Is Your Startup

Ready for

Pre-Seed Funding?

|

|

Raising your

first round of

funding as a

founder is one of

the most pivotal

steps in

transforming your

startup idea into

a viable business.

But with limited

traction, a lean

team, and few

resources, how do

you convince

investors to take

a chance on you?

The key lies in

securing pre-seed

funding

— the critical

first investment

that can turn your

idea into

reality.

|

|

In this playbook,

we’ll dive into

key strategies

that will help you

successfully

navigate the

pre-seed funding

process and

maximize your

chances of raising

the capital needed

to get your

startup off the

ground.

|

1. Develop a

Strong Pitch

Deck

|

|

Your pitch deck

is your first

chance to make a

lasting impression

on potential

investors. At the

pre-seed stage,

your deck doesn’t

need to be perfect

— it needs to

clearly articulate

your vision, the

problem you're

solving, and why

you're the right

person to solve

it.

|

|

Key Elements of

a Pitch Deck:

|

-

Problem

&

Solution: Be clear

about the

problem

you're

solving and

how your

solution

stands out

from the

competition.

-

Market

Opportunity: Show that

there’s a

substantial

market for

your

product.

Investors

need to know

that the

problem

you’re

solving is

significant

and the

market is

large enough

to support

growth.

-

Business

Model: Explain

how you plan

to make

money — even

if you don’t

have a

revenue

stream yet,

showcase

your vision

for

monetization.

-

Traction: Even in

the early

stages, show

any signs of

progress

you’ve made,

such as a

prototype, a

small user

base, or

partnerships.

-

Team: Investors

are

investing in

you, the

founder.

Showcase the

strength of

your team

and why

you’re

uniquely

positioned

to

succeed.

|

|

Remember,

investors are

looking for a

compelling

narrative. The

goal is to create

a story that

connects

emotionally and

logically with

potential

investors. Keep

your pitch concise

but

impactful.

|

2. Network

Early and Build

Relationships

|

|

Securing pre-seed

funding isn’t just

about having the

right deck — it’s

also about

building

relationships.

|

|

Networking early

with investors,

mentors, and

fellow

entrepreneurs will

open doors to

opportunities and

feedback that can

shape your

strategy.

|

|

How to Network

Effectively:

|

-

Attend

Startup

Events

&

Meetups: These

gatherings

are a

goldmine for

meeting

potential

investors

and fellow

founders who

can offer

advice and

introductions.

-

Engage on

Social

Media: Use

platforms

like

LinkedIn and

Twitter to

connect with

investors

and share

your

journey.

Authentic

engagement

is a

powerful way

to attract

interest.

-

Leverage

Your

Existing

Network: Reach out

to people

you know who

can make

introductions

or offer

advice.

|

|

Networking isn’t

about making a

direct ask

immediately. It’s

about cultivating

trust and

fostering

connections that

could eventually

lead to

investment.

|

3. Leverage

Accelerators and

Incubators

|

|

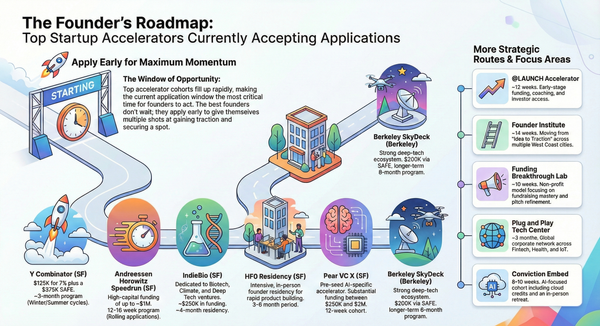

Accelerators and

incubators offer

more than just

funding — they

provide

mentorship,

community, and

credibility.

|

|

Programs like Y Combinator, Techstars, and Seedcamp

are designed to

help startups at

the earliest

stages by offering

resources, office

space, and

guidance from

experienced

mentors.

|

|

Benefits of

Joining an

Accelerator:

|

-

Funding: Many

accelerators

offer

initial seed

funding in

exchange for

equity.

-

Mentorship: Gain

access to

seasoned

entrepreneurs

and

investors

who can

offer

valuable

advice.

-

Credibility: Being

part of a

well-known

accelerator

adds

credibility

to your

startup,

which can

make it

easier to

attract

future

investors.

|

|

If you’re

considering an

accelerator,

choose one that

aligns with your

startup’s mission

and industry. The

right accelerator

can be a powerful

stepping stone to

your first

investment

round.

|

4. Target the

Right

Investors

|

|

Not all investors

are interested in

pre-seed deals. At

this stage, you’ll

want to target angel

investors, micro-VCs, and early-stage

venture funds

that specialize in

investing in

startups before

they’ve achieved

product-market

fit.

|

|

How to Identify

the Right

Fit:

|

-

Research

Investor

Portfolios: Look at

the types of

companies

they’ve

invested in

and see if

there’s

alignment

with your

startup.

