🚨AI Agents Are Becoming Employees — Most Teams Aren’t Ready

🚀 How AI Startups Will Win

In This Edition:

- 🎯 VCs Are Doubling Down — Fast

- 🔑 How One Wrong Accelerator Burns $35M

- 🤖 Google’s 64-Page Playbook on Building AI Agents

- 🎯 The Real Reason Most Startup Ideas Fail

- 🚨 AI Agents Are Becoming Employees

- ⭐ 15 Brutal Startup Lessons

- 🚀 How AI Startups Will Win

🎯 VCs Are Doubling Down — Fast

💰 Missed These Deals? So Did Most Founders

Here’s a quick snapshot of the latest major funding rounds shaping AI, deep tech, infrastructure, and defense innovation:

- xAI raised a massive $20B Series E, with participation from Valor Equity Partners, Fidelity, Qatar Investment Authority, Stepstone Group, MGX, Baron Capital Group, Nvidia, and Cisco Investments — underscoring strong investor conviction in frontier AI.

- Cambium, a 7-year-old startup from El Segundo, CA, secured $100M in Series B funding led by 8VC, with strategic backing from Lockheed Martin Ventures and multiple institutional and veteran-focused funds.

- DayOne Data Centers raised $2B+ in Series C, led by Coatue with participation from the Indonesia Investment Authority, highlighting the global race to build hyperscale AI-ready infrastructure.

- LMArena, a 1-year-old San Francisco startup, closed a $150M round at a $1.7B post-money valuation, co-led by Felicis and UC Investments, with top-tier VC firms joining the deal.

- Photonic closed $111.5M of a planned $250M round, led by Planet First Partners, bringing total capital raised to $232M as momentum builds in quantum computing.

🚀 Looking for angel investors to fuel your startup’s next stage?

We help founders connect with the right capital at the right time.

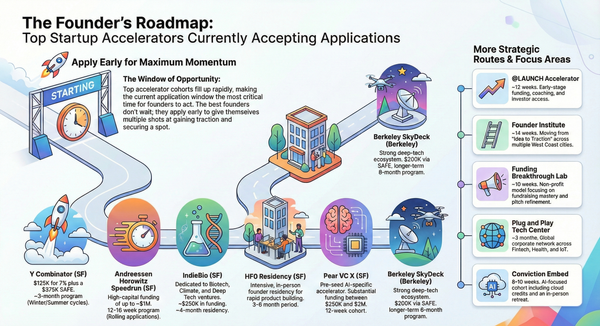

🔑 How One Wrong Accelerator Burns $35M

🚀 What a16z-Backed Founders Do Differently

If you’re building a Web3 startup in 2026, your accelerator decision can quietly become a $10M+ outcome lever—or a costly distraction.

This playbook distills 20 active Web3 accelerators, real founder outcomes, and 2025 market data into a clear, stage-by-stage decision system so founders don’t waste months, momentum, or equity.

🚀 Why This Matters

- $18B flowed into Web3 startups in 2025

- Founders coming out of top accelerators raise 4–7× more capital

- Wrong accelerator = 3 months lost + 5–7% equity gone + missed fundraising momentum

Big winners like Phantom, Flashbots, and Goldfinch didn’t get lucky—they chose the right accelerator for their stage.

❌ The 3 Accelerator Mistakes That Kill Momentum

- Apply to Everything → Generic pitches, weak signal, higher rejection

- Chase Brand Over Fit → Prestige ≠ outcomes (YC/a16z aren’t for everyone)

