💰22 Platforms to Find Active Early-Stage Investors

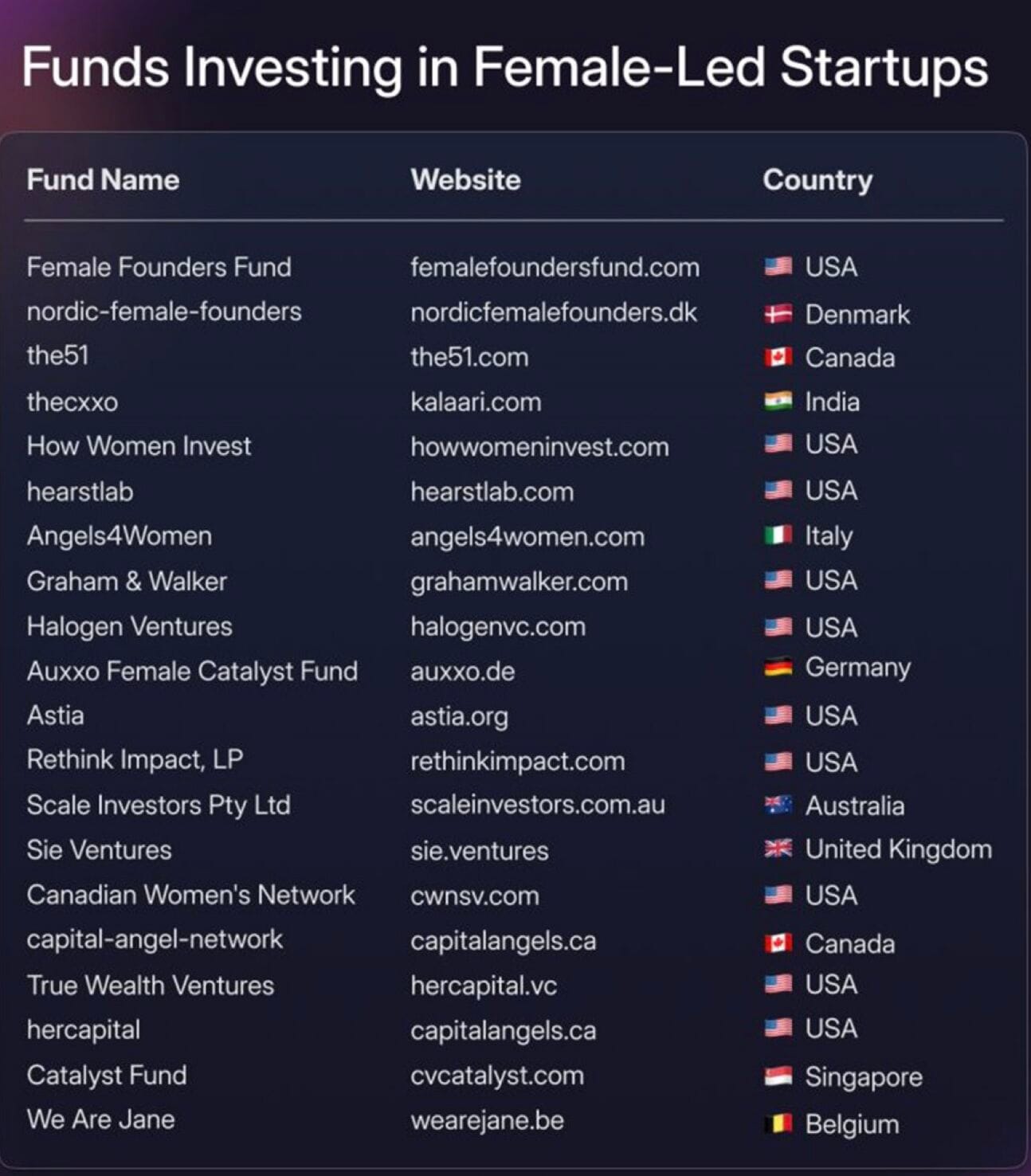

🚀 174+ VC firms led by women

In This Edition:

- 👩💼 174+ VC Firms Led by Women

- 🤖 Billion-Dollar Signals Across AI

- 🚀 Y Combinator’s 2026 Request for Startups

- 💰 22 Platforms to Find Active Early-Stage Investors

- 🎓 A New Home for Student-Led Startups

🚀 174+ VC firms led by women

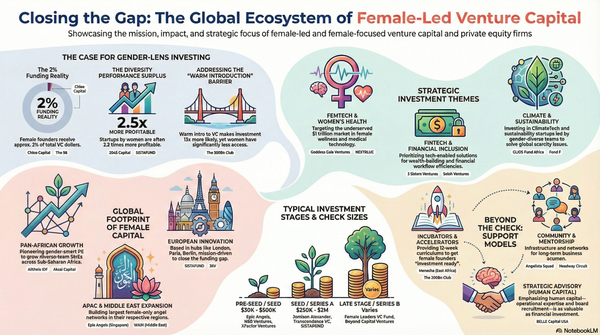

🌍 174+ Female-Led Venture Capital Firms to Know

Female-led venture capital firms are reshaping how capital is deployed—backing diverse founders, closing funding gaps, and unlocking overlooked markets.

This curated directory covers 174+ VC firms led by women across the globe, with a strong focus on pre-seed and seed funding, gender-smart investing, and high-impact sectors like femtech, fintech, future of work, family tech, and ESG-driven startups.

These firms aren’t just funding companies—they’re redefining early-stage investing with hands-on support, deep sector expertise, and long-term founder partnerships.

We’ve put together this list to help you stay informed and spot opportunities faster.

👉 Download the full list to explore everything in depth.

📊Where Capital Is Concentrating

💡Billion-Dollar Signals Across AI and Regulated Markets

Capital is flowing heavily into AI, healthcare, defense, and infrastructure. This week alone, startups across these sectors raised nine-figure rounds, signaling strong investor confidence beyond consumer tech.

Big checks are flowing across AI, healthcare, defense, gaming, and infrastructure.

- Alaffia Health raised $55M Series B to scale agentic AI for clinical claims review.

- Ares Interactive secured $70M Series A to expand its free-to-play mobile games portfolio.

- GenLogs pulled in $60M Series B to track freight activity using sensors and satellites.

- GrubMarket raised $50M at a $4.5B valuation.

- Gruve landed $50M Series A to power AI inference workloads.

- Midi Health raised $100M Series D, crossing $1B+ valuation.

- Overland AI closed a $100M round for military robotics.

- Skyryse raised a massive $300M Series C.

- Tomorrow.io secured $175M to expand its satellite-powered forecasting network.

Capital is concentrating in agentic AI, critical infrastructure, and regulated industries—not just consumer apps.

👉 Curious who’s leading the biggest bets right now? Click below to explore deeper investor signals, valuation moves, and funding context. 👇