-

Find

Investors

Who

Understand

Your

Industry: Investors

with

experience

in your

space will

be more

likely to

back you, as

they

understand

the

challenges

and

potential.

-

Focus on

Pre-seed

Specialists: These

investors

are

comfortable

with

high-risk

investments

and are more

likely to

take a

chance on a

startup at

the pre-seed

stage.

|

|

Don’t waste time

pitching to

investors who

don’t align with

your vision. Focus

your efforts on

those who have a

track record of

funding

early-stage

startups.

|

5. Prepare for

Due Diligence

|

|

Even though

you’re raising

pre-seed funding,

investors will

still conduct due

diligence before

writing a check.

While the process

may be less

intense than later

funding rounds,

you need to be

prepared.

|

|

Key Documents

to Have

Ready:

|

-

Legal

Documents: Ensure

your company

is legally

formed, and

you have all

necessary

incorporation

documents,

intellectual

property

agreements,

and any

necessary

licenses.

-

Cap

Table: Prepare a

clear

breakdown of

your

company’s

ownership

structure.

-

Financials: While you

might not

have

detailed

financials

at this

stage,

having

projections

and an

understanding

of your

startup’s

financial

future is

crucial.

-

Market

Research: Investors

want to know

that there

is a real

market for

your

product, so

any research

you’ve done

should be

compiled and

ready to

present.

|

|

Being prepared

for due diligence

will demonstrate

professionalism

and readiness,

increasing your

chances of

securing

funding.

|

6.

Understanding

and Managing

Dilution

|

|

One of the most

important

considerations

when raising

pre-seed funding

is dilution. Pre-seed rounds

can be highly

dilutive,

especially if

you’re using

instruments like SAFE notes

or convertible

notes.

|

|

These tools allow

investors to

invest in your

company without

setting a

valuation, but

they often result

in more equity

being given up

down the

line.

|

|

How to Minimize

Dilution:

|

-

Be

Mindful of

Terms: While

SAFE and

convertible

notes are

common, make

sure the

terms are

favorable

and not

overly

dilutive.

-

Raise

Only What

You

Need: Don’t

raise more

than you

need in the

pre-seed

round. It’s

better to

raise less

and come

back for a

seed round

once you’ve

hit your

milestones.

-

Negotiate: Don’t be

afraid to

negotiate

terms with

investors,

especially

on things

like

valuation

caps or

conversion

discounts.

|

|

While dilution is

inevitable,

managing it wisely

can help you

maintain control

of your company as

you move toward

the next

round.

|

7. Set Clear

Milestones for

the Next

Round

|

|

Pre-seed funding

isn’t just about

getting money in

the door — it’s

about setting the

stage for future

investment. Use

the funds you

raise wisely to

hit key milestones

that will make it

easier to raise a

seed round

later.

|

|

Key Milestones

to Focus On:

|

-

Develop

an MVP: Your MVP

is the first

step toward

proving that

your idea

works in the

real

world.

-

Gain

Early

Traction: Show

early signs

of

product-market

fit, such as

user

engagement,

partnerships,

or early

revenue.

-

Build a

Strong

Team: Investors

want to see

that you’ve

assembled a

capable team

that can

execute the

vision.

|

|

Having clear

milestones not

only demonstrates

progress to

investors but also

helps you stay

focused on the

most important

objectives as you

move toward the

next stage.

|

Conclusion

|

|

Securing pre-seed

funding can be a

daunting process,

but with the right

strategy and

preparation, it’s

entirely possible.

Focus on crafting

a compelling pitch

deck, networking

early, leveraging

accelerators, and

targeting the

right investors.

|

|

Prepare for due

diligence, manage

dilution, and

ensure you’re

hitting the right

milestones for

future

rounds.

|

|

By following

these strategies,

you’ll increase

your chances of

successfully

raising the first

round of funding,

giving your

startup the

momentum it needs

to grow and

scale.

|

|

Ready to take

your startup

to the next

level? Start

applying these

strategies

today and

secure the

pre-seed

funding you

need to turn

your idea into

a thriving

business.

|

|

Download our

comprehensive

list of top

startup

programs that

provide

pre-seed

funding, even

before

traction,

product, or

revenue. Get

access to

funding,

mentorship,

and resources

to help you

succeed.

️

|