- Ignore Equity Math → Early dilution can cost $25–35M at exit

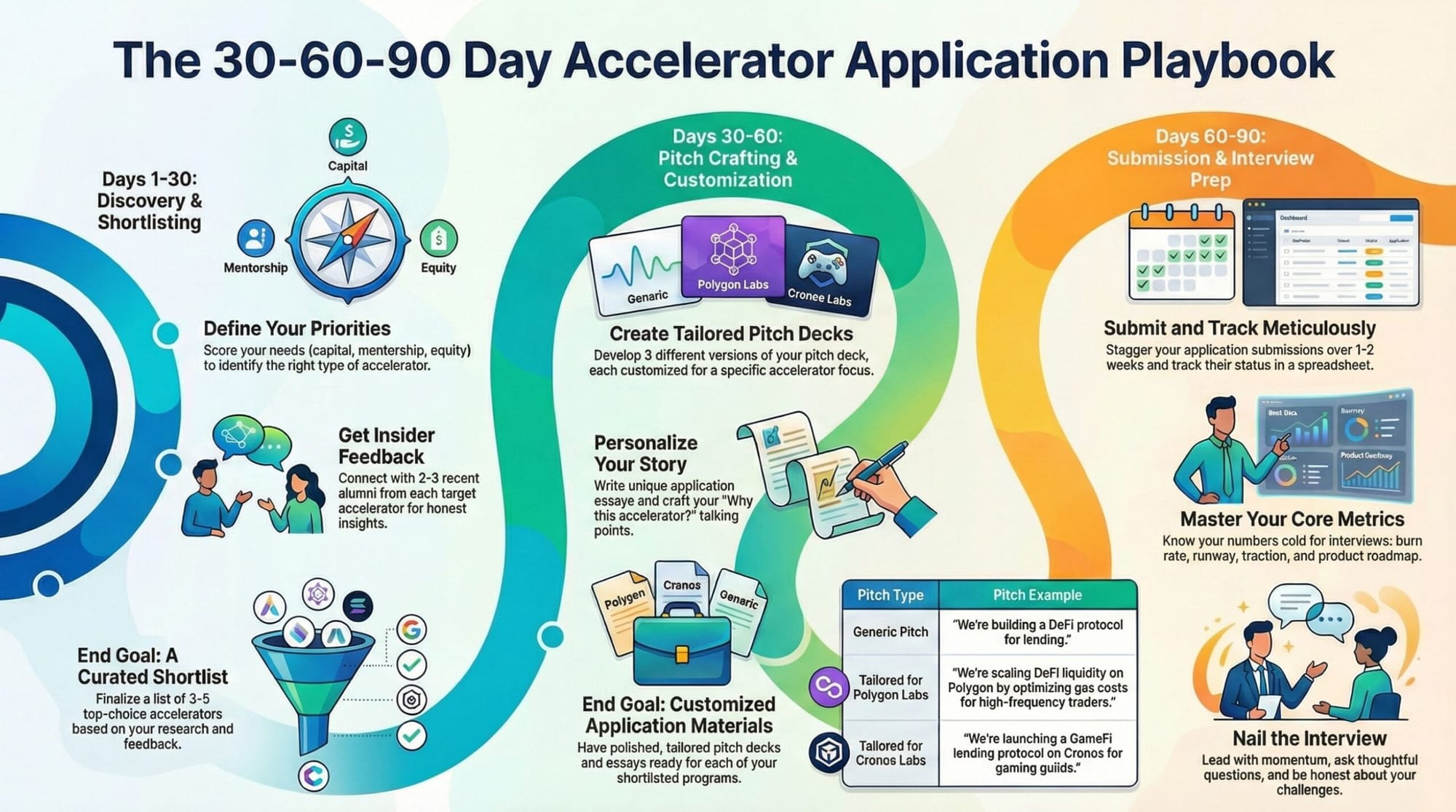

🧭 The Accelerator Selection Framework (Founder-Tested)

Step 1: Be Honest About Your Stage

- Pre-Seed (idea / no MVP) → Antler, XFounders, Celo Camp

- Early MVP / Validation → Alliance DAO, Outlier Ventures, Techstars Web3

- PMF / Growth → a16z Crypto Startup School, Y Combinator, Colosseum

- Ecosystem-Specific → Starknet, Polygon, TON, Cronos, ChainGPT Labs

Quick self-test: If asked about revenue, are you excited—or ashamed?