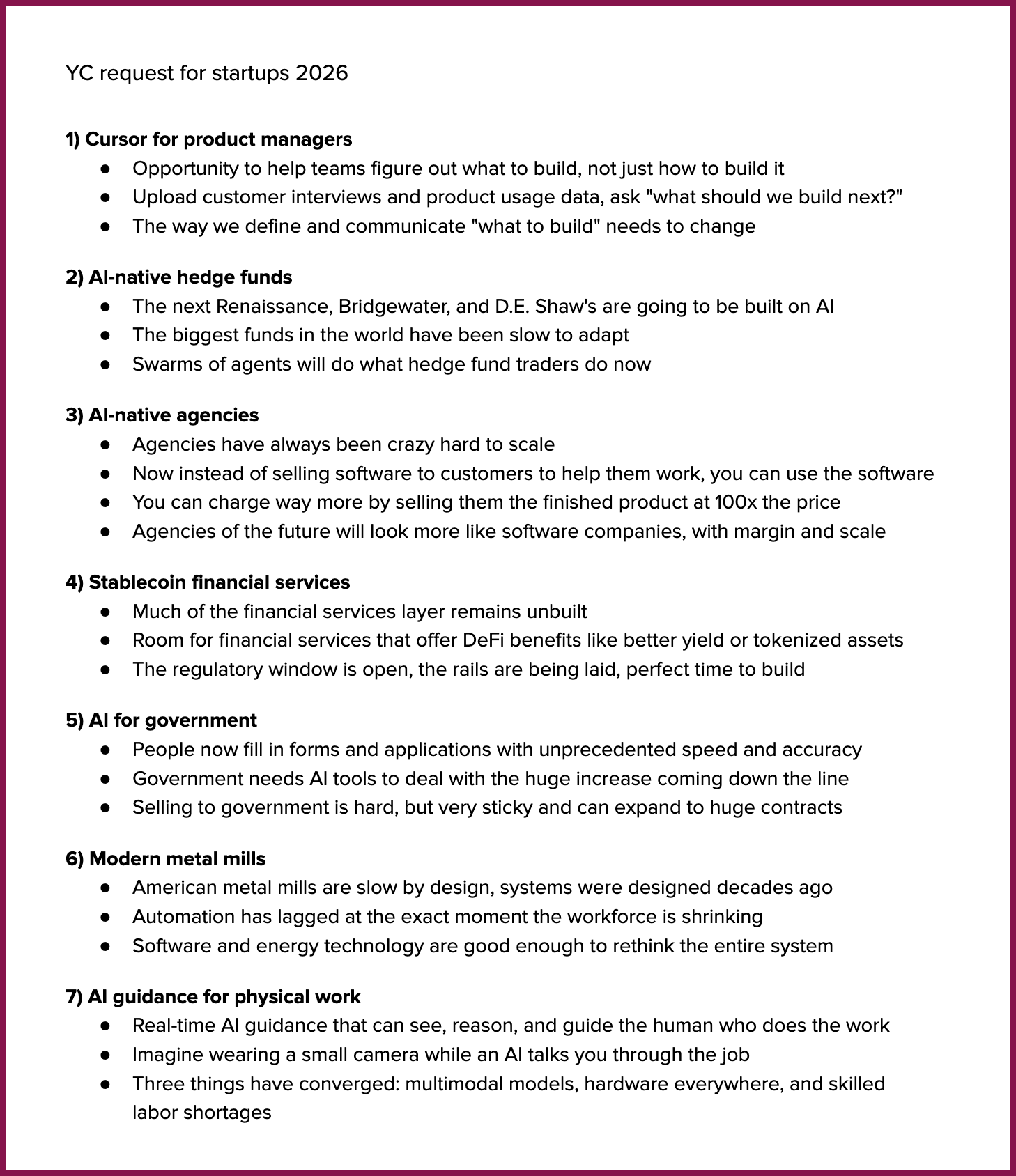

🚀Y Combinator's 2026 Request for Startups

🚀Y Combinator's 2026 Request for Startups

Most startup ideas fail because they chase trends.

Y Combinator just published what it actually wants founders to build.

YC’s Requests for Startups (RFS) reveal the problem spaces they believe will create the next breakout companies—from AI-native businesses and agentic workflows to new financial and industrial systems.

This isn’t theory. It’s a signal of where early funding, attention, and momentum are heading next from Y Combinator.

If you’re thinking about your next startup—or refining an existing one—this list is worth studying closely.

👉 Explore YC’s Requests for Startups.

