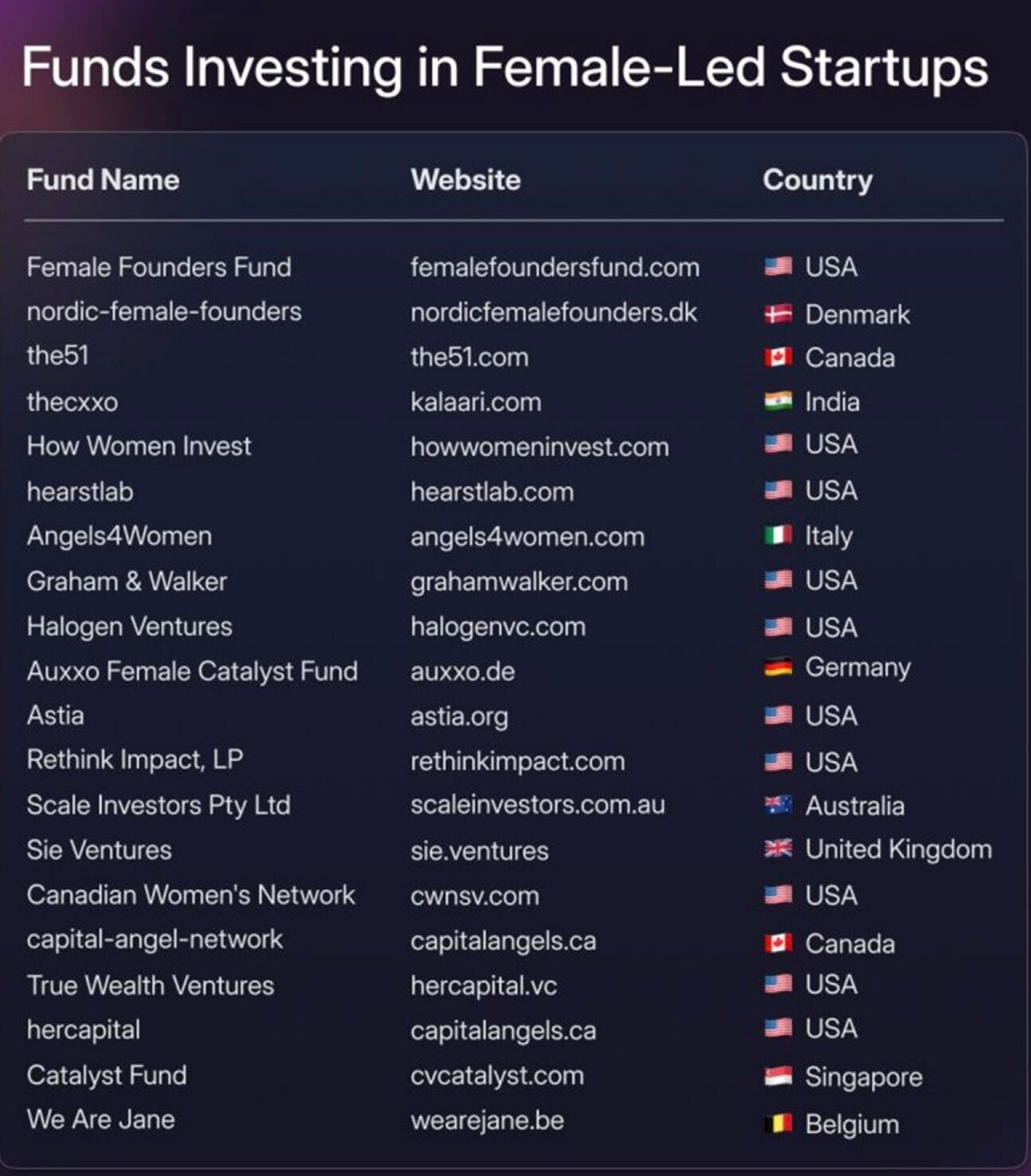

174+ Female-Led Venture Capital Firms Directory

Female-Led Venture Capital Firms

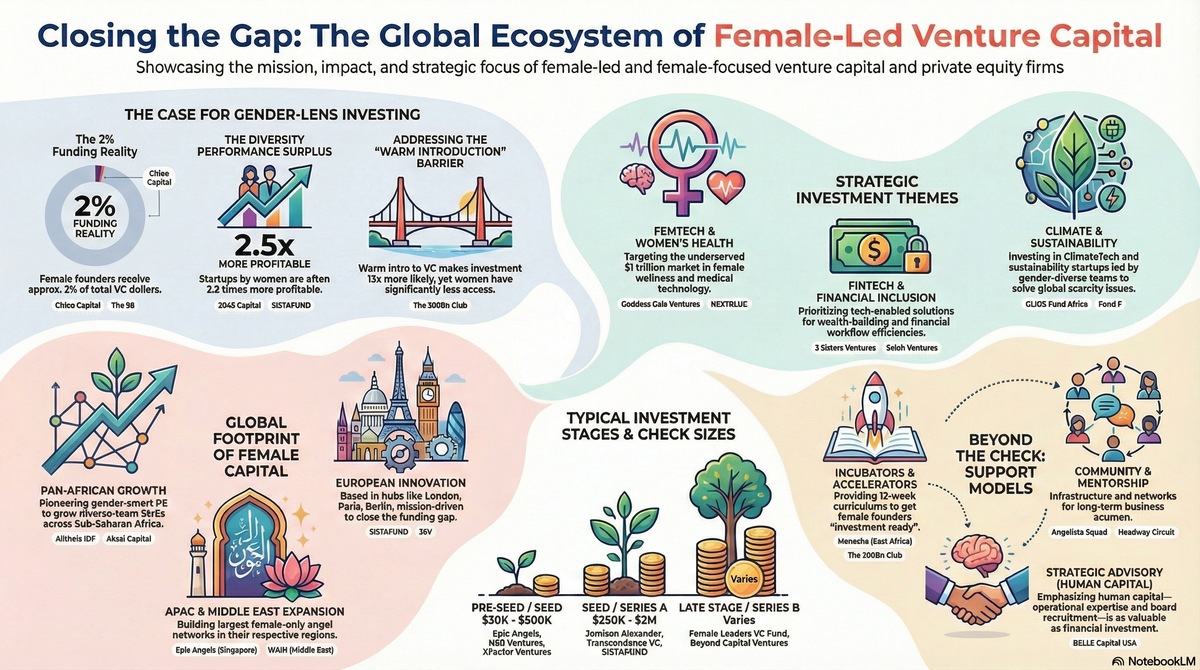

The venture capital landscape has long been dominated by homogeneous investor networks, creating persistent funding gaps for underrepresented founders. Female-led venture capital firms are challenging this status quo by deploying capital through gender-smart investing strategies that prioritize diverse founding teams and women-focused business solutions.

This comprehensive analysis examines over 170 venture capital firms led by women investors, revealing a growing ecosystem dedicated to closing gender funding gaps. These firms operate across multiple continents, from Silicon Valley to Sub-Saharan Africa, demonstrating that inclusive investing has become a global movement rather than a niche strategy.

Gender-Smart Investing: Context and Market Evolution

The emergence of gender-lens investing represents a fundamental shift in venture capital allocation. Traditional VC firms have historically directed less than 2% of total capital to all-female founding teams, creating a systemic barrier to entrepreneurial growth. Female-led venture capital firms emerged as a direct response to this market failure.

Gender-smart investing extends beyond simple diversity metrics. These firms recognize that diverse founding teams generate superior returns while addressing underserved market segments. Women control approximately 85% of consumer purchasing decisions globally, yet products and services rarely reflect their specific needs. This disconnect creates substantial market opportunities that traditional investors often overlook.

The growth trajectory of female-led VC firms has accelerated significantly. Early-stage funds focusing on women entrepreneurs have proliferated across geographies, with concentrations in the United States, United Kingdom, and emerging markets including Singapore and Australia. Many operate as partnerships or privately held entities, maintaining flexibility in investment strategies while building specialized expertise in sectors traditionally underinvested by conventional venture firms.

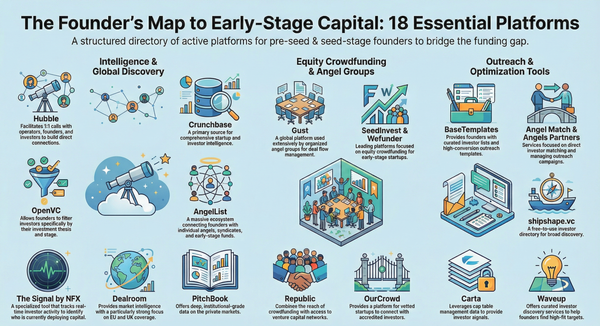

Early-Stage Investment Focus: Pre-Seed and Seed Funding Specialists

Female-led venture capital firms predominantly concentrate on early-stage investments, with the majority focusing on pre-seed and seed funding rounds. This strategic positioning addresses the most acute funding gaps, where women entrepreneurs face disproportionate challenges securing initial capital.

