💀The 18 Mistakes That Kill Startups

❌ Why VCs and Angel Investors Say "No"

In This Edition:

- 💀 The 18 Mistakes That Kill Startups

- 💸 Venture Funding Roundup

- 🧠 Most founders fail before the pitch deck

- ❌ Why VCs and Angel Investors Say "No"

- 👩💼 174+ Female-Led Venture Capital Firms

🚀 Venture Funding Roundup

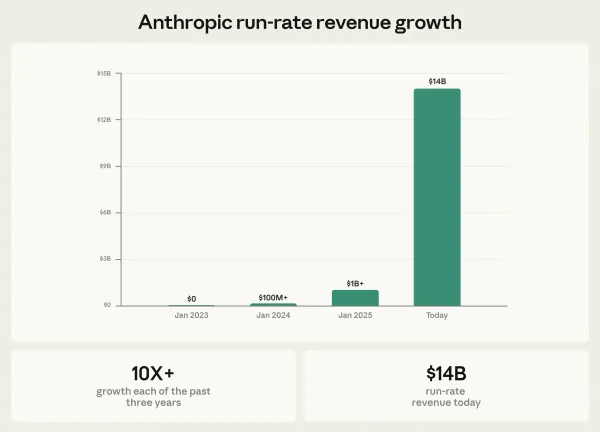

Anthropic — $30B Series G

Location: San Francisco, CA

Funding: $30 billion

Round: Series G

Valuation: $380 billion post-money

Anthropic raised $30 billion in a Series G round led by GIC and Coatue, with co-leads including D. E. Shaw Ventures, Dragoneer, Founders Fund, ICONIQ, and MGX. The capital will support frontier research, product development, and infrastructure expansion as the company continues scaling enterprise AI and coding solutions.

Breakthru Medicine — $60M Series A

Location: Phoenix, AZ

Funding: $60 million

Round: Series A

Breakthru Medicine emerged from stealth with a $60 million Series A following a prior seed round. Founded by biotech veterans Steve Potts, Mark Mulvihill, and Brian Barnett, the company focuses on delivering new therapeutic modalities to address major unmet needs in cancer treatment.

OPAQUE Systems — $24M Series B

Location: San Francisco, CA

Funding: $24 million

Round: Series B

Valuation: ~$300 million post-money

OPAQUE announced a $24 million Series B led by Walden Catalyst with participation from Intel Capital, Race Capital, Storm Ventures, Thomvest, and ATRC. The company builds a Confidential AI platform that provides privacy, governance, and compliance for enterprise AI workloads.

Sante — $7.6M Financing

Location: New York, NY

Funding: $7.6 million

Sante, a fintech platform for the wine and spirits industry, announced a $7.6 million financing round to support growth and expand its platform capabilities for industry stakeholders.

Inertia Enterprises — $450M Series A

Location: Livermore, CA

Funding: $450 million

Round: Series A

Inertia Enterprises secured a massive $450 million Series A led by Bessemer Venture Partners with participation from GV, Modern Capital, Threshold Ventures, and others. The company is developing laser-based fusion technology aimed at delivering grid-scale clean energy.

Northwood Space — $100M Series B

Location: Los Angeles, CA

Funding: $100 million

Round: Series B

Northwood Space raised $100 million in Series B funding led by Washington Harbour Partners and co-led by a16z, with participation from Alpine Space Ventures. The company builds phased-array ground stations to expand satellite control capacity.

PaleBlueDot AI — $150M Series B

Location: Palo Alto, CA

Funding: $150 million

Round: Series B

Valuation: $1B+

PaleBlueDot AI completed a $150 million Series B led by B Capital, valuing the AI compute platform at over $1 billion. The company provides infrastructure designed to power next-generation AI workloads.

Rogo — $75M Series C

Location: New York, NY

Funding: $75 million

Round: Series C

Rogo raised $75 million in Series C funding led by Sequoia Capital, with participation from Henry Kravis, Wells Fargo, Thrive Capital, Khosla Ventures, Tiger Global, and J.P. Morgan. The fintech company builds an agentic AI system for financial workflows and is expanding into Europe.

Scala — $8.5M Seed

Location: Seattle, WA

Funding: $8.5 million

Round: Seed

Scala emerged from stealth with $8.5 million in funding co-led by Madrona and FUSE. The company is building an operational intelligence platform designed for modern contact centers where human agents work alongside AI.

Uptiq — $25M Series B

Location: Dallas, TX

Funding: $25 million

Round: Series B

Uptiq raised $25 million in Series B funding led by Curql with participation from Silverton Partners, 645 Ventures, Broadridge, Green Visor Capital, Live Oak Ventures, First Capital, Epic Ventures, Tau Ventures, and Evolution VC. The platform provides AI solutions tailored for financial services.

