💀442 Startup Failure Post-Mortems

⚡15 Strategy Reports Shaping AI & Startups

In This Edition:

- ⚡15 Strategy Reports Shaping AI & Startups

- 💀442 Startup Failure Post-Mortems

- 💰 Massive Fundings & Mega Valuations

- 🏆How VCs Really Make Money

- ⚡How Prompt Politeness Affects LLM Accuracy

🧠 15 Must-Read Reports for AI Builders

⚡15 Must-Read Reports for AI & Startup Builders

Every week, hundreds of AI headlines flood your feed.

But only a handful actually move the needle for founders, investors, and operators.

So instead of doom-scrolling through hype, here’s a curated list of 15 must-read AI + VC reports worth your time this week.

Inside, you’ll find:

The real story behind the AI funding boom (FT)

Deep dives on valuations, growth rates, and VC trends

OpenAI’s leaked financials and public debate: IPO or stay private?

The Top 20 AI Agent Startups redefining the landscape

And new reports on State of AI 2025, Defence Tech, SaaS Survival, and more

From Meta’s latest AI research to VC reflections on courage and conviction — these insights paint a clearer picture of where the industry is heading next.

If you only read one AI roundup this week — make it this one.

Save yourself hours of digging. The gold is already filtered.

Explore every insight and download all 15 reports.

