💰36+ AI Startups Hit $1B Valuation

🔥 Most Web3 Founders Choose Wrong

In This Edition:

- 💰 36+ AI Startups Hit $1B Valuation

- 📈 Money Moves Without Gatekeepers

- 🔥 Most Web3 Founders Choose Wrong

- 👀 Why Exits Suddenly Matter Again

- 🎯 Winners Will Consolidate Sales AI

🚨 These VCs Don’t Need Intros

📈 Money Moves Without Gatekeepers

Fundraising stalls not because startups are weak — but because founders target the wrong investors and miss fast-moving, cold-pitch-friendly funds.

Key Points / Highlights:

• ⚡ 15 active funds accept cold pitches and move fast — some in 48 hours

• 💰 Check sizes range from $50K to $10M, covering pre-idea through seed stages

• 🌍 Founder-first, global, remote-friendly VCs are writing checks without warm intros

| No. | Fund Name | Typical Check Size | Stage Focus |

|---|---|---|---|

| 1 | Everywhere Ventures | $100K – $500K | Pre-seed / Seed |

| 2 | Village Global | $100K – $500K | Pre-seed / Seed |

| 3 | Anthemis Group | $500K – $10M | Seed / Series A |

| 4 | M13 | $500K – $3M | Seed |

| 5 | Founder Collective | $500K – $2M | Seed |

| 6 | Precursor Ventures | $250K – $500K | Pre-seed |

| 7 | BBG Ventures | $500K – $1M | Seed |

| 8 | Hustle Fund | $100K – $500K | Pre-seed / Seed |

| 9 | Human Ventures | $500K – $2M | Pre-seed / Seed |

| 10 | Susa Ventures | $500K – $2M | Seed |

| 11 | South Park Commons | ~$400K (≈7% equity) | Pre-idea / Pre-seed |

| 12 | Active Capital | $100K – $500K | Pre-seed |

| 13 | Notation Capital | $250K – $1M | Pre-seed / Seed |

| 14 | Pioneer Fund | $50K – $250K | Pre-seed |

| 15 | Lightship Capital | $250K – $1M | Pre-seed / Seed |

See the full list of investors and how to pitch them effectively.

Looking for early believers to back your startup? 👇

🚀 Why Smart Web3 Teams Scale Faster

🔥 Most Web3 Founders Choose Wrong

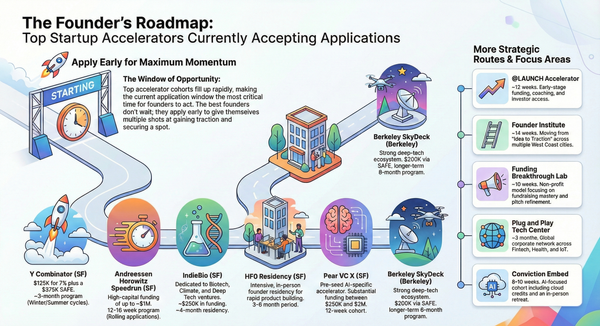

In Web3, founders don’t fail from competition — they fail by choosing accelerators that don’t match their stage or strategy.

- ⏱ Wrong accelerator = time lost, equity diluted, weak investor signal

- 💰 Web3 pulled $18B in funding in 2025 — only well-positioned teams break through

- 📊 Top programs drive outcomes: a16z Crypto Startup School alumni raised $300M+ post-program

→ Explore the full Web3 accelerator decision framework and priority matrix.

🚨 36 Startups Just Hit $1B

💰 36+ AI Startups Crossed $1B in 2025

Despite a cautious funding climate, 2025 minted at least 36 new tech unicorns, signaling where investor confidence and breakout momentum still exist.

Key Points / Highlights:

• 💰 36+ startups crossed the $1B valuation mark in 2025 so far, according to TechCrunch’s ongoing tracking

• 🤖 AI-led companies dominate the list — spanning enterprise AI, robotics, biotech, and infrastructure

• 🚀 Several unicorns were powered by late-stage mega rounds and insider-backed financings rather than hype-driven raises

• 🌍 The new unicorns reflect selective capital deployment, not a broad funding boom — fewer deals, but higher conviction

👉 See which startups investors are backing at $1B+.