👉 Curious who’s leading the biggest bets right now? Click below to explore deeper investor signals, valuation moves, and funding context. 👇

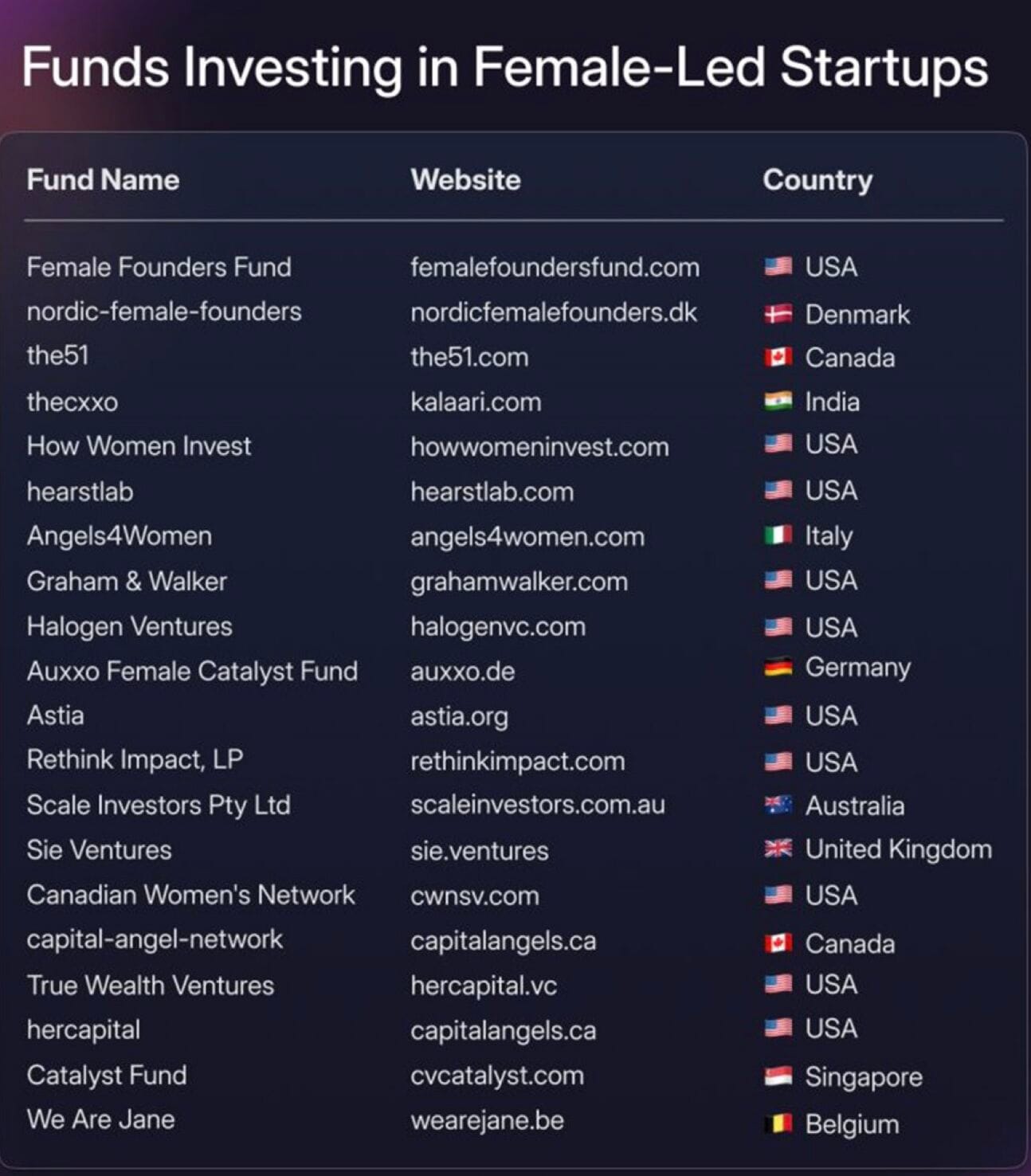

🌍 174+ Female-Led Venture Capital Firms to Know

Female-led venture capital firms are reshaping how capital is deployed—backing diverse founders, closing funding gaps, and unlocking overlooked markets.

This curated directory covers 174+ VC firms led by women across the globe, with a strong focus on pre-seed and seed funding, gender-smart investing, and high-impact sectors like femtech, fintech, future of work, family tech, and ESG-driven startups.

These firms aren’t just funding companies—they’re redefining early-stage investing with hands-on support, deep sector expertise, and long-term founder partnerships.

We’ve put together this list to help you stay informed and spot opportunities faster.

👉 Download the full list to explore everything in depth.

