|

The early-stage venture capital

ecosystem is buzzing with

opportunities, but finding the

best VC firms for startups

can make all the difference for

ambitious founders.

|

|

From accelerators and micro-funds to

established global players, today’s

landscape offers a diverse mix of

capital providers—each bringing

unique strengths, networks, and

areas of focus.

|

|

To help founders and investors

navigate this world, we’ve compiled

a curated list of the

best VC firms for startups,

complete with their official

websites and LinkedIn pages.

|

|

Whether you’re building in SaaS,

fintech, marketplaces, or frontier

technologies, this resource is

designed to help you connect with

the right investors and build

lasting partnerships.

|

1. Boost VC

|

|

Website: https://www.boost.vc/

|

|

Profile: Boost VC is an early

stage venture capital firm with

$200m AUM in San Mateo, CA founded

by Adam Draper & Brayton

Williams. We lead Pre-Seed rounds

for Deep Tech (crypto, space, bio,

AI, robotics, VR, Sci-Fi). Founded

in 2012, Boost VC is a venture

capital firm headquartered in San

Mateo, California.

|

|

The co-founders of the firm are Adam

Draper, the fourth-generation

venture capitalist, and Brayton

Williams. Both have a dedicated

focus on sourcing startups that

emerge from sectors that often face

regulatory challenges. Boost VC's

accelerator program provides

housing, office space, and

investment in exchange for equity.

They typically invest in startups

raising $2M or less and focus on

"accelerating the Sci-Fi Future."

|

-

Key Focus Areas:

Blockchain/Crypto, VR/AR, AI,

Robotics, Space Tech, Biotech,

Deep Tech

-

Stage: Pre-Seed

-

Notable: Operates both

as VC firm and accelerator

program

|

|

|

2. Outside VC

|

|

Website: https://outside-vc.com/

|

|

Profile: Outside VC is an

early-stage venture capital firm

focused on backing outsider founders

building fintech infrastructure and

products. They aim to create a

financial system that serves

everyone, not just the top 10%.

|

-

Key Focus Areas:

Fintech, Financial

Infrastructure, Economic

Inclusion

-

Stage: Pre-seed &

Seed (first checks).

-

Notable: Backed by

leading VC partners and

fintech leaders; positions

itself as a “friendvestor”

offering hands-on,

founder-first support.

|

|

|

3. VU Venture Partners

|

|

Website: https://www.vuventurepartners.com/

|

|

Profile: A multi-stage global

venture capital fund focused on

Consumer, Enterprise, Fintech,

Frontier, Healthcare, &

PropTech. VU Venture Partners takes

a multi-stage approach to investing

across diverse sectors, providing

capital from early to growth stages.

|

-

Key Focus Areas:

Consumer, Enterprise, Fintech,

Frontier Tech, Healthcare,

PropTech

-

Stage: Multi-stage

(early to growth)

-

Notable: Global

investment approach with broad

sector coverage

|

|

|

4. Marketplace Capital

|

|

Website: https://obsessedwithmarketplaces.com/

|

|

Profile: The firm appears to

focus on marketplace-related

investments based on the name, but

specific details about investment

thesis, team, or website were not

accessible through the search

results.

|

|

|

|

|

5. Gacsym Ventures

|

|

Website: https://www.gacsymventures.com/

|

|

Profile: Gacsym Ventures is a

London-based venture studio founded

in 2024 that accelerates startup

success through a blend of hands-on

development and financial

investment. Their six-step process

spans feasibility evaluation, MVP

development, and fundraising

support, positioning them as both

developer and investor.

|

-

Key Focus Areas: B2B

Software, SaaS, Tech

Infrastructure, Scalability

-

Stage: Pre-seed &

Seed

-

Notable: Scaled 50+

businesses, flexible

tech-for-equity and

sales-for-equity models

covering up to 50% of startup

costs

|

|

|

6. TreeO VC

|

|

Website: https://www.treeo.vc/

|

|

Profile: Explore Treeo VC's

in-depth investor profile, including

leadership team. While the firm

appears to be active (mentioned in

recent Tracxn reports), specific

details about investment focus,

website, or detailed profile

information were not accessible

through the search results.

|

-

Key Focus Areas:

Information not available

-

Stage: Information not

available

-

Notable: Active

investor per industry

databases

|

|

|

7. Baukunst

|

|

Website: https://baukunst.co/

|

|

Profile: A collective of

creative technologists advancing the

art of building companies at the

frontiers of technology and design.