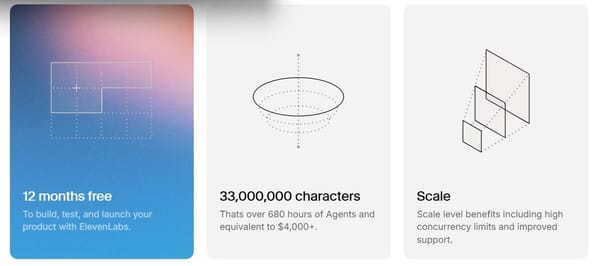

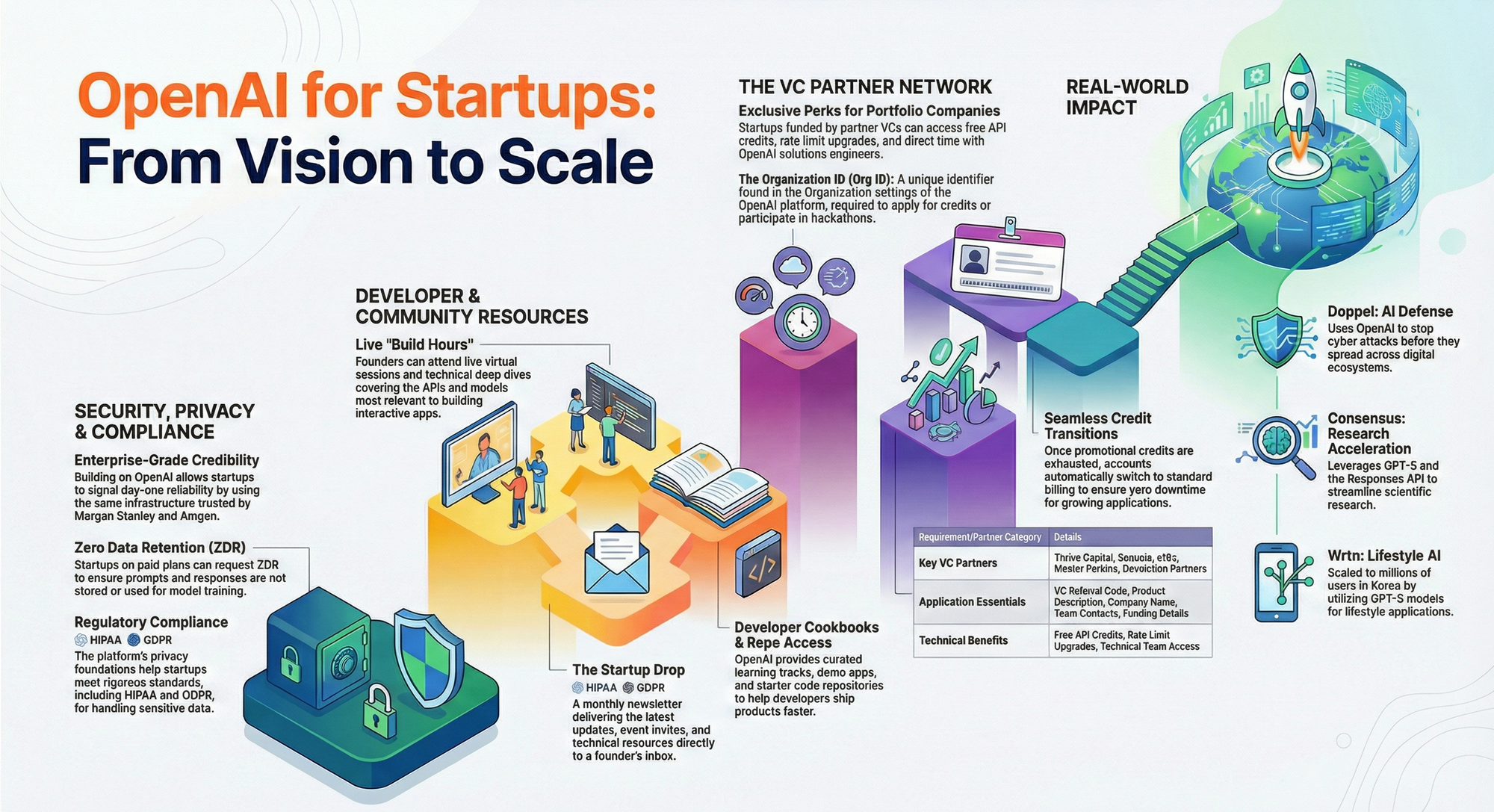

🚀 OpenAI for Startups Program Overview

🚀 What Founders Get with OpenAI for Startups

OpenAI is quietly backing founders building AI-first companies—at every stage.

The OpenAI for Startups program gives teams more than just API access. It combines technical depth, VC-backed perks, and enterprise-grade trust to help startups scale faster.

Key highlights:

- 🧑💻 Build Hours & Toolkits – Live deep dives, starter repos, cookbooks, and demo apps

- 🤝 Founder Community – Meetups, AMAs, webinars, and monthly Startup Drop updates

- 💰 VC Partner Benefits – Free API credits, higher rate limits, and direct OpenAI support (via Sequoia, a16z, Thrive, and more)

- 🔐 Enterprise-Ready Privacy – Zero Data Retention, GDPR/HIPAA-friendly compliance

- ⚡ Proven in the Wild – Used by startups like Doppel, Consensus, and Wrtn

If you’re building with AI at the core, this is a serious advantage.