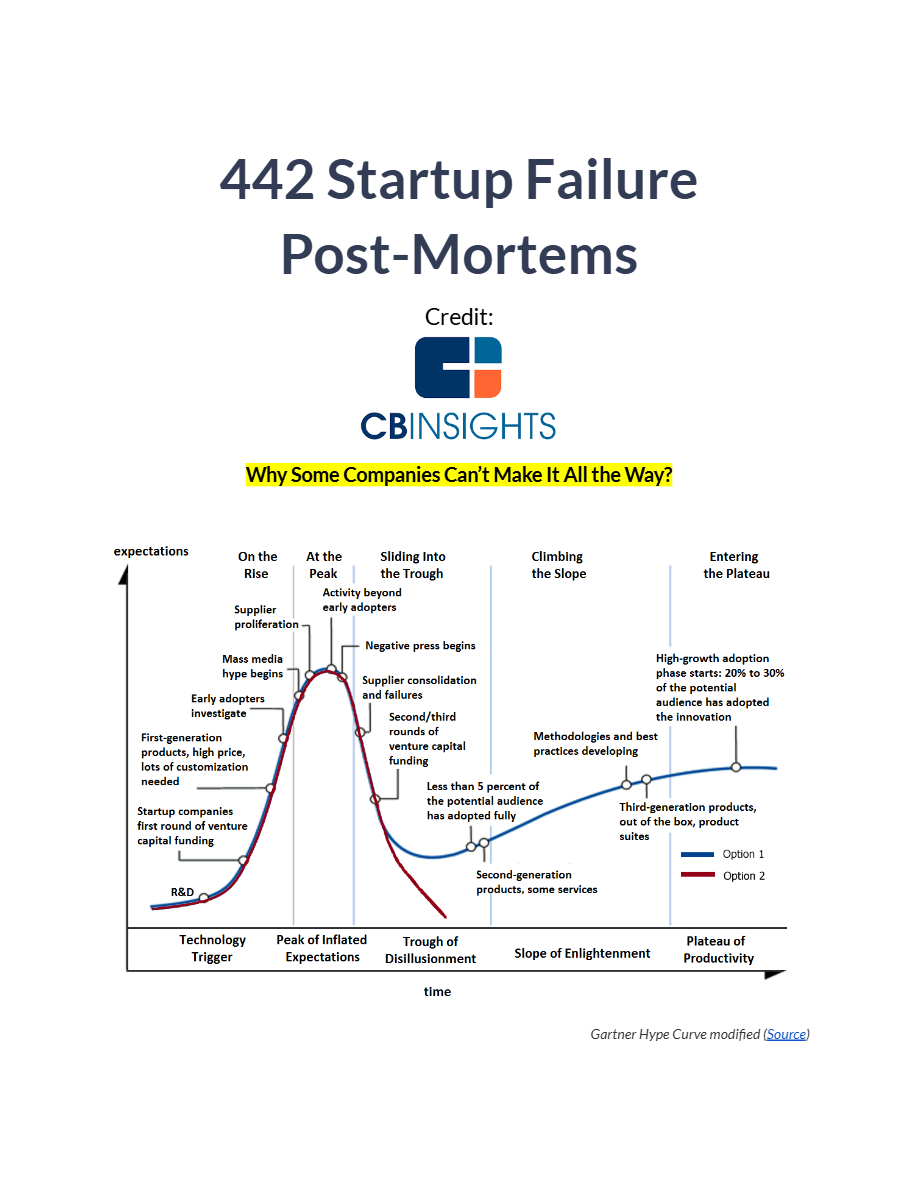

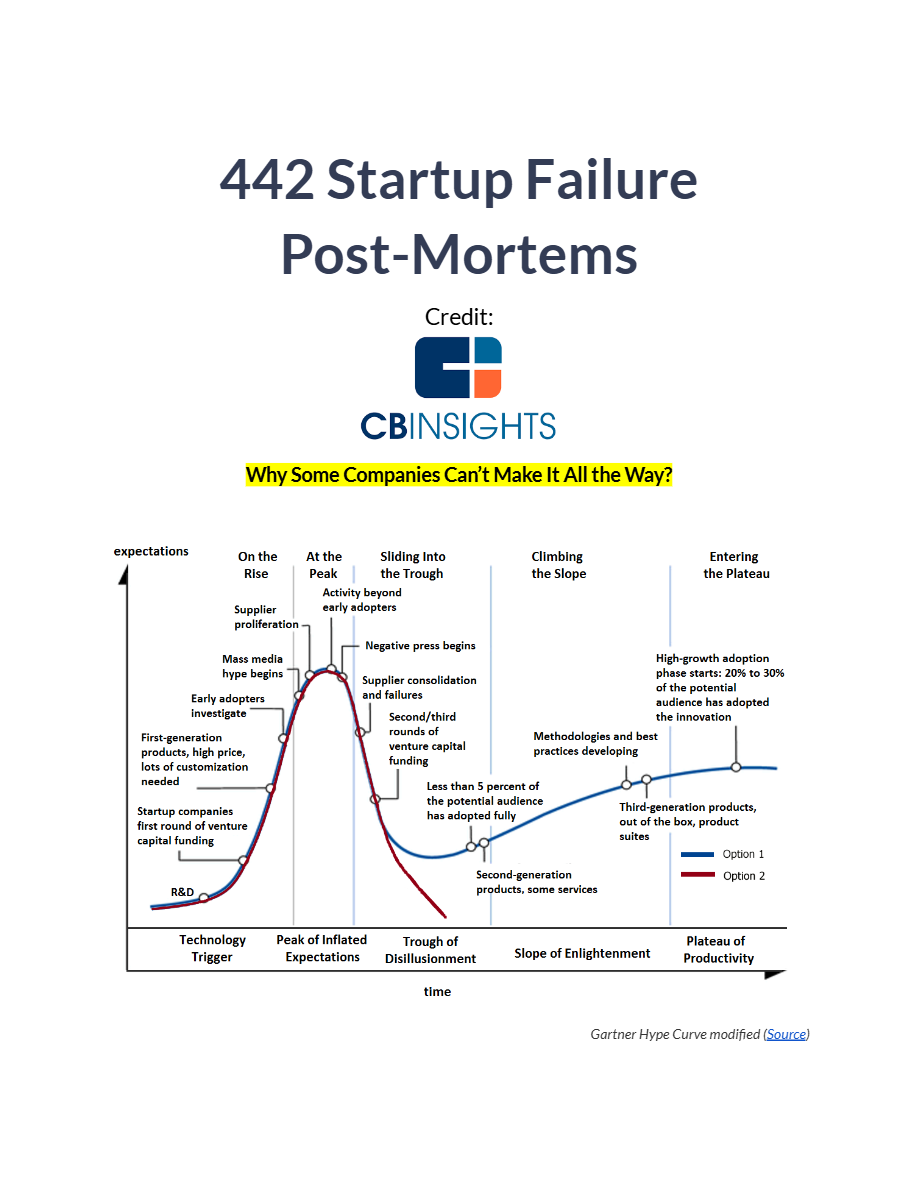

📉 What Every Founder Can Learn from 442 Shutdowns

💀 442 Startup Failure Post-Mortems

When Startups Fall: Lessons Hidden in 442 Failures

From billion-dollar unicorns to early-stage visionaries, more than 400 startups shut down in the past year — each carrying a vital lesson for founders, investors, and operators. Failure, when studied closely, becomes a playbook for resilience and better decision-making.

Key Insights:

⚙️ Funding ≠ Longevity – Even well-capitalized startups like Argo AI and Volt Bank collapsed under misaligned growth expectations.

Market Timing Matters – Companies like Kite and Faze Medicines fell victim to premature innovation and shifting investor sentiment.

Product-Market Fit Is Relentless – Many, from BeyondMinds to Protonn, had strong tech but weak market traction — the most common death signal.

External Shocks Accelerate Weakness – Economic downturns, regulation, and pandemics exposed fragile business models overnight.

Behind every shutdown lies insight worth saving.

Explore the “Learn From Failure” analysis to uncover what 442 post-mortems reveal about why startups fail — and how the next generation can avoid their fate. ️👇

🏆How VCs Really Make Money

🏆How VCs Really Get Rich (Founders Should Know This)

It’s not just about big checks and bold bets — there’s a hidden economic engine behind every venture fund. From LPs and GPs to management fees and carried interest, understanding VC mechanics can change how you view startups, investments, and exits.

This week’s feature breaks down venture capital economics in the simplest way possible — perfect for founders, operators, and aspiring investors.

Key Insights

- The Power Law Play: Out of 20 bets, most crash—but one breakout 200x win can repay the entire fund (and more).