Baukunst positions itself as more

than a traditional VC, describing

itself as a collective that combines

technology and design expertise to

help build companies.

|

-

Key Focus Areas:

Technology and design

intersection, frontier

technology

-

Stage: Information not

available

-

Notable: Describes

itself as "collective of

creative technologists" rather

than traditional VC

|

|

|

8. XRC Ventures

|

|

Website: https://xrcventures.com

|

|

Profile: XRC Ventures is an

early-stage venture firm driving

innovation at the intersection of

consumer and technology. The firm

focuses specifically on where

consumer needs meet technological

innovation, including consumer tech

and consumer healthtech investments.

|

-

Key Focus Areas:

Consumer Tech, Consumer

Healthtech, Innovative Brands

-

Stage: Early-stage

-

Notable: Specializes in

consumer-technology

intersection

|

|

|

9. Underscore VC

|

|

Website: https://underscore.vc/

|

|

Profile: Underscore VC is a

Boston-based venture capital firm

backing bold early-stage B2B

software founders at Pre-Seed and

Seed. Backing bold entrepreneurs

with an aligned community designed

to fit each startup's unique needs.

The firm emphasizes building a

supportive community around their

portfolio companies and focuses

exclusively on B2B software.

|

|

|

|

|

10. Outlander VC

|

|

Website: https://outlander.vc/

|

|

Profile: By focusing on

founders first, we know how to

identify and fund future unicorns at

the earliest stages—even before

revenue or product! Outlander VC is

a venture capital firm founded in

2020. It is primarily based out of

Atlanta, United States. As of Jun

2025, Outlander VC is an active

investor, having invested in 74

companies, with 5 new investments in

the last 12 months. It primarily

invests in Seed round in United

States. The company's mission is to

connect visionary founders to the

capital and expertise needed to

build and scale their game-changing

ventures.

|

-

Key Focus Areas:

Founder-first investing across

sectors

-

Stage: Primarily Seed,

invests

pre-revenue/pre-product

-

Notable: Atlanta-based,

founded in 2020, very

early-stage focus with 74+

portfolio companies

|

|

|

11. Forum Ventures

|

|

Website: https://www.forumvc.com/

|

|

Profile: Forum Ventures

partners with B2B SaaS startups,

extending venture studio services,

accelerator programs, and pre-seed

funding to propel their growth and

success. Founded in 2014 (formerly

known as Acceleprise), Forum is the

leading early-stage fund, program

and community for B2B SaaS startups.

As of Apr 2025, Forum Ventures is an

active investor, having invested in

216 companies, with 4 new

investments in the last 12 months,

primarily investing in Seed round in

United States based startups. Their

step-by-step approach has helped 450

founders of software companies

secure funding from well-known

investors.

|

-

Key Focus Areas: B2B

SaaS, Enterprise Applications,

FinTech

-

Stage: Pre-Seed and

Seed (provides $100k in

funding)

-

Notable: New York-based

with accelerator program

"Forum For Founders"

|

|

|

12. Hustle Fund

|

|

Website: https://www.hustlefund.vc/

|

|

Profile: Hustle Fund is a

venture capital fund investing in

hustlers at the pre-seed and seed

stages. Hustle Fund is a VC fund

that invests in pre-seed software

startups in the US, Canada and

Southeast Asia. Beyond the usual

criteria that VCs typically look

for, they prioritise founders' speed

of execution above all else. They

know how hard it is to run a company

because they've done it themselves,

and are taking that operational

knowledge and sharing it with their

founders.

|

-

Key Focus Areas:

Pre-seed software startups,

prioritizes execution speed

-

Stage: Pre-Seed and

Seed

-

Notable: Geographic

focus on US, Canada, and

Southeast Asia; offers Angel

Squad community

|

|

|

13. Everywhere Ventures

|

|

Website: https://everywhere.vc/

|

|

Profile: Everywhere is a

founder collective and early stage

venture fund investing in the future

of money, health, and work. They

embrace the challenge of investing

everywhere despite being told it's

crazy, impossible, and way too

ambitious for such a small, scrappy

team.

|

-

Key Focus Areas: Future

of money (fintech), health

(healthtech), work (future of

work)

-

Stage: Early stage

-

Notable: Founder

collective model, describes

itself as "small, scrappy

team"

|

|

|

14. FOVC

|

|

Website: https://www.farout.vc/

|

|

Profile: FOVC is a

mentorship-driven venture capital

firm that pairs high-conviction

capital with hands-on support,

seeking to partner with

non-consensus founders before they

become obvious to others.

|

-

Key Focus Areas: B2B

software (SaaS, AI, fintech,

commerce), process automation,

enterprise verticals.