👉 Explore the OpenAI for Startups Program.

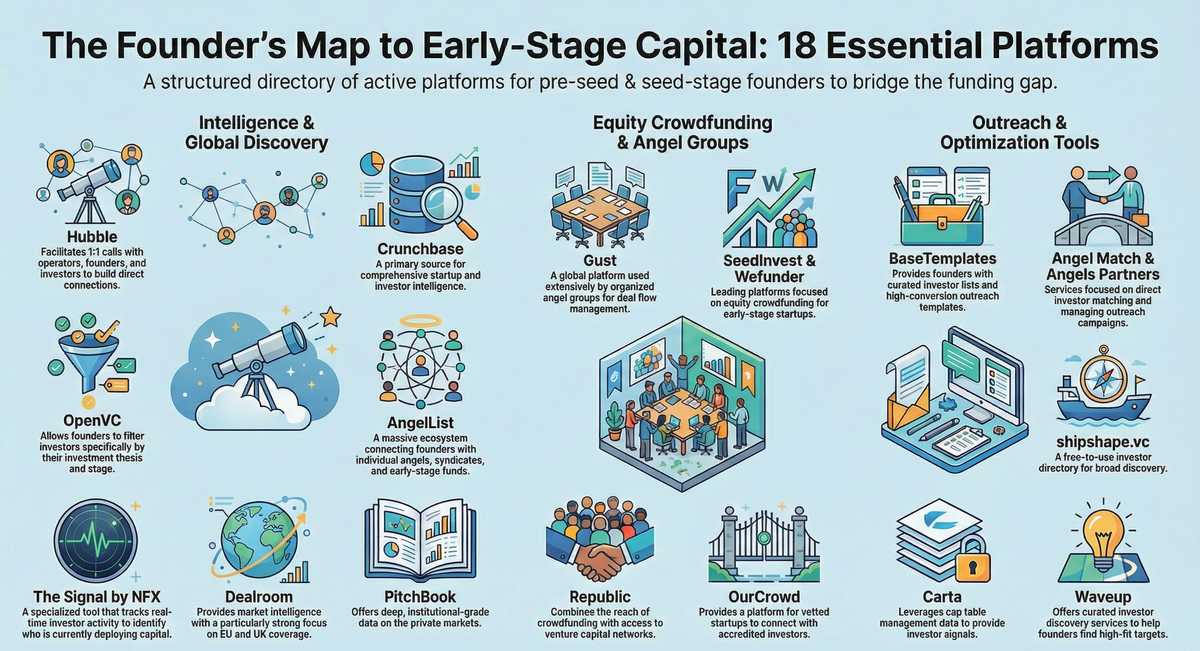

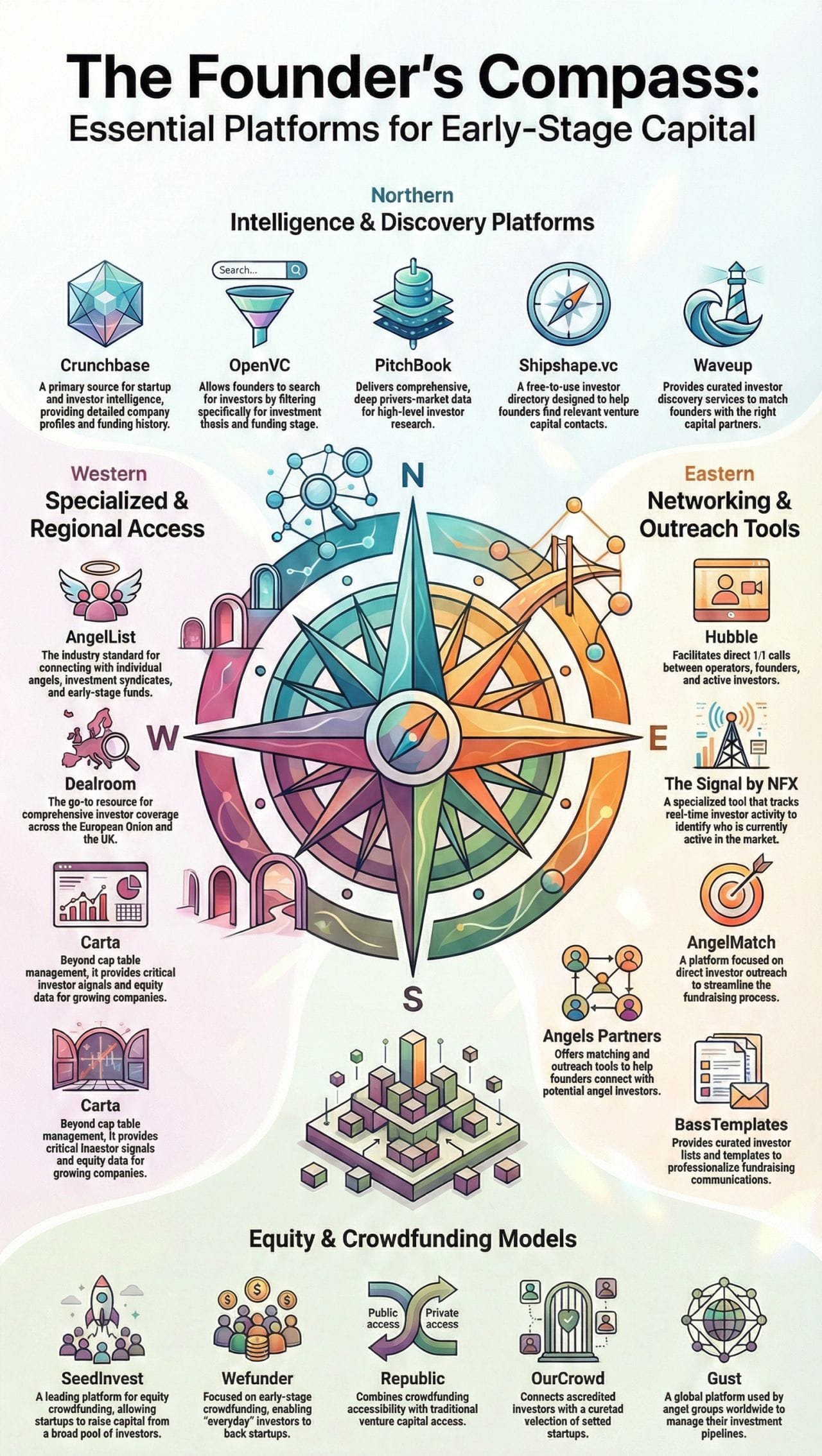

💰 22 Platforms to Find Active Early-Stage Investors

💰 Raising Pre-Seed or Seed? Founders Use These Platforms

Identifying active pre-seed and seed investors is often more difficult than building the product itself. Cold outreach rarely scales, warm introductions are limited, and many investor lists become outdated quickly.

Founders increasingly rely on platforms such as Hubble for direct conversations with operators and investors, OpenVC to filter investors by thesis and stage, AngelList for angel networks and syndicates, Crunchbase for investor intelligence, and The Signal by NFX to track real investor activity.

These platforms help surface who is actively deploying capital, not just who appears on a list.

A curated collection of 22 founder-used platforms highlights the most reliable tools for discovering early-stage investors.

👉 Access the complete list of platforms.

💡A New Home for Student-Led Startups

🌱A New Venture Fund Built for Student Founders

A new player is opening doors for student entrepreneurs.

Breakthrough Ventures just raised a $2M debut fund designed specifically for founders who are still in school—but thinking big. Built and run by students Roman Scott and Itbaan Nafi, the fund is rooted in a simple belief: talent is everywhere, access shouldn’t decide who gets to build.

Early traction speaks for itself:

- $60M+ raised by portfolio companies

- 100+ jobs created

- A growing network of student-led founders

It’s quickly earning comparisons to founder-first platforms like Y Combinator, a16z speedrun, South Park Commons, HF0 Residency, and Sequoia Capital.

🎓 Student founders: applications for the 2026 cohort are now open.