Step 2: Score What Actually Matters (1–10)

Founders should rank accelerators across 9 factors, including:

- Capital amount

- Equity cost

- Mentorship depth

- Investor access

- Ecosystem fit

- Timeline & intensity

- Prestige value

- Geography

- Vertical focus

This avoids “hype decisions” and forces rational trade-offs.

Step 3: Use the 3-Accelerator Strategy

Apply to:

- 1 Reach (2–5% acceptance) → YC, a16z, Outlier

- 1 Target (10–25%) → Alliance, CV Labs, Techstars, Colosseum

- 1 Safety (25%+) → Ecosystem or non-dilutive programs

This gives leverage, optionality, and faster outcomes.

⚠️ 6 Red Flags to Avoid

- Paid application fees

- “Guaranteed” investor intros

- No post-demo-day support

- 100% acceptance rates

- Celebrity mentors who never show up

- No alumni transparency

📈 The Accelerator Truth Most Founders Miss

Your outcome is 60% founder execution, 40% program quality.

Winning founders:

- Ship relentlessly

- Use mentors weekly

- Fundraise during the program

- Network intentionally

- Treat demo day as the start, not the finish

An accelerator won’t build your startup—but it can compress 24 months into 12 weeks if you pick the right one and show up all-in.

The difference between a $5M Series A and a $25M Series A often starts here.

👉 Download the 30-60-90 Accelerator Application Playbook

(Includes scoring matrix + decision tree for founders)

🤖 Google’s 64-Page Playbook on Building AI Agents

🤖 Google Released a 64-Page AI Agents Guide — Founders Are Quietly Downloading It

Google Cloud has quietly released a 64-page Startup Technical Guide on AI Agents—a practical blueprint for founders building production-ready agentic systems, not just demos.

What founders will learn:

- How AI agents actually work (models, tools, orchestration, runtime)

- When to use RAG, GraphRAG, and Agentic RAG for grounded, reliable agents

- How to move from prototype → production with AgentOps and observability

- A step-by-step path to building agents using Google’s Agent Development Kit (ADK)

- How to scale safely with governance, security, and evaluation built in

As capital shifts toward agent-native startups, this guide shows how to build agents that plan, act, verify, and scale—the kind VCs and enterprises actually trust.