-

Stage: Pre-seed

(typically lead or co-lead),

with participation in Seed and

follow-on capital reserved for

Series A.

-

Notable: Deep

involvement in portfolio

companies—offering product,

GTM, talent, leadership, and

fundraising support; actively

seeks founders with unique

insights and non-traditional

backgrounds (“outsiders

welcome”)

|

|

|

15. Geek Ventures

|

|

Website: https://geek.vc/

|

|

Profile: Geek Ventures

targets immigrant founders and

provides immigrant-focused

networking events so founders have

an opportunity to grow their

professional network. The firm

focuses specifically on supporting

immigrant entrepreneurs with both

funding and community building.

|

-

Key Focus Areas:

Immigrant-founded startups

-

Stage: Information not

available

-

Notable: Unique focus

on immigrant founders,

provides networking events

|

|

|

16. The Baobab Network

|

|

Website: https://thebaobabnetwork.com/

|

|

Profile: The Baobab Network

is an accelerator that backs

early-stage ventures across Africa,

providing founders with $100k in

capital and a global platform to

scale. They help build and fund

Africa's high potential start-ups

and accept applications on a rolling

basis.

|

-

Key Focus Areas:

African startups across

sectors

-

Stage: Early-stage

(provides $100k in capital)

-

Notable: Africa-focused

accelerator, rolling

application basis, next cohort

Q4 2025

|

|

|

17. Panache Ventures

|

|

Website: https://www.panache.vc/

|

|

Profile: Canada's leading

nationwide pre-seed venture fund.

Panache Ventures is Canada's most

active seed stage venture capital

fund, led by a team of experienced

operators, with a strong angel

investor track record, years of

institutional VC experience and a

strong network in Canada, in Silicon

Valley and worldwide. Panache

Ventures specializes in pre-seed and

seed-stage startup investments in

sectors that play to Canada's

strengths: artificial intelligence

(AI), fintech, digital health,

enterprise software, and blockchain.

|

-

Key Focus Areas: AI,

FinTech, Digital Health,

Enterprise Software,

Blockchain

-

Stage: Pre-Seed and

Seed

-

Notable: Canada's most

active seed stage fund,

founders-first philosophy,

commitment to diversity

|

|

|

18. Riceberg Ventures

|

|

Website: https://riceberg.vc/

|

|

Profile: Riceberg Ventures is

committed to partnering with

entrepreneurs who are passionately

working towards solving humanity's

most profound problems. They believe

that technology has the power to

catapult human progress, fostering

economic equality and opening new

avenues for innovation and growth.

Riceberg Ventures is an early-stage

venture capital firm with a focus on

companies building for global

markets and deep tech startups

across various sectors.

|

-

Key Focus Areas: Deep

Tech, Global market-focused

companies, solutions to

humanity's problems

-

Stage: Early-stage

-

Notable: Mission-driven

focus on solving profound

human problems

|

|

|

19. Don't Quit Ventures

|

|

Website: https://dqv.vc/

|

|

Profile: Based on their

website messaging "Tired of being

ghosted? Tired of da 'Warm Intro' to

VCs?", Don't Quit Ventures appears

to position itself as an alternative

to traditional VC processes that can

be frustrating for founders.

|

|

|

|

Notable: Positioning against

traditional VC frustrations

(ghosting, warm intros)

|

|

|

20. Pear VC

|

|

Website: https://pear.vc/

|

|

Profile: Pear VC are seed

specialists that partner with

founders at the earliest stages to

turn great ideas into

category-defining companies. They

focus specifically on pre-seed and

seed stage investments with the goal

of building category-defining

companies.

|

-

Key Focus Areas: Broad

sector coverage,

category-defining companies

-

Stage: Pre-Seed and

Seed

-

Notable: Specialists in

earliest-stage investing,

focus on category creation.

|

|

|

21. Wonder Ventures

|

|

Website: https://wondervc.com/

|

|

Profile: Wonder Ventures is a

Los Angeles-based venture capital

firm deeply rooted in the SoCal tech

community. The firm has a portfolio

of over 80 companies, supports 200+

founders, and thousands of

employees, with more than 70 of LA's

top founders and tech executives

investing in Wonder Ventures. This

creates a strong community network

that supports the founders they

invest in.