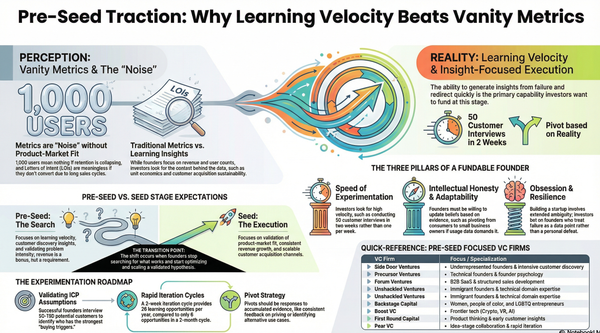

⚡The Anatomy of an Exceptional Startup

🧠 Most founders fail before the pitch deck

Not because their idea is bad.

Not because investors are unfair.

But because they’re optimizing the wrong layer of fundability.

Naval Ravikant has a brutal mental model for what actually makes startups investable—and most founders unknowingly spread their effort across all the wrong places.

Here’s the uncomfortable truth:

• A great pitch can’t hide weak traction

• Social proof doesn’t create belief—it only amplifies it

• “Well-rounded” founders blend into noise

• Exceptional founders dominate one layer ruthlessly

The real question isn’t “Is your startup good?”

It’s “Where are you unfairly strong?”

In this breakdown, we map Naval’s 5 Layers of Fundability—from raw signal to story—and explain why being exceptional at one layer beats being decent at all five.

If you’re raising (or planning to), this will change how you think about traction, team, and storytelling—permanently.

👉 Read the full breakdown here.

🎯Startups Buzz

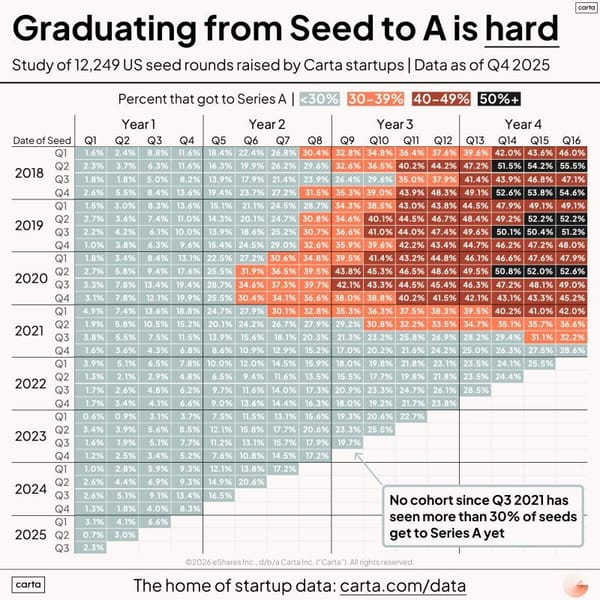

❌ One Funding Mistake = Game Over

Most startups don’t fail because the product is bad — they fail because founders make fundraising mistakes they don’t fully understand.

Giving away non-diluting shares, skipping contracts, or chasing an unreal valuation might feel harmless early on, but these decisions can quietly make your company uninvestable. Investors don’t just back ideas — they back clean cap tables, clear ownership, and smart long-term thinking.

Add buy-back clauses, too many founders, or messy equity terms, and future funding becomes harder, slower, or impossible.

💡 If you plan to raise VC money, your job isn’t just building — it’s building something investors want to invest in.

👉 Before your next funding round, make sure you’re not making these costly mistakes.

💡 Investor Rejection? Here’s the Real Reason

Hearing “no” from investors doesn’t mean your startup is dead—it usually means something needs fixing.

Most rejections come down to avoidable issues: pitching the wrong investors, weak timing, overconfidence, poor clarity on numbers, or lack of real traction.

Fit matters too. Investors back founders they trust, understand, and can work with long-term. And sometimes, the truth is simple—investors get it wrong.

Every “no” is feedback.

Use it to sharpen your story, strengthen your business, and move forward with clarity.

👉 Explore the guide: Right Steps to Successful Fundraising for Startups and turn rejections into momentum.

🔥WEB PICKS

🇪🇺 a16z hunts for Europe’s next unicorn

Andreessen Horowitz is expanding its scouting network across Europe, tapping local founders and operators to identify breakout startups earlier than ever. A clear signal that global VC competition for Europe’s next tech giants is heating up.

🧩 Ricursive Intelligence raises $335M at $4B valuation

This AI chip design startup moved fast — raising hundreds of millions within months of launch. The team is building AI systems that can design better chips through iterative learning, hinting at a new era of hardware innovation.

🛩️ Flapping Airplanes explores radically different AI paths

Instead of scaling existing models, this research group is experimenting with fundamentally new approaches to AI, aiming to rethink how intelligent systems learn and operate.

🌍 Cohere launches open multilingual models

Cohere introduced a new family of open-weight multilingual models supporting 70+ languages and capable of running on everyday devices — a big step toward more accessible global AI.