🧠How He Transformed $500 into a $10M Empire

🚀 1,000+ Investors Who Actually Reply

In This Edition:

- 🧠 Founder Notes: He Turned $500 Into $10M

- 🚀 1,000+ Investors Who Actually Reply

- 🔥Where AI, Startups & VC Collide

- ⚔️$25M vs. $250M Startup

- 🕵️Hidden YC Guides Every Founder Needs

- ⚡How a16z Turned VC Into a Brand

🧠 Founder Notes: He Turned $500 Into $10M

🧠How He Transformed $500 into a $10M Empire

Karthik didn’t win by having a “big idea.”

He won by starting small, executing fast, and building systems that scale.

✅ 1) Niche dominance first

He started with fraternities & sororities and owned that niche before expanding.

✅ 2) Scale through vertical brands

He launched multiple brands for different audiences using the same backend ops.

✅ 3) Tech as a moat

Instead of manufacturing, he built an order + vendor portal system that makes partners faster, cheaper, and more reliable.

✅ 4) Zero-budget growth

He relied on cold outreach + outbound email, and used affiliate/ambassador programs to turn customers into sellers.

✅ 5) Pick a “hard” market

Licensed merchandise is difficult—so competition is low. The barrier becomes the advantage.

✅ 6) Speed + service wins

Fast replies, strict SLAs, and strong delivery created trust and repeat buyers.

Founder takeaway: Start now, learn fast, and build operational leverage—not just a product.

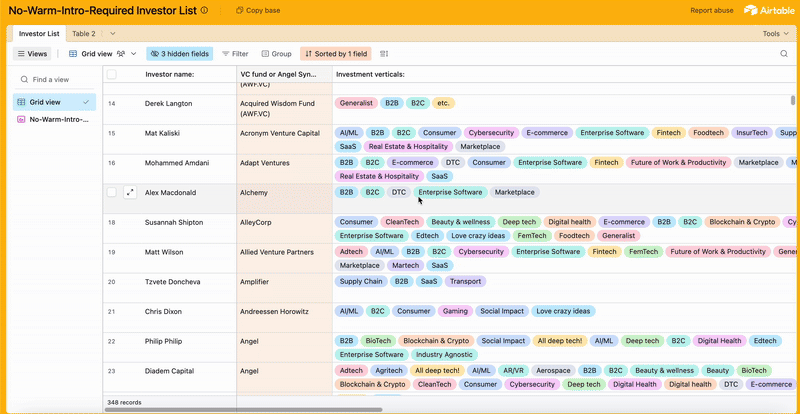

🚀 1,000+ Investors Who Actually Reply

Let’s face it — not every founder has connections.

Not every founder went to Stanford.

And not every investor needs a warm intro.

That’s exactly why this list exists — a goldmine of 1,000+ investors who’ve actually funded founders through cold outreach.

No gatekeepers. No gatekeeping emails.

Just investors who care about traction, story, and execution more than status.

Here’s what’s inside

- ✅ 1,000+ investors & funds — with names, roles, and direct contact info

- Stage focus: Pre-Seed, Seed, and Series A

- Sectors: B2B, SaaS, AI, Productivity, Future of Work

- LinkedIn profiles & investor notes — including those who said yes to cold DMs

But here’s the key — this isn’t just a spreadsheet.

It’s a playbook for founders who want to pitch smarter, personalize better, and build relationships that last.

Download the No-Warm-Intro Investor List here and connect directly with investors who actually reply.

👉 Curious who’s leading the biggest bets right now? Click below to explore deeper investor signals, valuation moves, and funding context. 👇

🏆How Fluently Hit $6M ARR

🏆How Fluently Hit $6M ARR in Record Time

Every founder talks about growth — few actually crack it.

Fluently, an AI English tutor, just jumped from $0 → $6,000,000 ARR, and the playbook behind it is a masterclass in simple, focused execution.

Here’s what made it take off:

Built for a real personal problem

He created Fluently because he needed it — giving him instant clarity on what mattered.

Shipped the MVP in 7 days

One core feature. Zero assumptions. Let real users guide the build.

Personally onboarded the first 150 users

Screen shares revealed every friction point — and shaped every early feature.

Engineered a faster “aha moment”

Shorter onboarding, quicker value, better activation.

Obsessed over the funnel

Fixing drop-off points became the growth engine.

Scaled with 50+ daily videos

100M+ weekly organic views across IG/TikTok/YouTube = explosive top-of-funnel.

Support as product research

For 20 months, he did it himself — and turned complaints into product wins.

Relentless weekly iterations

Feedback → ship → analyze → repeat. No magic, just discipline.

This isn’t hype — it’s a blueprint.

Want the full breakdown of how he went from $0 → $6M ARR?

Don’t miss the complete strategy — this one’s worth saving.

⚡2026 AI Trend Reports You Can’t Ignore

🔥Where AI, Startups & VC Collide

We’re living through a defining moment where AI breakthroughs, startup momentum, and venture capital are colliding — and rewriting the rules across every industry.

If you want a clear view of where the future is headed, these expert reports are your roadmap for 2026 and beyond.