|

-

Key Focus Areas: SoCal

tech ecosystem, broad

technology sectors

-

Stage: Information not

specified in search results

|

|

Notable: Strong LA tech

community connections with 70+ local

tech leaders as investors

|

|

|

22. Precursor Ventures

|

|

Website: https://precursorvc.com/

|

|

Profile: Precursor Ventures

is a classic pre-seed and seed stage

venture capital firm investing in

long-term relationships with

founders they believe in. Since

founding in 2015, they have invested

in more than 200 companies across

software, hardware, consumer and

enterprise, focusing on

entrepreneurs entering into new

markets solving the toughest

problems.

|

-

Key Focus Areas:

Software, Hardware, Consumer,

Enterprise

-

Stage: Pre-Seed and

Seed

-

Notable: Focus on

long-term relationships and

tough problem solving, 200+

portfolio companies

|

|

|

23. Wischoff Ventures

|

|

Website: https://www.wischoff.com/

|

|

Profile: Wischoff Ventures

invests in relentless early stage,

high growth technology companies.

Founded in 2021 and based in New

York, the firm prefers to invest in

vertical SaaS, fintech, supply

chain, marketplaces,

business-to-business SaaS, and

infrastructure sectors. Founded by

Nichole Wischoff, the firm targets

companies transforming offline

industries through innovative

solutions.

|

-

Key Focus Areas:

Vertical SaaS, FinTech, Supply

Chain, Marketplaces, B2B SaaS,

Infrastructure

-

Stage: Early-stage

(pre-seed and seed)

-

Notable: NYC-based,

founded by Nichole Wischoff,

focuses on offline-to-online

transformation

|

|

|

24. Nido Ventures

|

|

Website: https://www.nido.ventures/

|

|

Profile: Nido Ventures is a

California-based, cross-border

venture capital firm founded in

2021, investing in pre-seed B2B

technology startups that transform

traditional industries across the

U.S.–Mexico corridor, combining

Silicon Valley tech with Mexico’s

industrial strength.

|

-

Key Focus Areas: B2B

technology startups in legacy

industries, with a preference

for companies led by at least

one technical founder,

leveraging nearshoring and

foundational sectors.

-

Stage: Pre-seed

(typically first institutional

rounds in the U.S. and

Mexico).

-

Notable: Founded by

engineers bridging Silicon

Valley and Latin America;

closed Fund I at around $7M;

has invested in approximately

16 startups, with strong

female and Hispanic/Latino

founder representation.

|

|

|

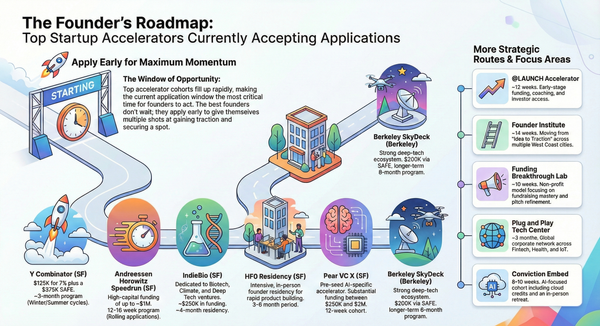

25. Plug and Play Tech Center

|

|

Website: https://www.plugandplaytechcenter.com/

|

|

Profile: Plug and Play Tech

Center (PNP) is an American venture

capital firm headquartered in

Sunnyvale, California, focusing on

deploying capital to early-stage

technology companies. According to

CB Insights from 2020 to 2022, it

was the most active startup

accelerator in the world with an

average deal count of 929 per year,

followed by Y Combinator and

Techstars. Their mission is to build

the world's leading innovation

platform and make innovation open to

anyone, anywhere, connecting

entrepreneurs, corporations, and

investors worldwide.

|

-

Key Focus Areas: Broad

technology sectors, corporate

innovation

-

Stage: Early-stage,

accelerator model

-

Notable: World's most

active startup accelerator

(2020-2022), 929 deals per

year average

|

|

|

26. Gaingels

|

|

Website: https://gaingels.com/

|

|

Profile: Gaingels is a

leading venture investment syndicate

founded in 2014 (or 2015 in some

sources) that champions diversity

and inclusion in startup leadership.

