⚡How to Check Your Startup Valuation

⚡Y Combinator Requests for Startups

In This Edition:

- 🚀 Startup Valuation Calculator

- ⚡Y Combinator Requests for Startups

- 💸 Massive Fundings You Shouldn’t Miss

- 🧠 Marc Andreessen’s Guide to Productivity

- 📊 McKinsey’s AI Reality Check

🚀 Startup Valuation Calculator

⚡How to Check Your Startup Valuation

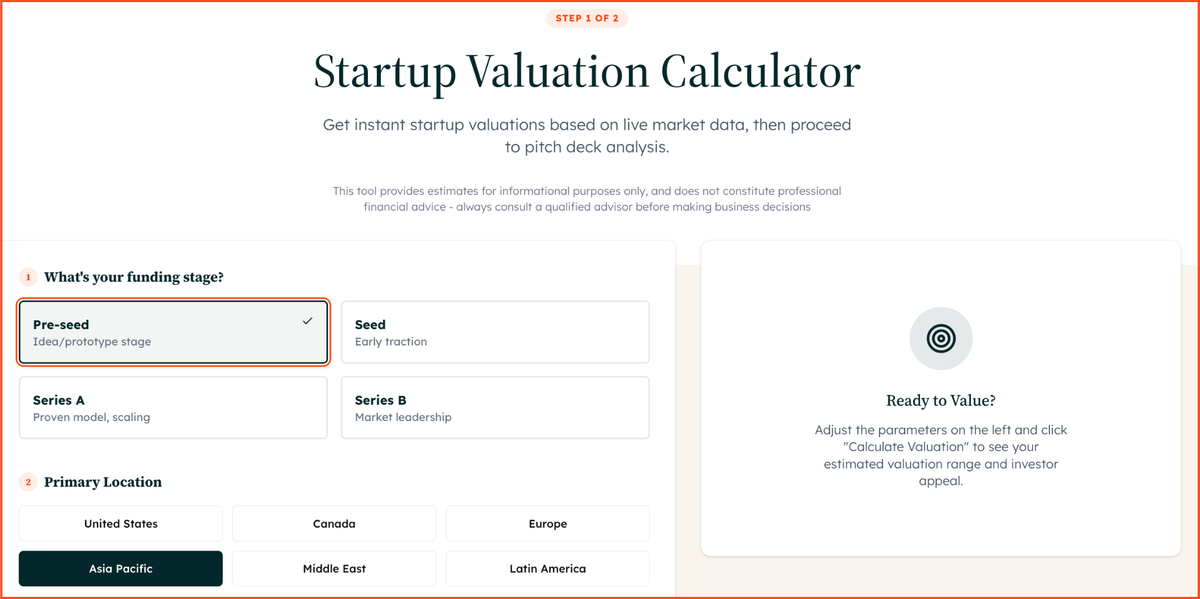

A new Startup Valuation Calculator helps founders estimate their company’s valuation in minutes using live market benchmarks. Simply select funding stage, region, sector, AI classification, revenue, and growth rate to get a clear valuation range—then move straight into pitch deck analysis to strengthen investor readiness.

Perfect for pre-seed to Series B teams who want quick signal, sharper positioning, and smarter conversations with investors. (Estimates are for guidance only—always validate with a qualified advisor.)

How to use it:

- Select your funding stage — Pre-seed, Seed, Series A, or Series B

- Choose your primary location — valuation benchmarks vary by region

- Pick your sector — such as AI, SaaS, FinTech, HealthTech, or Climate Tech

- Define AI classification — AI-native, AI-enabled, or traditional

- Enter annual revenue — adjust using the slider or manual input

- Set your year-over-year growth rate — higher growth reflects stronger investor interest

After entering the details, click Calculate Valuation to view an estimated valuation range based on live market data. Founders can then continue to pitch deck analysis to evaluate investor readiness and positioning.