They don’t just forecast trends — they reveal how funding, technology, and consumer behavior are evolving in real time.

Here’s what’s inside

AI & Tech Intelligence

CB Insights | Stanford | MIT | Bessemer | Sifted

Consumer & Commerce Trends

Andreessen Horowitz | Menlo Ventures |a16z | HubSpot

Venture & Private Markets

PitchBook | AngelList | Carta | DealRoom

Policy & Emerging Tech

Harvard’s Belfer Center

Whether you’re a founder, investor, or builder, these insights connect the dots between AI, capital, and the next wave of innovation.

Access the full list of reports here and get ahead of the curve — before the next funding cycle hits.

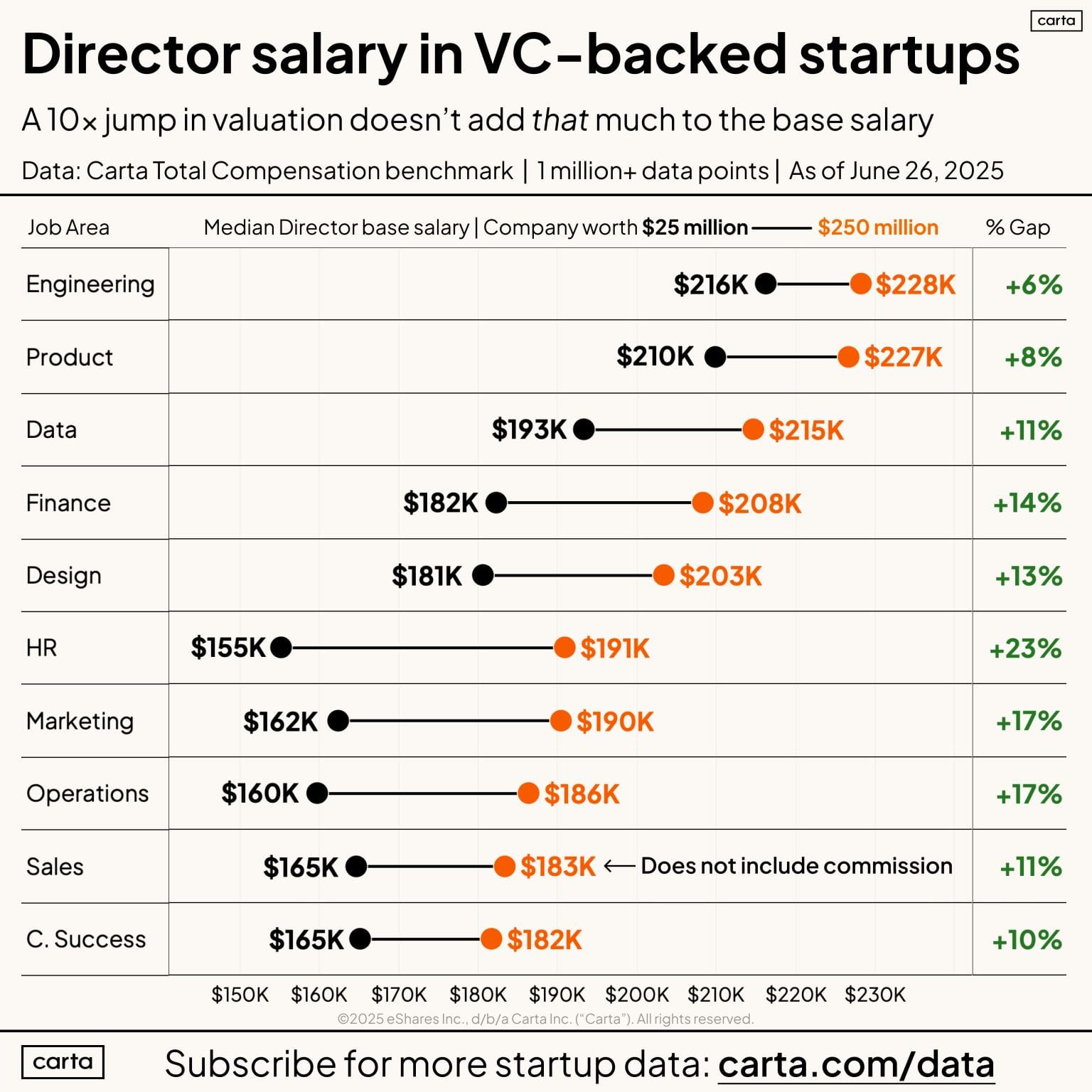

⚔️$25M vs. $250M Startup

⚔️$25M vs. $250M Startup: Which Offer Wins?

Thinking about that Director offer at a startup? Here’s a reality check

At a $25M company (Seed/Series A), a Director in Data earns around $193K. At a $250M company (Series C), it’s about $215K — just an 11% jump.

The real trade-off? Equity vs. stability. Smaller startups offer more equity but higher risk. Larger ones? Safer bets, but smaller ownership.

No right answer — just a question of what you’re optimizing for:

Learning or earning?

Read the full breakdown and see the role-by-role comp data here.