It co-invests alongside traditional

VCs and syndicates to promote

underrepresented founders, including

LGBTQIA+ individuals and allies.

|

-

Key Focus Areas:

Diversity and inclusion in

leadership, broad sector focus

(technology, B2B, healthcare,

consumer), board diversity

& recruitment.

-

Stage: Pre-seed through

Growth/Pre-IPO (co-invests in

rounds led by established

institutions).

-

Notable: Over $900M

invested since 2019 across

2,600+ rounds and 2,400+

companies; strong founder

support via the Gaingels

Letter, board recruitment,

jobs portal, and Diversity

Term Sheet Rider Initiative.

|

|

|

27. Amplify LA

|

|

Website: https://amplify.la/

|

|

Profile: Amplify makes early

investments in LA's most promising

startups, and is a leading

institution in the Los Angeles

venture capital scene. Amplify

provides passionate technology

entrepreneurs the funding and

guidance they need to grow their

startups into strong, scalable &

successful companies.

|

-

Key Focus Areas:

LA-based technology startups

-

Stage: Early-stage

-

Notable: Leading LA

venture institution, focus on

guidance and scalability

|

|

|

28. Dorm Room Fund

|

|

Website: https://www.dormroomfund.com/

|

|

Profile: Built by students

and backed by Midas-List winners and

some of the best VCs in the country,

Dorm Room Fund helps student

founders get all the help they need

to take their companies to the next

level while helping student

investors become the next generation

of venture capitalists. DRF is the

first and only program to give

students 100% of the decision making

power, allowing partners to build a

real investing track record.

|

-

Key Focus Areas:

Student-founded companies

-

Stage: Early-stage

student ventures

-

Notable: Original

student-run VC fund, students

have 100% decision-making

power

|

|

|

29. MBA Ventures

|

|

Website: https://mba-ventures.com/

|

|

Profile: MBA Ventures is a

global early-stage venture capital

fund and network dedicated to

investing in MBA student and alumni

founders from top-tier business

schools.

|

-

Key Focus Areas:

MBA-founder startups across

all sectors and geographies,

co-founder matching,

community-building, syndicate

funding.

-

Stage: Pre-seed &

seed (with a syndicate for

later-stage co-investments)

-

Notable: Exclusive

platform “The Valley” for

networking and co-founder

discovery; organizes annual

Summit; operates an

invite-only syndicate on

AngelList for follow-on

rounds; strongly tied to top

MBA programs.

|

|

|

30. Unshackled Ventures

|

|

Website: https://www.unshackledvc.com/

|

|

Profile: Unshackled Ventures

is the first and only early-stage

venture capital fund dedicated to

backing immigrant founders in the

U.S., providing not just capital but

also visa sponsorship, immigration

support, and a community to help

them launch companies from day zero.

|

-

Key Focus Areas:

Immigrant entrepreneurs,

Pre-seed & Seed-stage

ventures across sectors like

consumer products,

communications/IT, and life

sciences.

-

Stage: Pre-seed and

Seed — typically lead or

co-lead investments, with

check sizes ranging from $100K

to $500K.

-

Notable: Unique “friend

and family” capital model

offering full immigration

services; has supported 200+

founders, with 72% securing

follow-on funding; raised a

$35M Fund III; created 1,100+

jobs across 80 portfolio

companies.

|

|

|

31. Torch Capital

|

|

Website: https://www.torchcapital.vc/

|

|

Profile: Torch Capital is a

brand-focused investment firm built

to shepherd the next generation of

industry-changing mission-driven

consumer companies. Founded in 2018

and based in New York, they invest

in consumer platforms, products and

services from healthcare, fintech,

and food & beverage, to digital

media, e-commerce and marketplaces.

The firm focuses on investing in

visionary founders using technology

to revolutionize how consumers and

businesses operate.

|

-

Key Focus Areas:

Consumer healthcare, FinTech,

Food & Beverage, Digital

Media, E-commerce,

Marketplaces

-

Stage: Early-stage

(consumer-focused)

-

Notable: Brand-focused

with mission-driven approach,

124+ investments since 2018

|

|

|

32. Rally Cap VC

|

|

Website: https://rallycap.vc/

|

|

Profile: Rally Cap VC invests

in early-stage fintech across

emerging markets and climatetech

globally. Founded in 2020 and based

in San Francisco, the firm combines

capital, operating expertise and

networks into a collaborative

community. Rally Cap empowers a

portfolio of top-tier founders

building the next generation of

emerging market financial services

and climate technology solutions.