This tool provides indicative estimates only and should be used as a starting point—not as professional financial advice.

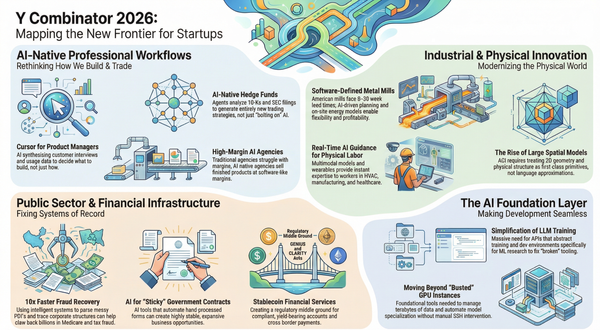

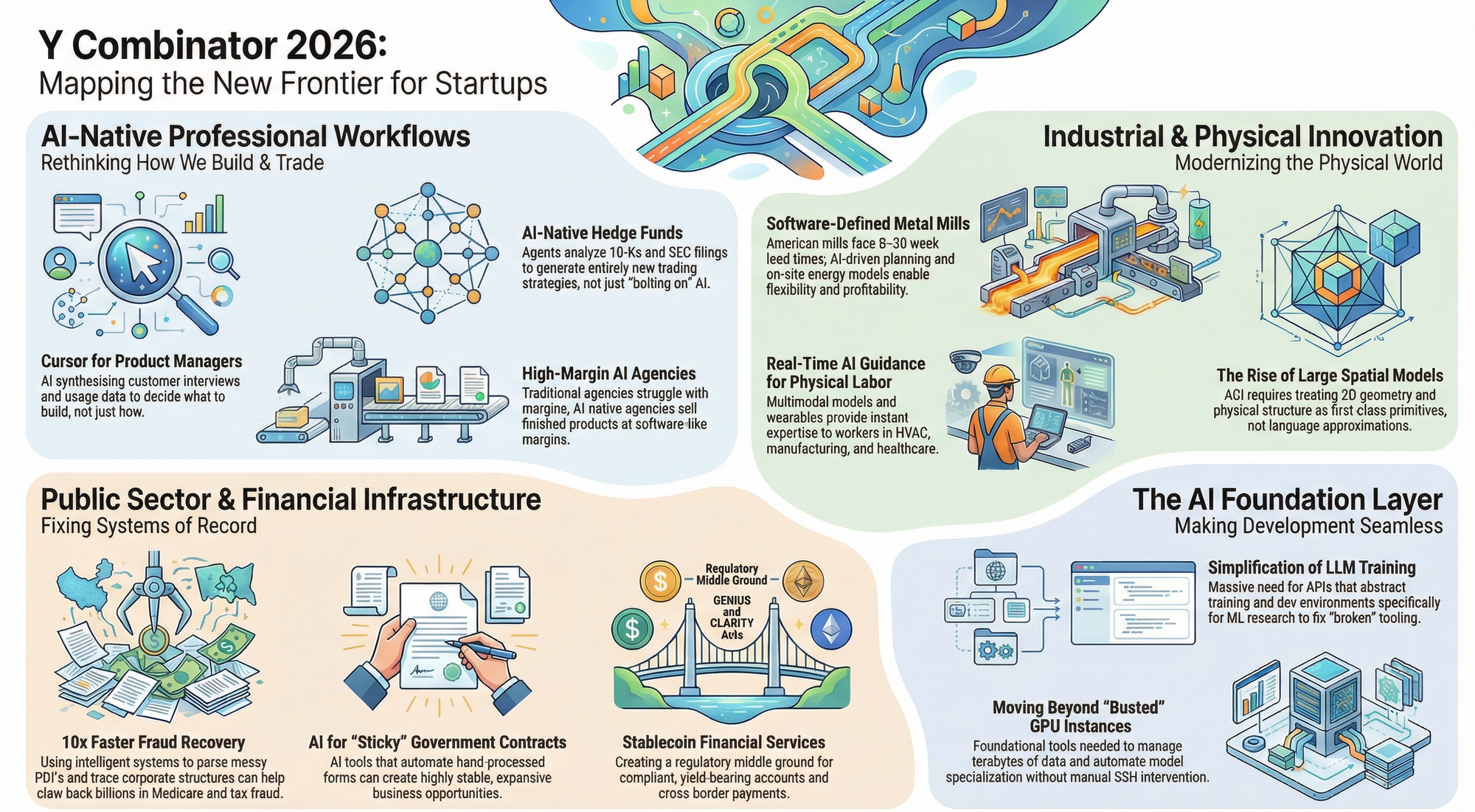

⚡Y Combinator Requests for Startups

🚀 YC Requests for Startups 2026: What Founders Should Pay Attention To

Y Combinator’s Spring 2026 Requests for Startups reveals where real startup demand already exists—not hype, but problems investors actively want solved.

🔑 Key Takeaways

- 🤖 AI-native wins: Rebuilding workflows around AI beats adding AI features

- ⚡ Smaller teams, faster execution: AI slashes build time and capital needs

- 🏗️ High-leverage sectors: Product tools, AI services, fintech & stablecoins, govtech, industrial tech, AI infra

- 🎯 Execution matters most: Domain insight + distribution > idea validation

- 🛡️ Regulation creates moats: Finance & government startups gain long-term defensibility

These are signals, not playbooks. The real edge comes from understanding why these problems are solvable now and matching them with the right founder strengths.

Want the full deep-dive with all opportunity areas, risks, and founder profiles? 👇

📖 Read the complete analysis on Foundevo and stay ahead of where startups are actually being built.