Download the AI Agents Ebook 👇

🎯 The Real Reason Most Startup Ideas Fail

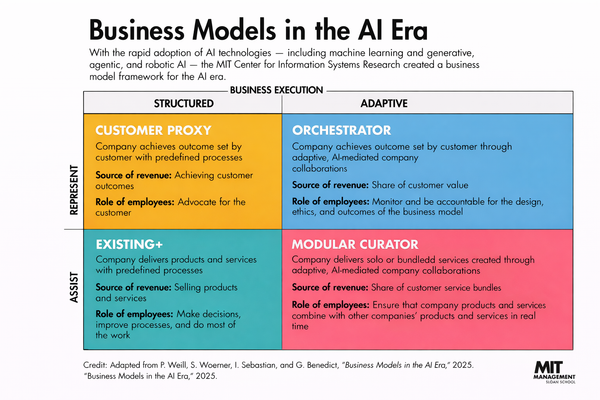

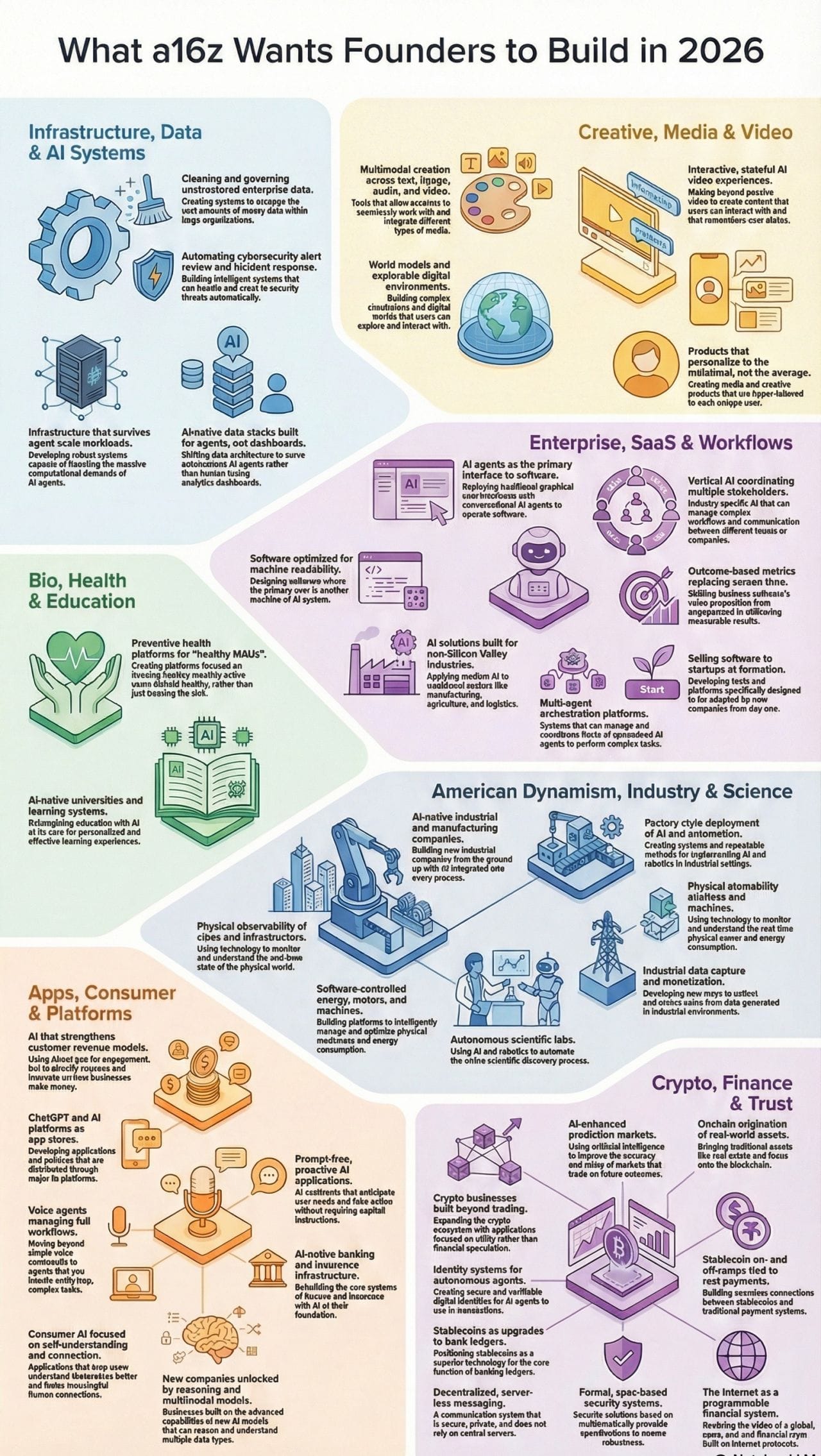

🎯 Andreessen Horowitz Just Revealed Where the Next Billion-Dollar Startups Will Come From

Most startups don’t fail because they’re too early or too late.

They fail because founders bet in the wrong direction.

According to Andreessen Horowitz’s 2026 roadmap, the next decade won’t be won by features—it’ll be won by compounding bets.

Here’s where the smartest founders are placing theirs:

- Infrastructure Bets → AI-native data, agent-scale systems, machine-readable software

- Agent-First Bets → Software that acts, decides, and coordinates without clicks

- Vertical AI Bets → Manufacturing, logistics, agriculture—real ROI, real pain

- Media & Creativity Bets → Interactive, multimodal, personalized content

- Physical World Bets → AI-driven industry, energy, cities, and science

- Financial & Trust Bets → Stablecoins, onchain assets, AI-native finance rails

Founder reality:

Every great company starts with one bet—and wins by expanding into adjacent ones.

The question isn’t “Is this a good idea?”

