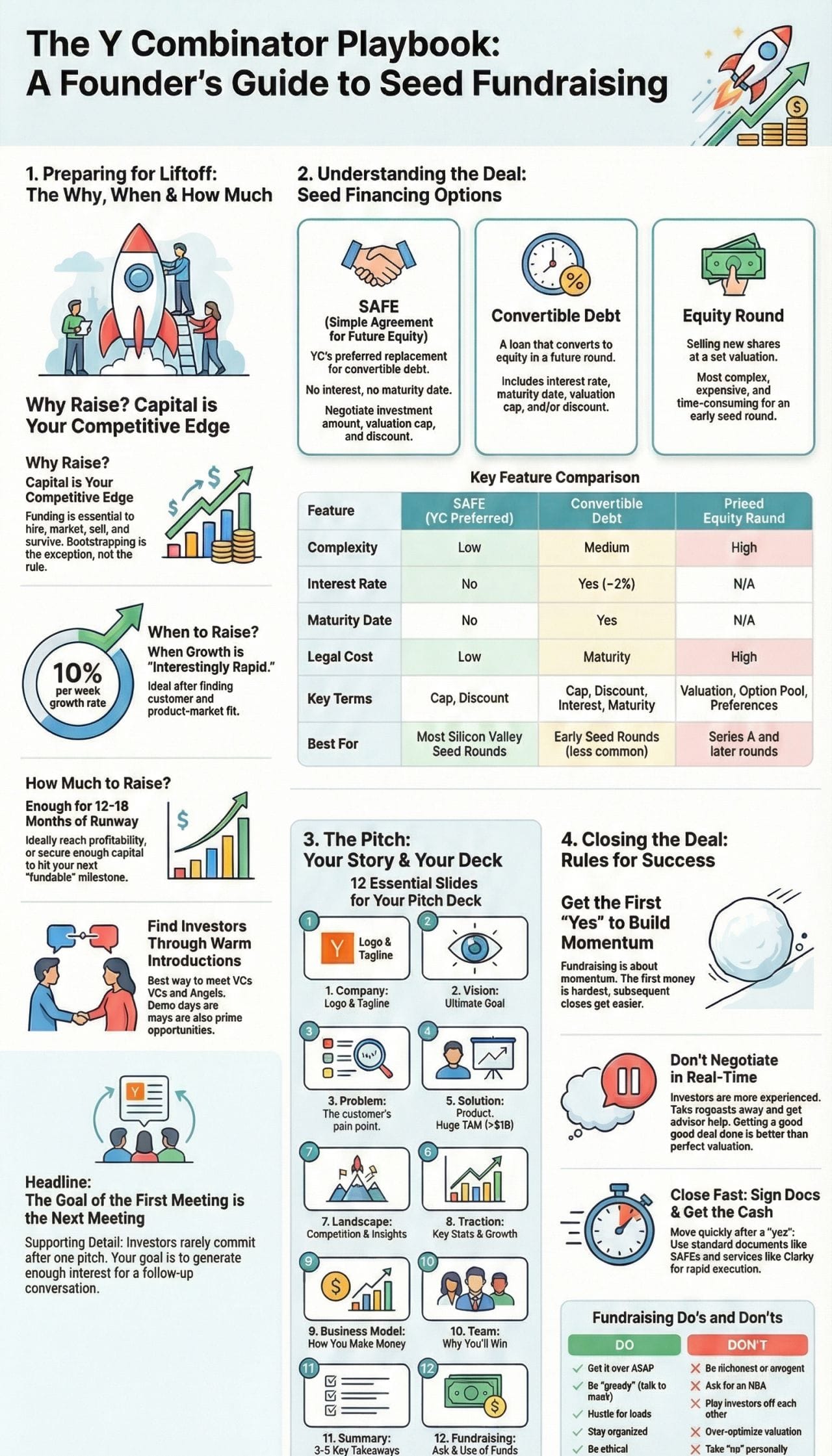

💰 How YC Raises Seed

🚨 90% of seed rounds fail before the first investor meeting.

Not because the idea is weak—but because the approach isn’t structured.