✨ ICYMI

Founders were scrambling for these drops—each one unlocked deal flow, investor access, or tactical fundraising shortcuts. If you missed them the first time, this is your chance to catch up before everyone else does.

Don’t wait. These are the kind of links founders bookmark—and competitors quietly use.

🔥 The Most Clicked Founder Resources

📚 The Ultimate Fundraising Resource Stack

A vault of tools most founders don’t know exists.

🔑 The Most Overlooked Key to Fundraising Success

YC founders swear by this — yet most ignore it.

🔥 Paul Graham’s ‘Small, Intense Fire’

The mindset shift that separates funded from forgotten.

🧠 What Sam Altman Wants Every Founder to Know

The blunt guidance founders rarely hear early enough.

📊 Venture Math Demystified

Why VCs say no — even when your pitch feels strong.

🚀 The Pre-Seed Playbook Every Founder Needs

A practical guide to nailing your first raise.

💡Fundraising Mistakes From a $13M Raise

Avoid the painful errors most founders repeat.

Don’t just save these—use them. The founders who act fastest raise fastest. Want these in a searchable Notion library?

🎯Startups Buzz

🤝Co-Founder Equity: What 18,228 Startups Revealed

Equal splits are rare.

There’s almost always a “pillar founder” holding the largest stake.

And teams that avoid the equity talk early? They struggle later.

Vesting protects everyone — and saves cap tables.

Learn how real startups split equity before funding.

🚀 How Startups Are Winning the AI Race—Without AI Hires

Big Tech is spending millions to win AI talent wars.

Startups are winning by changing the rules.

Elite AI talent is expensive, scarce, and built for scale—not speed. Instead of chasing $200K+ PhDs, smart founders are focusing on AI leverage, not AI headcount.

Here’s what’s working:

- AI literacy across teams, not isolated experts

- Hybrid skill sets that blend domain knowledge with AI tools

- Tool-first execution that compounds output fast

- Lean teams shipping faster with lower burn

The result?

Small teams quietly outperforming companies 10× their size.

The real advantage isn’t who you hire—it’s how well your team can wield AI.

👉 We broke down 6 leverage points founders are using to win the AI era.

One shift could redefine how you hire, train, and scale in 2026.

🧠 Smart Web3 Founders Apply Differently

Web3 startups don’t stall because of bad ideas.

They stall in the accelerator application phase.

Wrong timing. Wrong pitch. Wrong programs.

And suddenly, 6 months are gone.

Smart founders play this differently.

What they do instead:

- 🎯 Customize the pitch — every accelerator has a bias

- ⏱️ Timing beats hype — apply when your stage actually fits

- 🔍 Study accelerator signals — mentors, cohorts, demo day results

- 🧠 Strategic stacking — 3–5 aligned programs > 20 random shots

- 🗺️ Respect timelines — most top programs take 3–6 months to start

Choosing the right accelerator tier matters:

- Elite: Y Combinator, a16z Crypto Startup School

- Specialists: Techstars Web3, Outlier Ventures

- Protocol-backed: Polygon Labs, Starknet Foundation

The best founders don’t chase acceptance.

They design alignment.

🚀 Want to get into the right accelerator without wasting months? Click below to access our proven strategy guide and curated list of top programs for Web3 founders!

🌐 WEB PICKS

- 💰 NVIDIA × OpenAI

NVIDIA is reportedly nearing a $20B investment in OpenAI’s latest funding round—one of the largest AI deals ever. - 📊 Meta Goes All-In on AI

Meta has officially tied employee performance reviews to AI usage, signaling AI fluency is now a core job requirement. - 📈 Axiom Math Surges

Founder Carina Hong’s Axiom Math just quadrupled its valuation, highlighting strong momentum in AI-powered education. - 🚗 Waymo Expands Globally

After raising $16B, Waymo plans to roll out self-driving cars in 20+ new cities by 2026, including Tokyo and London. - 🧠 Intel Challenges NVIDIA

Intel announced plans to manufacture GPUs, aiming to compete directly in the AI compute market. - 📉 Enterprise AI Market Shift

A new Andreessen Horowitz (a16z) survey shows OpenAI leads enterprise adoption at 78%, while Anthropic surged to 44%, narrowing the gap fast.