How Investors Evaluate Pre Seed Startups Without Revenue

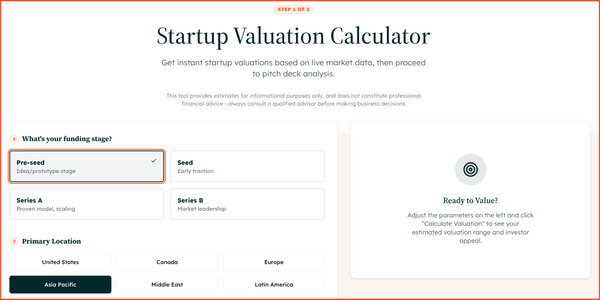

Founders frequently believe that hitting certain metrics will unlock pre-seed funding. The logic seems sound: build a product, acquire users, generate revenue, then fundraise. But this framework misunderstands how venture capital evaluates early stage startups.

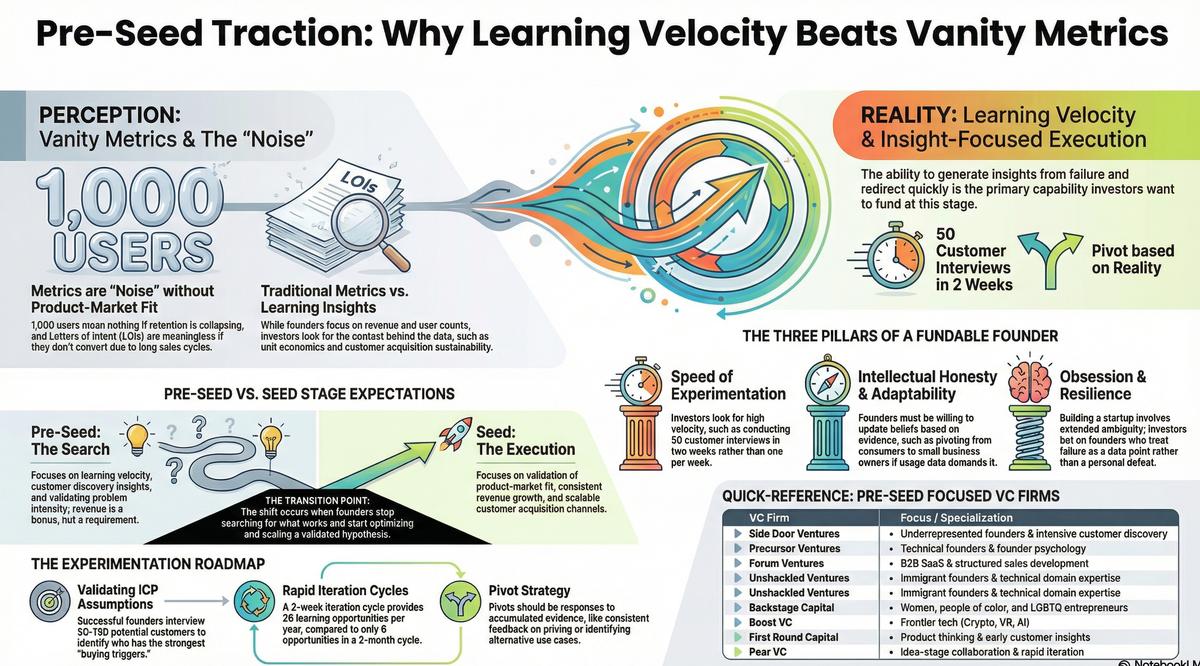

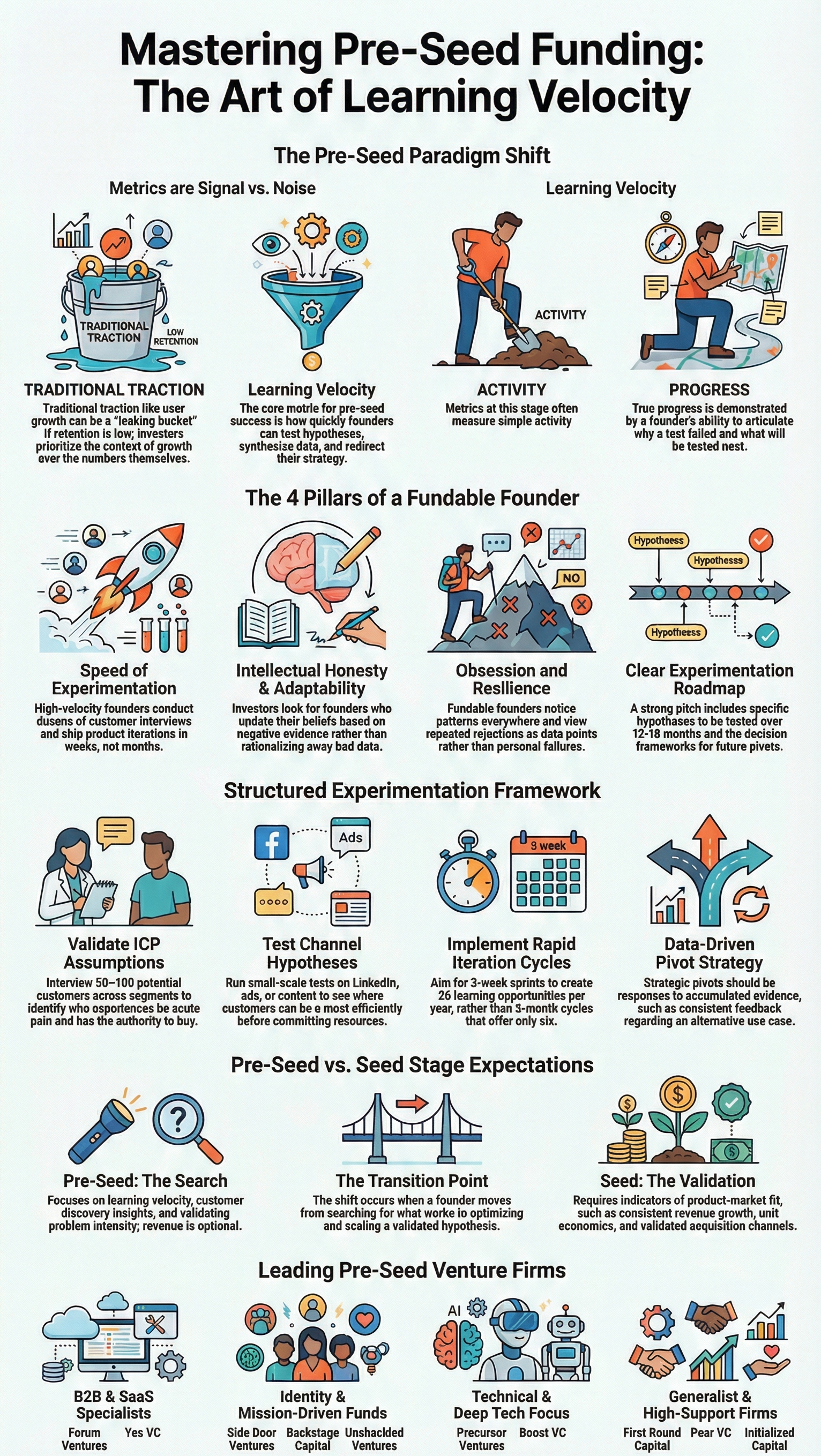

Pre-seed investors rarely make decisions based on traditional traction metrics. At this stage, there's insufficient data to determine whether numbers represent signal or noise. A thousand users might mean nothing if retention collapses. Ten enterprise letters of intent might be meaningless if sales cycles never convert.

The actual evaluation happens elsewhere. Investors assess whether founders can navigate profound uncertainty, experiment rapidly, and adapt when reality contradicts assumptions. This article breaks down what pre seed funding requirements for founders actually look like, how to raise pre seed funding without revenue, and which venture capital firms invest at this stage.

What Counts as Traction at Pre Seed Stage

Traditional traction metrics lack context at the earliest stages. Revenue means nothing without understanding unit economics, customer acquisition costs, or whether the business model is sustainable. User growth appears impressive until retention data reveals a leaking bucket. Letters of intent from enterprise customers sound valuable until the eighteen-month sales cycle becomes apparent.