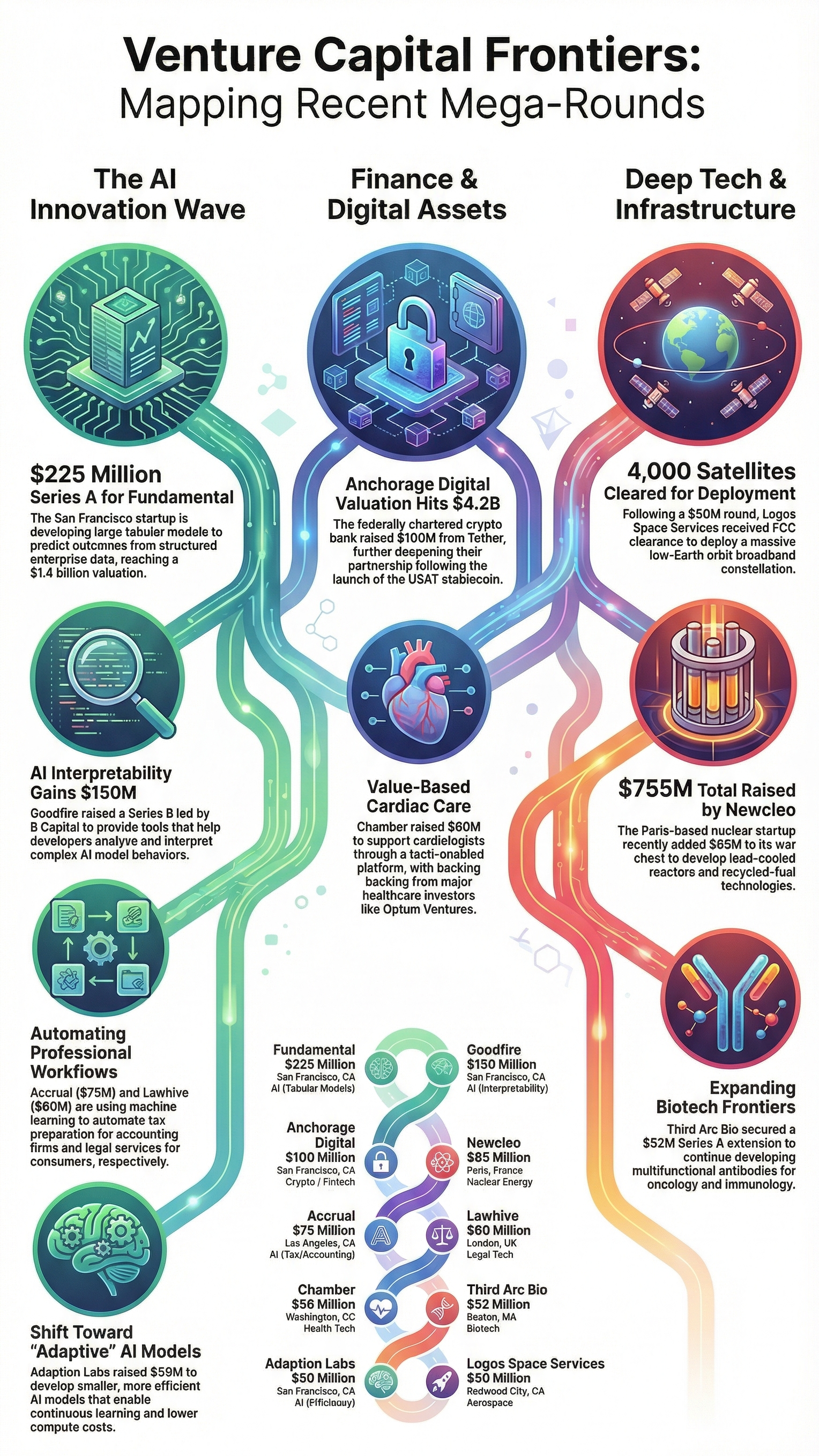

🔥 Massive Fundings — Where Smart Money Is Moving

Fresh capital continues pouring into AI, fintech, healthtech, legal, space, energy, and biotech, signaling strong conviction in AI-native and regulated, defensible businesses.

This Week’s Funded Companies

- 🤖 Accrual — $75M Series A led by General Catalyst; joined by Pruven Capital, Edward Jones Ventures, Patrick & John Collison

- 🧠 Adaption Labs — $50M Seed led by Emergence Capital; Mozilla Ventures, Fifty Years, Threshold Ventures, Alpha Intelligence Capital, E14 Fund, Neo

- 🏦 Anchorage Digital — $100M from Tether (post-money valuation: $4.2B)

- ❤️ Chamber — $60M Series A led by Frist Cressey Ventures; General Catalyst, AlleyCorp, Optum Ventures, Healthworx Ventures, others

- 📊 Fundamental — $225M Series A led by Oak HC/FT; Battery Ventures, Salesforce Ventures, Valor Equity Partners (post-money: $1.4B)

- 🔍 Goodfire — $150M Series B led by B Capital; DFJ Growth, Salesforce Ventures, Eric Schmidt, Lightspeed, Menlo, others

- ⚖️ Lawhive — $60M Series B led by Mitch Rales; TQ Ventures, GV, Balderton Capital, Jigsaw

- 🛰️ Logos Space Services — $50M Series A led by U.S. Innovative Technologies; FCC cleared deployment of ~4,000 LEO satellites

- ⚛️ Newcleo — $85M from Kairos, Indaco Ventures, Azimut Investments, CERN pension fund, others (total raised: $755M+)

- 🧬 Third Arc Bio — $52M Series A extension co-led by Andreessen Horowitz and Omega Funds; Goldman Sachs Alternatives, T. Rowe Price, AbbVie Ventures, others

📌 Signal: Capital is concentrating around AI infrastructure, regulated fintech, deep tech, and science-led platforms—not just apps, but category builders.