It’s: Is this the bet you want to compound for the next 10 years?

🔥Using AI ≠ Owning AI

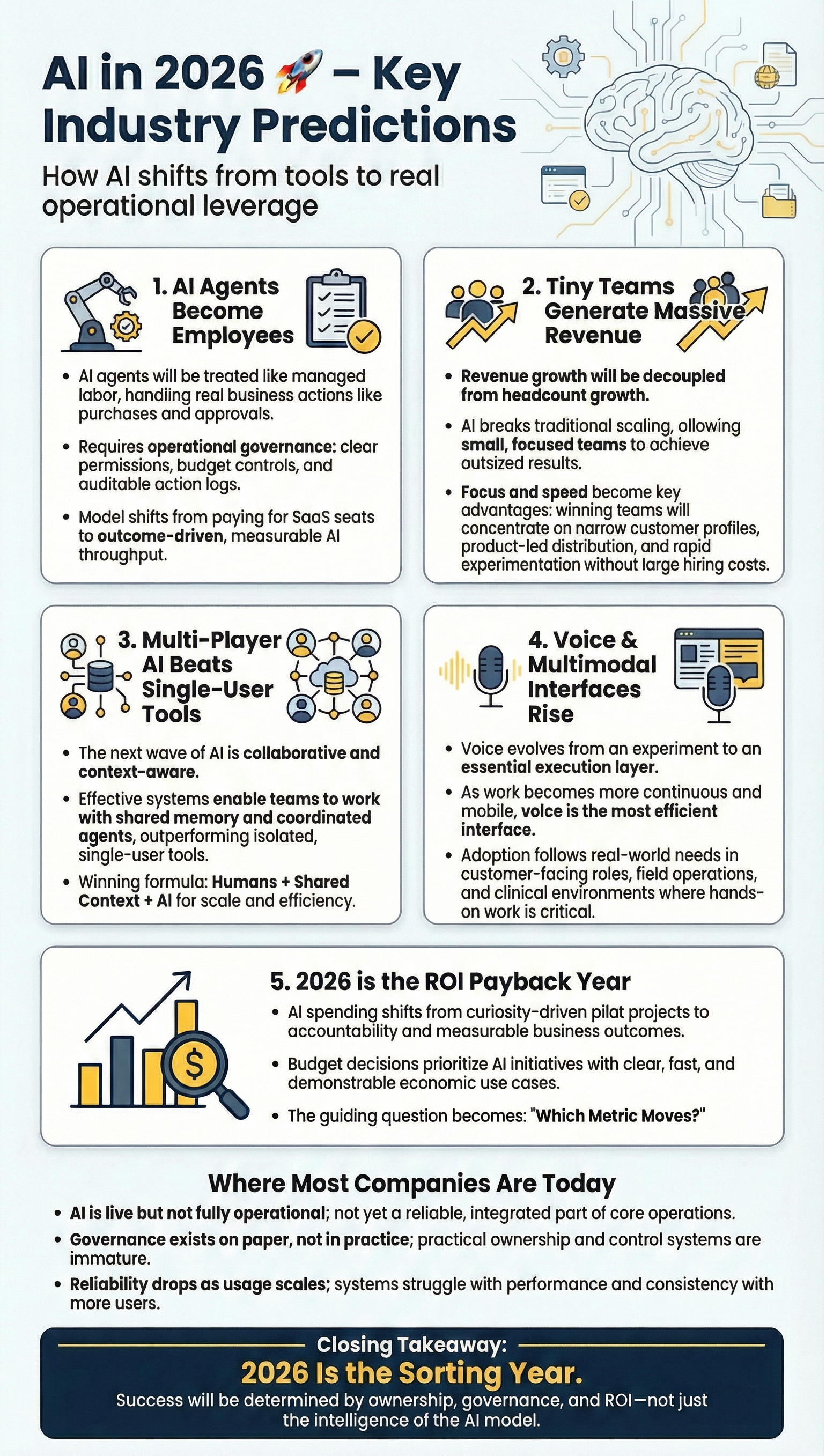

🚨 AI Agents Are Becoming Employees — Most Teams Aren’t Ready

Most companies already use AI.