The fundamental challenge is uncertainty. Founders haven't discovered product-market fit yet. The target customer might be wrong. The problem being solved might not be acute enough. The solution might require years of behavior change. Metrics at this stage often measure activity rather than progress toward a viable business.

Investors understand this reality. Rather than evaluating traction in isolation, they assess it within the context of learning. A founder who built a product, launched to users, and saw flat engagement has learned something valuable if they can articulate why it failed and what they'll test next. Another founder with identical metrics but no clear hypothesis about what went wrong has learned nothing.

Consider a founder who spent three months building a B2B SaaS product for marketing teams, only to discover after twenty sales calls that the pain point wasn't acute enough. If that founder pivoted to a different vertical, ran another batch of interviews, and identified stronger buying signals from operations teams, they've demonstrated the exact capability investors want to fund: the ability to generate insights from failure and redirect quickly.

How Venture Capital Evaluates Early Stage Startups

Without hard metrics to anchor decisions, pre-seed investors evaluate founders through a different lens. The assessment focuses on capabilities and psychology rather than achievements.

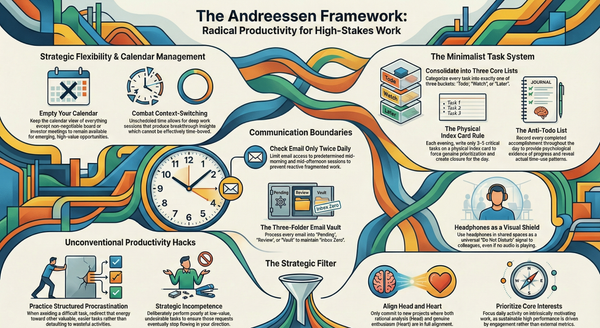

Speed of Experimentation

Experimentation velocity determines how quickly founders can test hypotheses and accumulate learnings. A founder who runs one customer interview per week moves too slowly. Market conditions shift, competitive dynamics change, and runway depletes. A founder who conducts fifty interviews in two weeks, synthesizes patterns, and adjusts their approach demonstrates the urgency required at this stage.

This speed extends beyond customer discovery. Founders need to ship product iterations rapidly, test messaging variations, experiment with pricing models, and validate distribution channels. Each cycle generates data that either validates assumptions or forces adaptation.

Adaptability and Founder Market Fit

Adaptability separates founders who can navigate toward product-market fit from those who optimize prematurely. Markets rarely behave as expected. Initial customer segments don't convert. Pricing models that seemed obvious prove unworkable. Distribution channels that appeared straightforward hit unexpected friction.

Founder adaptability means updating beliefs based on evidence rather than clinging to original assumptions. It requires intellectual honesty about what's working and what isn't. Founders who rationalize away negative signals or cherry-pick data to support predetermined conclusions will struggle to find product-market fit before capital depletes.

A founder building a consumer fintech app might discover through usage data that small business owners represent their most engaged segment, not individual consumers. Adapting means pivoting the product roadmap, messaging, and distribution strategy entirely, even after months of work in the opposite direction.

Obsession and Resilience

Obsession manifests as an inability to stop thinking about the problem. Founders who are genuinely obsessed notice relevant patterns everywhere, connect seemingly unrelated insights, and pursue understanding beyond what's strictly necessary. This quality matters because building startups involves extended periods of ambiguity and setbacks.

Resilience complements obsession. The path to product-market fit involves repeated failure. Customer interviews reveal the problem isn't painful enough. Product launches generate minimal interest. Early sales calls result in consistent rejection. Founders who internalize these failures personally rather than treating them as data points will burn out before finding traction.

A technical founder who spent years in enterprise sales might notice inefficiencies that colleagues accepted as inevitable. That observation becomes an obsession, leading to nights and weekends spent interviewing potential customers, mapping workflows, and prototyping solutions, even before leaving their job. This pattern signals the type of commitment required to push through the inevitable obstacles ahead.