👉 Curious who’s leading the biggest bets right now? Click below to explore deeper investor signals, valuation moves, and funding context. 👇

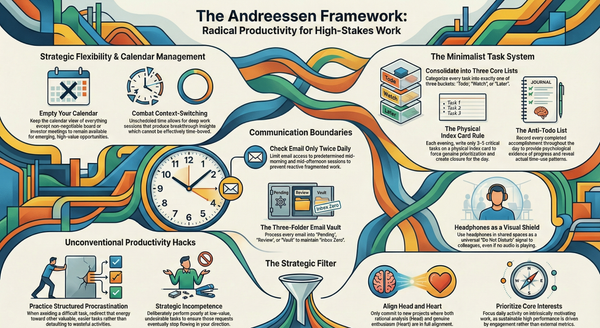

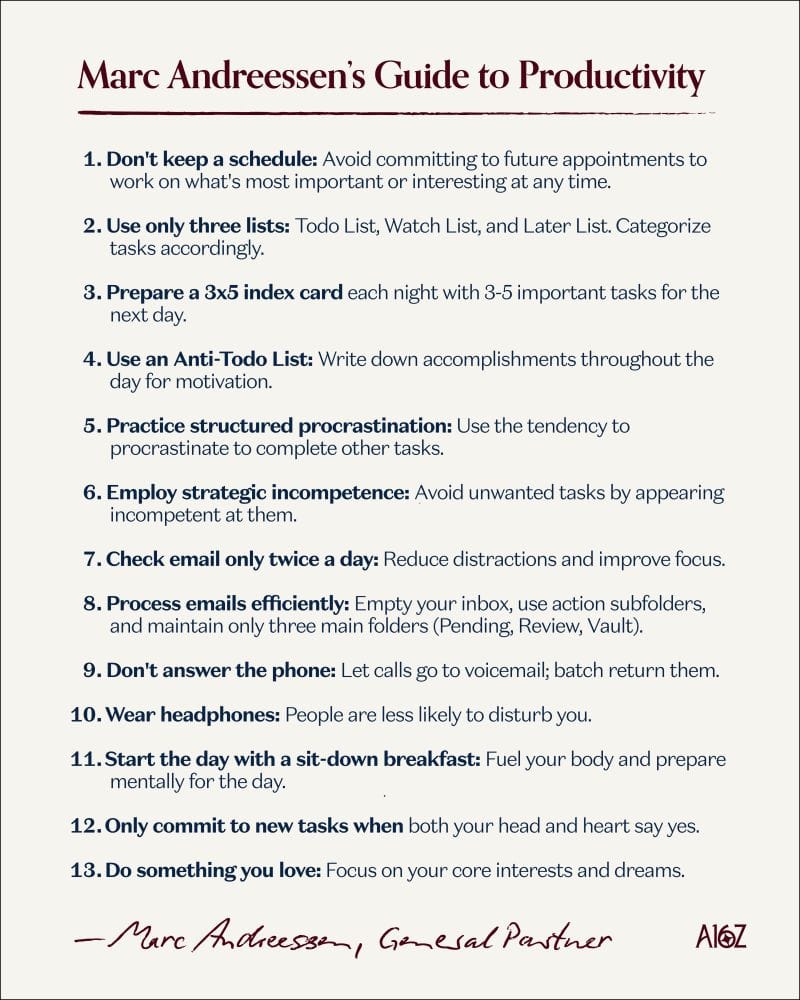

🧠 Marc Andreessen’s Productivity Framework — Built for Founders

In high-uncertainty startup environments, traditional productivity systems break down. Marc Andreessen follows a radically different approach—one optimized for outcomes, flexibility, and sustained high performance, not busy schedules.

Key Ideas

- 🗓️ No rigid schedules → stay flexible for high-leverage work

- 📋 Just three lists → Todo, Watch, Later

- 🧠 Deep focus over responsiveness → limited email, fewer interruptions

- ✍️ Daily priorities on paper → clarity beats complexity

- 🚫 Selective commitments → say yes only when logic and energy align

- ❤️ Work that genuinely matters → long-term performance beats short-term hustle

The framework isn’t about doing more—it’s about protecting attention, avoiding low-value work, and staying mentally sharp in chaotic environments.