Y Combinator’s playbook treats seed fundraising as a system, not a scramble.

Raise only when growth is “interestingly rapid” (around 10% weekly) and secure 12–18 months of runway. Use SAFEs to move fast and keep things simple. Keep your deck tight—investors look for a massive vision, real traction, and a team that moves with speed.

Most importantly, understand momentum. The first yes is the hardest. Once it happens, fundraising shifts from chasing meetings to closing capital—fast.

And remember: a yes isn’t real until the money hits the bank.

👉 Want a deeper breakdown of how YC founders actually run seed rounds? Dive into the full playbook.

🎯 Startups Buzz

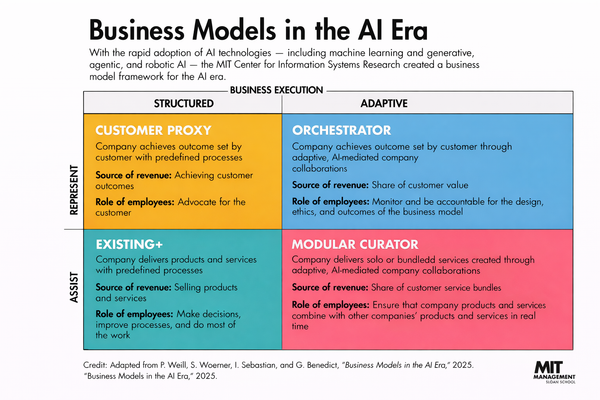

🚨 The Future of Business Isn’t What You Think

In a world obsessed with speed and short-term wins, some leaders are choosing to pause—and rethink what success truly means.

What happens when decisions are anchored in principles, not pressure? When talent is treated as a long-term investment, not a cost? And when impact matters as much as growth?

The Mars CEO shares how balancing purpose with performance isn’t idealism—it’s a competitive advantage. From values-driven leadership to building businesses that last, this conversation challenges how modern companies should operate.

🎧 Don’t miss this perspective-shifting discussion.

Listen to the full podcast and see how business can become a force for good—without sacrificing results.

💡 The Hidden Rules of Pitching

Most founders think a business plan wins investors. It doesn’t.

A clear, confident, momentum-driven pitch does.

Investors decide in minutes. They look for proof others already believe, signs of traction, and a story they instantly understand. Momentum, clarity, and professionalism matter more than hype.

The best founders treat fundraising like a system—tight summaries, undeniable progress, and a credible team—while avoiding the small mistakes that quietly kill trust.

⚡The difference between ignored and funded is rarely the idea. It’s the pitch.

👉 Want to see how winning founders structure investor-ready pitches? Download the free DCF model and break down what actually converts interest into capital.

🔥WEB PICKS

🚀 OpenAI’s $10B Bet Could Create a $750B Giant

Amazon may pour $10B into OpenAI, pushing its valuation toward $750B—signaling one of the biggest private funding moments in tech history.

🤖 AI Coding Tools Just Supercharged Developers by 76%

New data shows AI copilots massively boosting dev output in 2025, with bigger PRs and “AI memory” tools like mem0 quietly dominating.

🧪 GPT-5.2 Crushes Olympiad Questions—But Struggles With Real Research

OpenAI’s new FrontierScience benchmark reveals a sharp gap between structured problem-solving and open-ended scientific discovery.

☁️ Amazon Reshuffles AI Leadership to Win the AI Arms Race

Andy Jassy consolidates Amazon’s AI efforts under a single leader, spanning models, custom chips, and even quantum computing.

🧩 ChatGPT Is Becoming an App Store—And Builders Are Invited

OpenAI opens submissions for ChatGPT apps, launching an in-product directory and SDK that could redefine AI distribution.

🌍 AI Is Now Powering the World’s Weather Forecasts

NOAA rolls out next-gen AI-driven global forecast models, promising faster, more accurate predictions starting December 17.

🇨🇳 China’s EUV Breakthrough Could Rewrite the Chip War

China reportedly built a prototype EUV lithography machine, aiming to challenge ASML’s monopoly—though timelines remain debated.