🤖 AI Is Powering Liquidity

👀 Why Exits Suddenly Matter Again

After a massive $131B in VC-backed M&A in 2025, 2026 is shaping up to be a buyer-led exit cycle driven by AI, control assets, and scale.

Key Points / Highlights:

• 🔄 M&A dominates exits — IPOs reopened, but most liquidity still came from acquisitions, not public markets

• 🤖 AI is the deal engine — nearly $200B flowed into AI, pushing larger, fewer exits and early consolidation

• 📈 Exit backlog is massive — unicorns and $100M+ revenue companies represent ~$7T in waiting value

👉 See where liquidity and buyers are really moving next.

⚡ AI Is Replacing Sales Work

🎯 Winners Will Consolidate Sales AI

Sales is being rebuilt by AI from the ground up — and the explosion of tools across agents, outreach, CRM, personalization, video, and intelligence shows just how fast the stack is fragmenting and evolving.

🧠 AI agents are replacing manual sales work — from SDRs and meeting notes to coaching, follow-ups, and deal intelligence

• 📤 Outbound and personalization are hyper-automated — LinkedIn outreach, cold email, multichannel sequencing, and copywriting now run on AI

• 🎥 Video + voice AI go mainstream — personalized video prospecting, AI avatars, voice agents, and call intelligence are now table stakes

• 🧩 The stack is massively unbundled — dozens of point solutions for intent signals, pricing, enrichment, enablement, forecasting, and CRM

• ⚠️ Consolidation is inevitable — too many tools, overlapping features, and rising buyer fatigue will force winners to emerge

Sales teams aren’t choosing whether to use AI anymore — they’re choosing which layer to automate, replace, or consolidate first.

Dive into the full AI sales landscape and spot the tools shaping tomorrow’s revenue teams.

🔥WEB PICKS

- ⚡ Microsoft promises its new data centers won’t raise local electricity bills – Microsoft rolled out a “community-first” AI infrastructure plan to expand data centers while ensuring its energy usage doesn’t push up residents’ electricity costs.

- 🛒 Watchdog warns Google’s AI shopping protocol could be misused; Google disputes it – A consumer economics group raised concerns that Google’s AI-powered shopping protocol could impact pricing fairness, but Google says the warning is misleading.

Big/bad news for consumers. Google is out today with an announcement of how they plan to integrate shopping into their AI offerings including search and Gemini. The plan includes “personalized upselling.” I.e. Analyzing your chat data and using it to overcharge you. 1/2 https://t.co/Txh6Im73YE pic.twitter.com/AqDYxSgjk5

— Lindsay Owens (@owenslindsay1) January 11, 2026

- 🩺 Doctors see a role for AI in healthcare, but not necessarily as chatbots – Physicians agree AI can support healthcare operations, but many remain cautious about using chatbots for direct patient interaction.

- 🤖 Humanoid-robot maker 1X releases a world model to help robots learn visually – Robotics startup 1X introduced a world model that allows its Neo humanoid robots to learn tasks by understanding what they see through video data.

- 🧬 OpenAI acquires health records startup Torch for ~$100M – OpenAI reportedly bought Torch to strengthen its health-focused AI tools by improving how medical records are unified and analyzed.

We’ve acquired Torch, a healthcare startup that unifies lab results, medications, and visit recordings. Bringing this together with ChatGPT Health opens up a new way to understand and manage your health.

— OpenAI (@OpenAI) January 12, 2026

We're excited to welcome the Torch team to OpenAI @IlyaAbyzov, @elh_online,… https://t.co/4H8KNa8kVt

- 📈 Meta-backed Hupo finds growth after pivoting to AI sales coaching – After shifting from mental wellness to AI-powered sales coaching, Hupo is seeing renewed traction and business growth with Meta’s backing.

- 💊 AI drug discovery startup Converge Bio raises $25M – Converge Bio secured $25M in funding led by Bessemer and executives from Meta, OpenAI, and Wiz to accelerate AI-driven drug discovery.