Want the full breakdown of all 13 principles with real-world context? 👇

📖 Read the complete guide on Foundevo and rethink how founders actually stay productive.

✨ ICYMI

Founders were scrambling for these drops—each one unlocked deal flow, investor access, or tactical fundraising shortcuts. If you missed them the first time, this is your chance to catch up before everyone else does.

Don’t wait. These are the kind of links founders bookmark—and competitors quietly use.

🔥 The Most Clicked Founder Resources

📚 The Ultimate Fundraising Resource Stack

A vault of tools most founders don’t know exists.

🔑 The Most Overlooked Key to Fundraising Success

YC founders swear by this — yet most ignore it.

🔥 Paul Graham’s ‘Small, Intense Fire’

The mindset shift that separates funded from forgotten.

🧠 What Sam Altman Wants Every Founder to Know

The blunt guidance founders rarely hear early enough.

📊 Venture Math Demystified

Why VCs say no — even when your pitch feels strong.

🚀 The Pre-Seed Playbook Every Founder Needs

A practical guide to nailing your first raise.

💡Fundraising Mistakes From a $13M Raise

Avoid the painful errors most founders repeat.

Don’t just save these—use them. The founders who act fastest raise fastest. Want these in a searchable Notion library?

📊 McKinsey’s AI Reality Check: Adoption Is Easy. Impact Is Rare.

A recent survey by McKinsey, based on insights from nearly 2,000 business leaders, reveals a growing gap between AI hype and real business impact.

Key Signals

- 🤖 AI is everywhere: Nearly 9 in 10 organizations use AI in some form

- 📉 True scale is rare: Only 7% have embedded AI across the enterprise

- 🧪 Pilots dominate: Two-thirds are still experimenting, not transforming

- 🧠 AI agents are emerging: Most are testing, but fewer than 10% have scaled them in any function

- 💰 Limited profit impact: Innovation and CX gains are common, but bottom-line impact remains modest

- 🔄 Workflow redesign is the differentiator: Leaders rebuild processes around AI instead of layering it on

The conversation has shifted from “Should AI be used?” to “Can pilots turn into real outcomes?”

Most companies are still stuck in between—but the gap between AI-mature leaders and the rest is widening fast.

🌐 WEB PICKS

🤖 Sapiom Raises $15M to Let AI Agents Buy Their Own Tools

Sapiom secured fresh funding to build infrastructure that allows AI agents to autonomously purchase APIs, software, and compute—removing humans from routine procurement loops.

📉 a16z: Founders Should Stop Obsessing Over Insane ARR Numbers

An Andreessen Horowitz VC argues that viral ARR metrics distort reality. Sustainable growth, retention, and real customer value matter more than flashy top-line figures.

💼 Secondary Sales Are Becoming Employee Retention Tools

Secondary transactions are shifting away from founder windfalls toward giving employees earlier liquidity—emerging as a powerful tool for talent retention in AI startups.

📊 Fundamental Raises $255M to Rethink Big Data Analysis

Fundamental closed a massive Series A to scale its large tabular AI model, built specifically to analyze structured enterprise data where traditional LLMs struggle.

🧠 Anthropic Releases Opus 4.6 With AI Agent Teams

Anthropic unveiled Opus 4.6, introducing “agent teams” that divide work across multiple AI agents—pushing Claude closer to complex, multi-step execution.

🎥 Meta Tests a Standalone App for AI-Generated Vibes Videos

Meta is experimenting with a separate app for AI-generated short videos, signaling a deeper push into creative AI and social-native content formats.

🎙️ ElevenLabs CEO: Voice Is the Next AI Interface

The CEO of ElevenLabs predicts voice will become the primary way people interact with AI—moving beyond text and screens toward more natural, conversational systems.