The typical fund size ranges from small, nimble operations with 1-10 employees to slightly larger teams of 11-50 professionals. This lean structure enables rapid decision-making and hands-on support for portfolio companies. Smaller team configurations also reduce overhead costs, allowing funds to deploy more capital directly into startups rather than operational expenses.

Early-stage specialization serves multiple strategic purposes. First, it allows these firms to access promising ventures before traditional VCs recognize their potential. Second, it creates opportunities to provide mentorship and operational guidance during critical company formation phases. Third, it builds strong founder relationships that often lead to follow-on investment opportunities in subsequent funding rounds.

Many firms explicitly state their commitment to supporting entrepreneurs through acceleration programs, advisory services, and network access. This value-added approach differentiates gender-smart investors from purely transactional capital providers, creating deeper partnerships with founding teams navigating early growth challenges.

Sector Specialization: Femtech, Fintech, and Impact-Driven Solutions

Female-led venture capital firms demonstrate clear sector preferences aligned with underserved market needs. Femtech emerges as a dominant investment theme, encompassing reproductive health, maternal care, menopause solutions, and women's wellness technologies. These products address medical conditions and life stages that traditional healthcare systems have historically neglected.

Fintech represents another major focus area, particularly solutions addressing the gender wealth gap and financial inclusion challenges. Investment targets include women-focused banking platforms, credit access tools for female entrepreneurs, and wealth management services designed for women's unique financial journeys. These applications recognize that women control increasing amounts of wealth yet remain underserved by conventional financial institutions.

Future of work technologies attract significant attention, especially remote work platforms, flexible employment solutions, and professional development tools. These innovations respond to women's disproportionate caregiving responsibilities and the persistent wage gap in traditional employment structures.

Family tech solutions, including childcare management platforms, education technology, and parenting resources, receive dedicated funding. These tools acknowledge the reality that women continue to shoulder primary responsibility for family logistics and child development activities.

Impact investing and ESG-friendly ventures feature prominently across firm investment theses. Many funds explicitly prioritize companies generating measurable positive social or environmental outcomes alongside financial returns. This dual mandate reflects growing investor recognition that profit and purpose need not exist in tension.