|

-

Key Focus Areas:

FinTech (emerging markets),

Climate Technology

-

Stage: Early-stage

-

Notable: Dual focus on

fintech and climate, emerging

markets expertise, 93+

investments

|

|

|

33. Cortado Ventures

|

|

Website: https://cortado.ventures/

|

|

Profile: Cortado invests in

seed-stage frontier tech companies

transforming legacy industries in

America's Midcontinent Region with

innovative solutions. The firm

focuses specifically on supporting

startups that are modernizing

traditional industries through

technology adoption.

|

-

Key Focus Areas:

Frontier tech transforming

legacy industries

-

Stage: Seed-stage

-

Notable: Geographic

focus on America's

Midcontinent Region, legacy

industry transformation

|

|

|

34. LvlUp Ventures

|

|

Website: https://www.lvlup.vc/

|

|

Profile: LvlUp Ventures is

one of the most active multi-stage

venture capital firms globally,

backing and supporting over 500

startups annually across 6

continents. Founded in 2019 and

based in Los Angeles, LvlUp is an

early-stage value-add fund and

hybrid accelerator-venture studio,

investing in teams with strong

initial market validation. They

don't just "accelerate" - they

"upcelerate" businesses and help

startups with investor pitch decks

and capital raising.

|

-

Key Focus Areas:

Multi-stage investing across

various sectors

-

Stage: Early-stage

(multi-stage capability)

-

Notable: 500+ startups

annually, hybrid

accelerator-venture studio

model, global reach

|

|

|

35. Ganas Ventures

|

|

Website: https://www.ganas.vc/

|

|

Profile: Ganas Ventures is a

Latina-led VC fund investing in

pre-seed and seed-stage,

community-driven startups across the

US and Latin America. They back

underestimated founders with tools

like their startup-investor matching

platform, fundraising guides, LP and

scout resources, and ecosystem

insights. Their goal is to support

founders with big visions and a

passion for addressing big problems

in growing markets.

|

-

Key Focus Areas:

Community-driven startups,

broad sectors

-

Stage: Pre-Seed and

Seed

-

Notable: Latina-led

fund, US and Latin America

focus, comprehensive founder

support tools

|

|

|

36. Symphonic Capital

|

|

Website: https://www.symphoniccapital.com/

|

|

Profile: Symphonic Capital is

a mission-driven early-stage venture

capital firm founded in 2022 by

Sydney Thomas, committed to

supporting underserved founders

building healthcare and fintech

solutions. The firm offers both

capital and hands-on operational

support, aiming to bridge access

gaps and build lasting businesses.

|

-

Key Focus Areas:

Healthcare, FinTech, Financial

Access, Digital Health,

Underserved & Overlooked

Communities

-

Stage: Pre-seed and

Seed (investing in

post-product launch startups

with MVP and first customer,

rounds of $1–3M on valuations

under $10M)

-

Notable: Closed a

$13.5M inaugural Fund I in

2025; deep, founder-first

support model; focused on

equity and impact; backed by

prominent institutional and

founder LPs; headquartered in

Oakland, CA.

|

|

|

37. Alpaca VC

|

|

Website: https://alpaca.vc/

|

|

Profile: Alpaca VC brings

deep real estate expertise to their

portfolio companies. Based on

testimonials, they are recognized as

strong advisors to management teams,

particularly with deal structuring

and introductions to tech leaders.

The firm appears to focus on real

estate technology and related

sectors.

|

-

Key Focus Areas: Real

Estate Technology, PropTech

-

Stage: Information not

specified

-

Notable: Deep real

estate expertise, strong

advisory capabilities, deal

structuring focus

|

|

|

38. Deciens Capital

|

|

Website: https://deciens.com/

|

|

Profile: Deciens Capital

backs early-stage founders

redefining how financial services

are created, distributed, and

consumed. The firm has a specific

focus on the financial services

sector and works with founders who

are fundamentally changing the

fintech landscape.

|

-

Key Focus Areas:

Financial Services, FinTech

-

Stage: Early-stage

-

Notable: Specialized

focus on redefining financial

services ecosystem

|

|

|

39. Afore VC (Afore Capital)

|

|

Website: https://www.afore.vc/

|

|

Profile: Afore Capital is a

Pre-Seed VC with $300 million in AUM

co-founded by Anamitra Banerji &

Gaurav Jain. They support

product-oriented founders building

software companies at the very

earliest stages, with their sweet

spot being investing $1-2M+ into

founders' first institutional round.