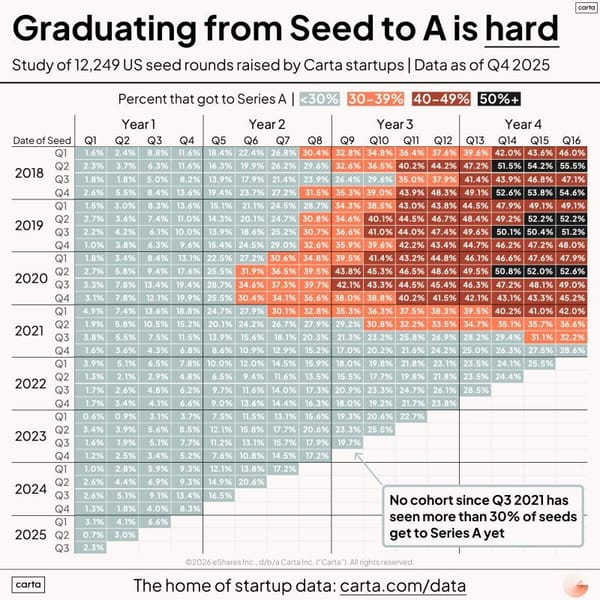

Pre Seed vs Seed Traction Expectations

Understanding the distinction between pre-seed and seed traction expectations prevents founders from prematurely optimizing for the wrong metrics.

Pre-Seed Stage: Investors fund learning velocity and founder capabilities. Traction might include customer discovery insights, rapid iteration on product hypotheses, early design partner relationships, or validated problem intensity. Revenue and user growth are positive signals but not requirements. The emphasis is on generating insights that inform product direction.

Seed Stage: Investors expect early validation of product-market fit indicators. This typically includes consistent revenue growth, improving unit economics, validated customer acquisition channels, or strong retention cohorts. The business model doesn't need to be fully proven, but clear signals should exist that customers value the product and a scalable path forward is emerging.

Transition Point: The shift from pre-seed to seed happens when founders move from searching for product-market fit to optimizing and scaling what works. Pre-seed funds learning; seed funds execution against a validated hypothesis.

Founders sometimes try to raise pre-seed rounds with seed-stage expectations, creating misaligned conversations. A pre-revenue startup funding strategy at the pre-seed stage should emphasize the learning roadmap and experimentation plan rather than projecting future metrics based on limited data.

Experimentation Before Product Market Fit

Structured experimentation separates founders who find product-market fit from those who drift through possibilities without direction.

Validating ICP Assumptions

Initial target customer assumptions are usually wrong. Founders build products for who they think will buy, not who actually experiences acute pain. Systematic customer discovery involves interviewing fifty to one hundred potential customers across different segments, asking about workflows, pain points, current solutions, and buying triggers.

The goal isn't confirmation but understanding. Patterns emerge around which customer types express the strongest pain, show willingness to pay, and have authority to purchase. These insights inform ICP refinement and product prioritization.

Testing Channel Hypotheses

Distribution assumptions fail frequently. A product that seems perfect for viral growth might lack a compelling sharing mechanism. An enterprise sales motion might require executive relationships the founding team doesn't possess. Direct-to-consumer advertising might have prohibitive customer acquisition costs.

Founders should test multiple channel hypotheses simultaneously at small scale. Run targeted LinkedIn outreach to fifty prospects. Test Facebook ads with a small budget. Attend industry conferences and measure conversion rates. Publish content and track inbound interest. Each test generates data about where customers can be reached efficiently.

Implementing Rapid Iteration Cycles

Speed compounds learning. A two-week iteration cycle generates twenty-six learning opportunities per year. A two-month cycle generates six. Founders should structure work to enable fast feedback loops: ship minimum viable features, gather usage data, conduct user interviews, and incorporate learnings into the next iteration.

This requires discipline around scope. Features that take months to build delay learning. Founders should identify the smallest version that tests a hypothesis and ship that first.

Startup Pivot Strategy

Pivots shouldn't be reactions to single data points but responses to accumulated evidence. A pattern of customers expressing the same alternative use case, consistent feedback that pricing is structured incorrectly, or discovery that a different segment shows stronger engagement all justify strategic pivots.

The key is maintaining velocity through pivots. Founders who spend months deliberating lose momentum. Strong founders make pivot decisions quickly, communicate clearly to stakeholders, and execute the new direction with the same urgency they brought to the original thesis.