Very few actually own it.

2026 marks a clear shift: AI moves from experiments to accountability.

The winners won’t have the smartest models—they’ll have ownership, governance, and measurable ROI.

What’s changing fast:

- AI agents become managed employees → permissions, budgets, audit logs matter

- Tiny teams outperform big orgs → revenue scales faster than headcount

- Multi-agent collaboration wins → shared memory + coordinated execution

- Voice & multimodal take over execution → ops and frontline work go hands-free

- ROI becomes non-negotiable → every AI project must move a real metric

Most teams have AI live—but governance is thin, ownership is fuzzy, and reliability breaks at scale.

2026 separates builders from experimenters.

This is the kind of practical, operator-first AI thinking is built for—less hype, more execution.

🎯 Startups Buzz

⭐15 Brutal Startup Lessons Most Founders Learn Too Late

Building a startup is harder than it looks — and repeat founders learn this the hard way.

After scaling and exiting multiple 8-figure businesses, one founder distilled what actually matters when going from idea to scale:

- Product > everything — marketing can’t save churn

- Networks compound — relationships built years earlier unlock growth later

- Founder-led distribution wins — personal brands are go-to-market

- Speed is leverage — ship fast, learn faster

- Pre-validated markets beat novelty — 10× better > brand new

- Free value builds trust at scale — content converts before sales

- Build in public early — waitlists before products create momentum

- Obsess over first 100 users — PMF is engineered, not accidental

- Revenue ≠ profit — unit economics decide survival

- Founders become recruiters — talent is the real multiplier

- AI is leverage, not judgement — reduce friction, don’t replace thinking

- Delegation is survival — bottlenecks kill scale

Founder reality:

Speed, distribution, and focus compound. Everything else is noise.

🎯This One Pitch Slide Saves Founders Months of Useless Meetings

Founders: stop trying to convince every investor.

The smartest decks don’t persuade—they filter.

After dropping its Series A deck, Boardy made one thing clear: the most important slide isn’t traction or team. It’s “What You Need to Believe.”

Instead of selling features, the deck forces investors to agree with a few bold truths:

- A founder explosion is underway, driven by AI-native leverage

- Boardy aims to become the first call for positioning and narrative—not a one-off tool

- Context scales execution across hiring, partnerships, and media

- Software is shifting from tools to teammates—with zero-friction, no-human onboarding

The slide is intentionally polarizing.

If an investor doesn’t “get it,” that’s a win—time saved on both sides.

Great decks don’t chase consensus. They surface belief alignment early and attract partners who already see the future you’re building.

🚀 Marc Andreessen Just Redefined How AI Startups Will Win

AI isn’t slowing down—it’s reshaping how startups compete, price, and win.

In a wide-ranging conversation, Ben Horowitz and Marc Andreessen unpacked what actually matters in the current AI cycle—from startup strategy to long-term economic impact.

Key signals founders should notice:

- Startups can still beat giants by moving faster on applications, not models

- “God models” may not get 100× better—but data quality and use cases will

- AI unlocks latent human capability, not just automation

- Business-value pricing will replace usage-based pricing for AI apps

- Data moats are weaker than they look; execution + validation matter more

- Software demand becomes effectively infinite in an AI-driven world

- Big tech will try to lock down AI—but history suggests open ecosystems win

- VC reality check: expect half of bets to fail—by design

Please enjoy @bhorowitz and me answering questions on the current state of AI!

— Marc Andreessen 🇺🇸 (@pmarca) May 10, 2024

01:14 How AI startups can compete with the bigger players

05:57 Will the "God models" get 100x better?

09:19 Counter argument: Are the tests too simple?

10:14 Internet data represents average human… pic.twitter.com/a2PukwLE6a

Founder takeaway:

This AI wave looks less like a model race and more like the internet era all over again—where value accrues to builders who ship real products, price on outcomes, and ride expanding demand.