Founded in 2016 and based in San

Francisco, they focus on business

services, consumer services,

fintech, SaaS, marketplace, and

information technology sectors. They

offer a Founder in Residence program

providing at least $100K in capital.

|

-

Key Focus Areas:

Business Services, Consumer

Services, FinTech, SaaS,

Marketplaces, Information

Technology

-

Stage: Pre-Seed (first

institutional round focus)

-

Notable: $300M AUM,

Founder in Residence program,

product-oriented focus, 101+

investments

|

|

|

40. The Council

|

|

Website: https://www.wearethecouncil.com/

|

|

Profile: The Council Fund is

a pre-seed venture capital fund and

angel community rooted in San

Francisco, investing in founders

transforming legacy industries (such

as manufacturing, education,

fintech, logistics, and healthcare).

It combines capital with curated

operator support through its network

of operator-angels and strategic

introductions.

|

-

Key Focus Areas:

Enterprise, Education,

Fintech, Future of Work,

Defense/Government/Legal,

Logistics, Healthcare &

Life Sciences.

-

Stage: Pre-seed and

Seed, with check sizes up to

$100K; facilitated via angel

syndicates and SPVs.

-

Notable: Operates a

highly curated community of

over 200 operator-angels,

hosts weekly live pitch calls

and deal flow newsletters, and

connects founders to both

operators and multi-stage VCs.

Location: San Francisco, CA.

|

|

|

41. GoAhead Ventures

|

|

Website: https://www.goaheadvc.com/

|

|

Profile: GoAhead Ventures is

a Silicon Valley-based venture

capital fund managing over $175M in

AUM, founded in 2015. The firm has

created a streamlined investment

process featuring a 1-way video

pitch system where all 3 managing

partners review every submission,

with decisions made within ~6 days.

They focus on seed-stage investments

in software, AI, and healthcare

industries, primarily in Santa

Monica, Los Angeles, and New York.

As of February 2024, they have

invested in 105 companies across all

technology sectors and geographies

globally.

|

-

Key Focus Areas:

Software, AI, Healthcare (but

invests in all tech sectors

and geographies)

-

Stage: Pre-Seed and

Seed

-

Notable: Streamlined

6-day decision process, 1-way

video pitch system, 105+

investments, Venture Scout

program for students

|

|

|

42. Barrel Ventures

|

|

Website: https://www.barrelvc.com/

|

|

Profile: Barrel Ventures is a

seed-stage fund founded in 2019 and

based in Evanston, Illinois, focused

on fixing the broken food ecosystem.

The firm addresses massive market

inefficiencies that are harming the

planet, investing in innovative

companies working on supply chain

solutions, resource optimization,

and food system adaptation. As of

September 2024, they have invested

in 22 companies, primarily in Series

A rounds for US-based startups.

|

-

Key Focus Areas: Food

ecosystem, supply chain

innovation, sustainability,

resource optimization

-

Stage: Seed to Series A

-

Notable: Illinois-based

with specific focus on food

system transformation, 22+

investments

|

|

|

43. Enzo Ventures

|

|

Website: https://www.enzoventures.eu/

|

|

Profile: Enzo Ventures is an

early-stage VC fund founded in 2019,

investing in tech companies that

meet future generation needs. Based

in Madrid/Barcelona, Spain, the firm

focuses on disruptive digital

solutions across Southern Europe.

Led by Gen Z entrepreneurs, Enzo

empowers disruptive ventures and has

invested in 31+ companies since

founding, targeting technology

sector companies across the region.

|

-

Key Focus Areas: Future

generation tech needs,

disruptive digital solutions

-

Stage: Early-stage

-

Notable: Gen Z-led

fund, Southern Europe focus,

Madrid/Barcelona based, 31+

investments

|

|

|

44. Redbud VC

|

|

Website: https://www.redbud.vc/

|

|

Profile: Redbud VC is an

early-stage venture capital fund and

studio that invests monetary and

social capital in tech founders who

are "strengthened by struggle." Led

by the Schlacks brothers (Willy and

Jabbok), who founded EquipmentShare,

and Brett Calhoun, the firm combines

traditional venture capital with

studio services to support founders

facing significant challenges.

|

-

Key Focus Areas:

Early-stage tech across

sectors

-

Stage: Early-stage

-

Notable: Founded by

EquipmentShare founders, focus

on founders "strengthened by

struggle," venture capital +

studio model

|

|

|

45. Next Wave NYC

|

|

Website: https://www.nextwave.nyc/

|

|

Profile: Next Wave NYC is a

pre-seed venture fund launched in

2024 by Flybridge, run by some of

the best and brightest founders and

operators from the last decade of

the New York City startup scene. The

investment team includes leaders

from Bowery Farming, Casper, Chief,

Flatiron School, Foursquare, Google,

Major League Hacking, and other

notable NYC companies. The fund is

dedicated to supporting the next

chapter of NYC's tech scene in an

AI-driven world.

|

-

Key Focus Areas:

NYC-based startups, AI-driven

tech

-

Stage: Pre-Seed

-

Notable: Backed by

Flybridge, team of proven NYC

operators, launched in 2024,

AI focus

|

|

|

46. F7 Ventures

|

|

Website: https://www.f7ventures.com/

|

|

Profile: F7 Ventures is

positioned as a hands-on partner for

scaling companies, with deep

expertise as former operators and

executives. Based on portfolio

company testimonials, F7 is known

for being one of the most

operational partners, helping

companies achieve key milestones

including Series A fundraising. The

firm appears to focus on being the

"go-to call for operational

questions" for their portfolio

companies.

|

-

Key Focus Areas:

Information not specified in

search results

-

Stage: Early-stage

(supports through Series A)

-

Notable: Former

operators/executives, highly

operational support, hands-on

scaling expertise

|

|

|

47. Recall Capital

|

|

Website: https://www.recall.capital/

|

|

Profile: Recall Capital is a

venture capital firm that partners

with founders building

next-generation companies across

technology and innovation-driven

industries. They focus on

early-stage investments, supporting

startups with capital, strategy, and

long-term partnership.

|

-

Key Focus Areas:

Technology, Innovation,

Early-Stage Startups

-

Stage: Early-stage

-

Notable: Provides

hands-on support and strategic

guidance to founders, focusing

on transformative ideas with

long-term growth potential.

|

|

|

48. Launch Factory

|

|

Website: http://www.launchfactory.com.au/

|

|

Profile: Launch Factory is a

San Diego–based startup studio and

venture capital firm dedicated to

building and investing in innovative

early-stage companies. They support

founders through strategic guidance,

capital, and a deep operational lens

to drive growth.

|

-

Key Focus Areas:

Startups with early

product-market fit; enterprise

and B2B technology ventures

across diverse sectors.

-

Stage:

Post-product-momentum

early-stage—typically when

startups demonstrate initial

traction and are ready to

scale.

-

Notable: Combines

venture capital with hands-on

venture studio support,

offering founders both funding

and strategy from a team of

seasoned entrepreneurs and

industry experts.

|

|

|

49. Ethos Fund

|

|

Website: https://www.ethosfund.vc/

|

|

Profile: Ethos Fund invests

in early-stage, globally ambitious

tech startups in Southeast Asia and

the US. The firm empowers visionary

entrepreneurs to bring their

transformative ideas to life,

fueling innovation and pushing

society forward. Ethos focuses on

supporting companies with global

ambitions from their early stages.

|

-

Key Focus Areas:

Early-stage tech with global

ambitions

-

Stage: Early-stage

-

Notable: Dual

geographic focus on Southeast

Asia and US, mission to fuel

transformative innovation

|

|

|

50. Better Tomorrow Ventures

|

|

Website: https://www.btv.vc/

|

|

Profile: Better Tomorrow

Ventures focuses specifically on

Financial Technology with the belief

that fintech will create a better

tomorrow. The firm is dedicated to

building and investing to create

that future, with a specialized

focus on the financial technology

sector and its potential to improve

financial systems and accessibility.

|

-

Key Focus Areas:

Financial Technology (FinTech)

-

Stage: Information not

specified

-

Notable: Specialized

FinTech focus, mission-driven

approach to improving

financial systems

|

|

|

Conclusion

|

|

Securing funding is more than

raising money—it’s about choosing

the right partners who believe in

your vision and bring strategic

value beyond capital.

|

|

The

best VC firms for startups

don’t just invest; they mentor,

connect, and help founders scale in

competitive markets.

|

|

As you explore these firms, treat

this list as a roadmap to find

investors whose values, networks,

and expertise align with your goals.

|

|

The right partnership can fuel

growth, unlock opportunities, and

set your startup on the path to

lasting success.

|