Real Meaning of Pre Revenue Startup Funding Strategy

Capital at the pre-seed stage serves specific strategic purposes beyond survival.

Capital as Acceleration

Raising capital before traction shortens the time required to test hypotheses. Without funding, founders bootstrap slowly, testing one idea at a time with limited resources. Capital enables parallel experimentation, faster product development, and broader customer outreach.

A founder with capital can hire contractors to accelerate product development while simultaneously running comprehensive customer discovery. A bootstrapped founder must choose between building and validating, extending time to insight.

Capital as Learning Fuel

Each experiment costs money. Customer interviews require time away from other work. Product iterations need engineering resources. Marketing tests consume advertising budgets. Capital provides the runway to generate sufficient learnings before making definitive strategic decisions.

Founders who raise too little capital often run out of runway before accumulating enough data to confidently identify product-market fit. They're forced to raise again prematurely or shut down with questions still unanswered.

Capital as Strategic Leverage

Pre-seed funding allows founders to make bets that wouldn't be possible while bootstrapping. Hiring a domain expert, investing in customer research tools, or attending industry conferences all require capital. These investments accelerate learning disproportionately.

The strategic leverage comes from compressing timelines. Markets evolve constantly. Competitive dynamics shift. Customer preferences change. Founders who move faster capture opportunities that disappear for slower competitors. Capital enables that speed advantage, but only if founders deploy it toward structured experimentation rather than premature scaling.

Lead-Generating Angel Investor Database: Your Direct Path to Pre-Seed Capital

Access 1000+ verified angel investors actively seeking early-stage startups to fund. These investors have backed companies at the idea stage, written checks without revenue requirements, and provide hands-on mentorship alongside capital.

💡 Thousands of founders have used this list to secure their first checks. Angel investors often move faster than VCs and provide flexible terms for pre-revenue startups.

Venture Capital Firms That Invest at Pre Revenue Stage

Multiple venture capital firms specialize in pre-revenue investments, though each brings different focus areas and founder preferences.

Side Door Ventures focuses on underrepresented founders building category-defining companies. The firm invests at the earliest stages, often when founders are still validating market hypotheses. Side Door Ventures looks for exceptional founder market fit and supports founders through intensive customer discovery and product development phases.

Precursor Ventures backs technical founders solving complex problems in large markets. The firm invests pre-product and emphasizes founder psychology alongside market opportunity. Precursor Ventures seeks founders with unique insights from prior experience and the resilience to navigate extended periods of uncertainty.

Forum Ventures operates an accelerator model combined with pre-seed capital, focusing on B2B SaaS founders. The program provides structured support around customer discovery, sales process development, and fundraising strategy. Forum Ventures invests in founders committed to rapid iteration and rigorous experimentation.

Unshackled Ventures specifically backs immigrant founders building technology companies. The firm provides pre-seed capital alongside visa sponsorship and operational support. Unshackled Ventures invests in technical founders with domain expertise and tolerance for the compounded uncertainty of building companies while navigating immigration challenges.

Yes VC invests in technical founders building infrastructure, developer tools, and B2B software. The firm provides capital at the idea stage and supports founders through product development and early customer acquisition. Yes VC looks for founders with deep technical expertise and conviction about emerging technology trends.

Backstage Capital focuses on underrepresented founders, particularly women, people of color, and LGBTQ entrepreneurs. The firm invests across industries at the pre-seed stage and emphasizes founder resilience and market understanding. Backstage Capital seeks founders with clear hypotheses about underserved customer segments.

Boost VC specializes in frontier technology, including crypto, VR, and AI. The firm operates an accelerator model with pre-seed investment and supports technical founders exploring emerging categories. Boost VC backs founders with contrarian insights about technology adoption and strong technical capabilities.

First Round Capital invests at the pre-seed and seed stages across various industries, with particular strength in B2B software and consumer technology. The firm emphasizes product thinking and early customer insights. First Round Capital looks for founders who can articulate clear product hypotheses and demonstrate customer obsession.

Initialized Capital backs technical founders building products for both consumer and enterprise markets. The firm invests early, often at the idea stage, and supports founders through product development and market validation. Initialized Capital seeks founders with unique technical insights and strong execution capabilities.