🤯 YC Wisdom They Don’t Teach in School

🕵️Hidden YC Guides Every Founder Needs

Everyone knows the famous YC quotes.

But the real value? It’s buried deep inside their lesser-known resources — the ones only seasoned founders talk about.

If you’re an early-stage founder trying to go from idea → MVP → fundraising → scale, this collection is your cheat code. ⚡

Here’s a taste of what’s inside

- How to Start a Startup (Stanford Course) — the gold standard for startup fundamentals.

- Build Your MVP the YC Way — practical frameworks that stop you from overbuilding.

- Finding Product-Market Fit — David Rusenko’s guide to nailing the hardest stage.

- How to Pitch Your Startup — YC’s no-fluff playbook for storytelling that sells.

- B2B vs B2C Metrics — the numbers that actually matter to investors.

- Understanding SAFEs & Equity Rounds — simplify your fundraising structure.

These aren’t just blog posts — they’re battle-tested lessons from YC partners, founders, and alumni who’ve built unicorns and survived the dip.

🚀 Why a16z Made VCs Go Viral

⚡How a16z Turned VC Into a Brand

When Andreessen Horowitz (a16z) launched, Silicon Valley laughed.

Marc Andreessen and Ben Horowitz were called “the bad boys of venture.” Their playbook? Pure heresy at the time.

While traditional firms waited for founders to come to them, a16z flipped the script.

They realized that in venture, only ~15 deals per year create most of the returns — and to win, they had to be in those 15.

So they made themselves impossible to ignore.

They built a brand before it was cool — writing blogs, hosting podcasts, giving interviews, and turning their partners into cultural figures.

They didn’t wait for deal flow; they created gravity.

What looked like PR was actually strategy — a power-law play for credibility and momentum.

Marc called it “preferential attachment” — the idea that startups attract resources once others believe they’re real.

A16z became that “bridge loan of credibility.” They gave founders not just money — but magnetism.

Today, they’ve institutionalized what made them different:

➡️ turning venture capital into a network effect business — combining high-touch founder support with scalable influence.

From being dismissed as outliers to defining how modern venture operates, a16z didn’t just change VC.

They rebranded it.

✨ ICYMI — These Resources Blew Up This Week

Founders were scrambling for these drops—each one unlocked deal flow, investor access, or tactical fundraising shortcuts. If you missed them the first time, this is your chance to catch up before everyone else does.

Don’t wait. These are the kind of links founders bookmark—and competitors quietly use.

🔥 The Most Clicked Founder Resources

📚 The Ultimate Fundraising Resource Stack

A vault of tools most founders don’t know exists.

🔑 The Most Overlooked Key to Fundraising Success

YC founders swear by this — yet most ignore it.

🔥 Paul Graham’s ‘Small, Intense Fire’

The mindset shift that separates funded from forgotten.

🧠 What Sam Altman Wants Every Founder to Know

The blunt guidance founders rarely hear early enough.

📊 Venture Math Demystified

Why VCs say no — even when your pitch feels strong.

🚀 The Pre-Seed Playbook Every Founder Needs

A practical guide to nailing your first raise.

💡Fundraising Mistakes From a $13M Raise

Avoid the painful errors most founders repeat.

Don’t just save these—use them. The founders who act fastest raise fastest. Want these in a searchable Notion library?

🚀Startups Buzz

💰How Startup Valuations Actually Work

Startup valuations aren’t about what your company is “worth.”

They’re about investor demand for your round.

Revenue, founder experience, competition — they matter.

But demand sets the number.

You’ll also learn why high valuations can backfire, plus how cap tables and vesting shape your future.

See how founders really negotiate valuation.

📈The Guide to Scaling Sales & Raising Capital

Great products don’t win — great distribution does.

This playbook shows how top founders:

• Close the first 10–20 customers themselves

• Build repeatable sales engines investors love

• Treat fundraising like a parallel sales process

• Use proof, not promises, to win capital

Steal the sales + fundraising system VCs expect.

🤝Co-Founder Equity: What 18,228 Startups Revealed

Equal splits are rare.

There’s almost always a “pillar founder” holding the largest stake.

And teams that avoid the equity talk early? They struggle later.

Vesting protects everyone — and saves cap tables.

Learn how real startups split equity before funding.

🔥WEB PICKS

- 🧠 Google researchers found reasoning models improve when they simulate internal debates between diverse “personalities.” Adding conversational debate markers boosted DeepSeek-R1 accuracy from 42% → 55%.

- 📊 A WSJ survey of 5,000 white-collar workers revealed a productivity gap: 40% of executives say AI saves them 8+ hours/week, while non-managers report just 2 hours or less.

- 🎙️ Google acquired Hume AI’s CEO and engineering team through a licensing-style deal to strengthen Gemini’s voice capabilities.

- 🇰🇷⚖️ South Korea passed a major AI law requiring transparency + safety for “high-impact” AI systems, taking effect January 2026.

- 🌍🏥 The Gates Foundation + OpenAI committed $50M to the “Horizon 1000” initiative—deploying AI across 1,000 primary healthcare clinics in Africa by 2028.