- LPs vs GPs: The silent backers (LPs) fund the show, while the dealmakers (GPs) call the shots—splitting profits only after LPs get their money back, with GPs pocketing up to 30% of the upside.

- Fees & Carry Secrets: Those 2–3% annual fees keep the lights on—but the real fortune lies in carried interest, where performance, not promises, pays off big.

For founders, operators, and emerging investors, mastering VC economics is key to understanding what drives funding decisions.

Read the full breakdown & explore the course here.

⚡How Prompt Politeness Affects LLM Accuracy

⚡Founders: This Simple Prompting Trick Boosts Accuracy

A new study reveals a surprising twist in how large language models respond to human tone. Contrary to expectations, aggressive or direct prompts appear to improve AI accuracy—especially in advanced models.

Key Insights:

- Study Scope: Researchers tested 250 prompts across math, science, and history—each repeated 10 times using varying tones.

- ⚡ Results: “Very rude” prompts achieved 84.8% accuracy, outperforming “very polite” ones at 80.8%.

- Model Behavior: Earlier systems like GPT-3.5 showed no tone-based variation—suggesting the effect is unique to newer architectures.

- Interpretation: The improvement may stem from how AI models interpret urgency and assertiveness in user intent.

This discovery challenges assumptions about how humans should communicate with AI—hinting that tone could shape performance.

Download the full report and explore expert resources on effective prompting at here.️

💰 Massive Fundings & Mega Valuations — Full Breakdown

Capital is pouring into biotech, AI, fintech, and vertical SaaS. Here’s where the biggest checks are going — and who’s backing them:

• Corxel (Berkeley Heights, NJ) — Cardiometabolic biotech

Raised $287M Series D1

Investors: SR One, TCGX, RA Capital Management, HBM Healthcare, SymBiosis, RTW Investments, Hengdian Group Capital