Slow Ventures invests across consumer and enterprise categories with an emphasis on cultural trends and network effects. The firm backs founders at the earliest stages and provides access to a broad network of operators and advisors. Slow Ventures looks for founders building products that tap into emerging cultural or technological shifts.

Founder Collective operates a founder-led fund that invests at the pre-seed and seed stages. The firm emphasizes product-market fit discovery and supports founders through structured experimentation. Founder Collective seeks founders with obsessive focus on customer problems and willingness to pivot based on evidence.

Village Global invests in technical founders solving large-scale problems across various industries. The firm provides pre-seed capital and connects founders with successful entrepreneurs through its network. Village Global backs founders with ambitious visions and the technical capabilities to execute them.

Afore Capital focuses on Latino founders and pre-seed stage companies across industries. The firm provides capital alongside operational support and network access. Afore Capital seeks founders with strong market insights and commitment to building enduring businesses.

Pear VC invests at the idea stage and emphasizes founder-investor collaboration. The firm works closely with technical founders to refine product strategy and customer targeting. Pear VC looks for founders with deep domain expertise and willingness to iterate rapidly based on customer feedback.

Susa Ventures backs technical founders building data-intensive companies across enterprise and consumer categories. The firm invests pre-product and supports founders through technical architecture decisions and early customer development. Susa Ventures seeks founders with unique data insights and strong engineering capabilities.

Alumni Ventures operates a distributed model with funds focused on specific universities and regions. The firm invests at the pre-seed stage across industries and emphasizes founder networks and ecosystem support. Alumni Ventures backs founders with strong educational or professional pedigrees and clear market hypotheses.

Erik Ventures focuses on fintech and financial services innovation at the earliest stages. The firm provides pre-seed capital and domain expertise around financial services infrastructure. Erik Ventures seeks founders with deep fintech expertise and insights about emerging payment, lending, or investment opportunities.

Remagine Ventures invests in insurance technology and adjacent industries at the pre-seed stage. The firm provides capital alongside insurance industry expertise and partnership opportunities. Remagine Ventures backs founders tackling distribution, underwriting, or claims challenges in insurance markets.

Octopus Ventures invests across health, fintech, and deep tech categories with particular strength in European markets. The firm backs technical founders at the pre-seed stage and supports product development through early customer acquisition. Octopus Ventures seeks founders with domain expertise and ambitious visions for category transformation.

Lead-Generating Angel Investor Database: Your Direct Path to Pre-Seed Capital

Access 1000+ verified angel investors actively seeking early-stage startups to fund. These investors have backed companies at the idea stage, written checks without revenue requirements, and provide hands-on mentorship alongside capital.

💡 Thousands of founders have used this list to secure their first checks. Angel investors often move faster than VCs and provide flexible terms for pre-revenue startups.

What Investors Really Look for in Pre Seed Founders

Patterns emerge across pre-seed investors about what separates fundable founders from those who struggle to raise capital.

Demonstrated Adaptability

Investors want evidence that founders update their beliefs based on new information. This might manifest as pivots from prior attempts, clear articulation of what hypotheses were tested and disproven, or honest assessment of current uncertainties. Founders who present overly polished narratives without acknowledging challenges signal either lack of experience or unwillingness to confront difficult realities.

Founder Psychology and Obsession

The psychological profile matters as much as the business opportunity. Investors assess whether founders have the emotional resilience to endure years of setbacks, the humility to learn from customers and advisors, and the conviction to persist when evidence is ambiguous. Obsession manifests in how founders speak about problems, the depth of customer insights they've accumulated, and their energy when discussing potential solutions.

Speed and Execution

Past patterns predict future behavior. Investors evaluate how quickly founders moved from idea to customer interviews to prototype to early tests. Founders who spent months planning before taking action signal different execution capabilities than founders who started testing hypotheses within weeks.

Clear Experimentation Roadmap

Strong founders articulate what they plan to learn over the next twelve to eighteen months. This roadmap includes specific hypotheses to test, metrics that would validate or invalidate those hypotheses, and decision frameworks for how learnings will inform strategy. Vague plans to "talk to customers and iterate" lack the structure that generates confidence.

Investor psychology at pre seed centers on pattern recognition around founder capabilities rather than business metrics. The goal is identifying founders who will navigate toward product-market fit regardless of how many pivots or iterations that journey requires.

Conclusion

Raising capital before traction requires reframing what investors actually evaluate at the pre-seed stage. Metrics matter, but only within the context of learning velocity and founder capabilities. Revenue, users, and engagement data signal progress when they emerge from structured experimentation and inform clear next steps.

The most fundable pre-seed founders demonstrate obsessive focus on customer problems, willingness to adapt when evidence contradicts assumptions, and velocity in running experiments. They articulate clear hypotheses about what they're testing, frameworks for evaluating results, and decision criteria for pivots versus persistence.

Capital at this stage accelerates learning rather than scaling proven models. Founders who understand this distinction structure their fundraising narratives around experimentation roadmaps rather than financial projections. They seek investors who provide strategic guidance during ambiguous periods rather than those who emphasize governance and metrics.

The venture capital firms listed above share common patterns in what they fund: technical capabilities, domain expertise, founder resilience, and commitment to rapid iteration. Founders who embody these characteristics and can articulate compelling experimentation plans will find capital available, even without traditional traction metrics.

Frequently Asked Questions

How to raise pre seed funding without revenue?

Raising pre seed funding without revenue requires demonstrating strong founder capabilities and a clear learning roadmap. Investors look for evidence of customer discovery work, validated problem intensity, rapid iteration velocity, and founder market fit. Focus fundraising conversations on what experiments will be run, what hypotheses will be tested, and what decision frameworks will guide strategy. Strong founders articulate how capital accelerates learning rather than promising future metrics based on limited data. Pre-revenue raises succeed when founders show they can navigate toward product-market fit through structured experimentation regardless of how many pivots that requires.

What is the difference between pre seed traction and seed stage traction?

Pre seed traction focuses on learning velocity and validated insights rather than growth metrics. Evidence of traction includes comprehensive customer discovery, rapid product iteration based on feedback, validated problem intensity, or early design partner relationships. Seed stage traction requires early product-market fit indicators like consistent revenue growth, improving unit economics, validated acquisition channels, or strong retention cohorts. The transition happens when founders shift from searching for product-market fit to optimizing and scaling what works. Pre-seed investors fund the search process while seed investors fund execution against validated hypotheses.

Which venture capital firms invest in pre revenue startups?

Multiple venture capital firms specialize in pre-revenue investments including Side Door Ventures, Precursor Ventures, Forum Ventures, First Round Capital, Initialized Capital, and Pear VC among others. These firms invest based on founder capabilities, market opportunity, and learning roadmaps rather than requiring existing traction. Each firm brings different focus areas: some emphasize technical founders, others support underrepresented entrepreneurs, and some specialize in specific industries like fintech or B2B SaaS. Founders should research firm investment theses and portfolio companies to identify which investors align with their specific market and stage.

What do investors look for in pre seed founders?

Investors evaluate pre seed founders on adaptability, obsession, execution velocity, and learning capability rather than achievements. Strong founders demonstrate intellectual honesty about what's working and what isn't, update beliefs based on evidence, and articulate clear hypotheses about what they're testing next. Investors assess whether founders can accumulate learnings quickly, make decisions based on data rather than assumptions, and maintain momentum through inevitable setbacks. Founder psychology matters as much as business opportunity since pre-seed investing bets on who will navigate toward product-market fit regardless of how many pivots that journey requires.

How long should experimentation take before product market fit?

Experimentation timelines vary by market complexity, customer segment, and product category. Enterprise products typically require longer validation periods due to extended sales cycles and implementation timelines. Consumer products can generate feedback faster but may need more iterations to achieve strong retention. Most pre-seed rounds provide twelve to eighteen months of runway specifically for structured experimentation. Founders should plan experiment cycles that generate meaningful learnings within two to four week sprints, allowing twenty to thirty distinct learning opportunities before capital depletes. The goal is accumulating sufficient insights to confidently identify product-market fit signals rather than rushing to premature conclusions.