• Cubby (New York) — Self-storage software platform

Raised $63M Series A

Lead investor: Goldman Sachs Alternatives

• Juspay (Bengaluru) — Payments infrastructure for enterprises & banks

Raised $50M Series D at $1.2B valuation

Lead investor: WestBridge Capital

• Mews (Amsterdam) — Hotel operating system

Raised $300M Series D at $2.5B valuation

Investors: EQT Growth (lead), Atomico, HarbourVest, Kinnevik, Battery Ventures, Tiger Global

• Oura (Finland) — Smart health wearable (Oura Ring)

Planning tender offer at ~25% discount to $11B valuation

Goal: enable liquidity while staying private longer

• Recursive (Palo Alto) — Autonomous AI research systems

Raising hundreds of millions at $4B valuation

In talks with: GV, Greycroft

Founder: Richard Socher

• World Labs (San Francisco) — 3D world models for AI simulation

In talks to raise up to $500M at $5B valuation

Founder: Fei-Fei Li

📌 Signal: AI infrastructure, autonomous research, biotech, and vertical SaaS are pulling in the largest conviction bets from top-tier VCs.

✨ ICYMI — These Resources Blew Up This Week

Founders were scrambling for these drops—each one unlocked deal flow, investor access, or tactical fundraising shortcuts. If you missed them the first time, this is your chance to catch up before everyone else does.

Don’t wait. These are the kind of links founders bookmark—and competitors quietly use.

- 🧠 How He Transformed $500 into a $10M Empire

- 🚀55 U.S. AI Startups Raised $100M+ in 2025

- 🥇490+ AI Pitch Decks VCs Said Yes To

- 🤖 20,000 McKinsey “Employees” Aren’t Human

- 💰36+ AI Startups Hit $1B Valuation

- 🏆 Why Founders Raise Wrong

- 🚀 From “$0 Market” to Global Giant — A Playbook for AI Founders

- 🤑How AI Creates Millionaires (According to Nvidia’s CEO)

- 🔥Why Good Ideas Still Fail

- 🚨AI Agents Are Becoming Employees — Most Teams Aren’t Ready

- 🌱OpenAI Startup Program 2026

Startups Buzz

The 40% Rule: How to Know When You’ve REALLY Hit Product-Market Fit

Finding product-market fit isn’t guesswork; the “40% Rule” suggests 40% of customers would be “very disappointed” without your product. Use this benchmark to validate real traction and avoid premature scaling.

Read more: The 40% Rule: How to Know When You’ve REALLY Hit Product-Market Fit

Top 10 Legal Mistakes Made by Startup Founders

Startups often overlook key legal documents and protections—mistakes that can derail funding or invite lawsuits. For example: not having a founders’ agreement or ignoring trademark registration can cause significant disruptions.

Read more: Top 10 Legal Mistakes Made by Startup Founders

Extending Your Runway: Practical Cash Management Hacks for Early-Stage Startups

Cash isn’t just about how much you have—it’s how you plan, track and allocate it. Founders must define true “cash,” model runway, and remain flexible to avoid liquidity pitfalls.

Read more: Extending Your Runway: Practical Cash Management Hacks for Early-Stage Startups

Anatomy of a Series Seed Pitch Deck That Closes – Investor Storytelling Essentials

Effective decks tell a clear story: problem → solution → market size → traction → team → ask. Investors want narrative clarity, not slides full of jargon. A well-structured deck dramatically increases closing chances.

Read more: Anatomy of a Series Seed Pitch Deck That Closes: Investor Storytelling Essentials

The Great Debate: When to Bootstrap and When to Seek Institutional VC

Bootstrapping allows control and slower growth; institutional VC brings capital, scale-up speed and dilution. The right choice depends on your product stage, market urgency and team capacity.

Read more: The Great Debate: When to Bootstrap and When to Seek Institutional VC

Hiring Your First 5: Leveraging Culture and Mission to Attract A-Players Without Big Salaries

Early startup talent isn’t always motivated by high pay—mission, ownership and culture matter more. Lay foundations for a strong team by weaving purpose into your hiring story.

Read more: Hiring Your First 5: Leveraging Culture and Mission to Attract A-Players Without Big Salaries