🚀14 Must-Follow YouTube Channels for Startup Founders

🎯 The Free University for Startup Founders

In This Edition:

- 🎯 The Free University for Startup Founders

- 💸 Massive Fundings You Shouldn’t Miss

- 🔗 500+ Angels + 530+ Networks (One Pack)

- 🚀 Startup Programs Helping Founders

- 🌍 From $0 Market to Global Giant

- 🔥 How One Wrong Accelerator Burns $35M

🚀 The Free University for Startup Founders

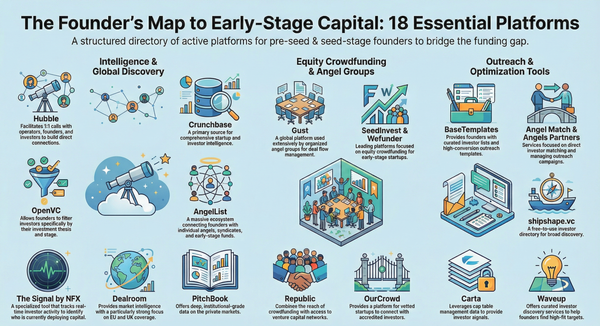

🚀 14 Must-Follow YouTube Channels for Startup Founders

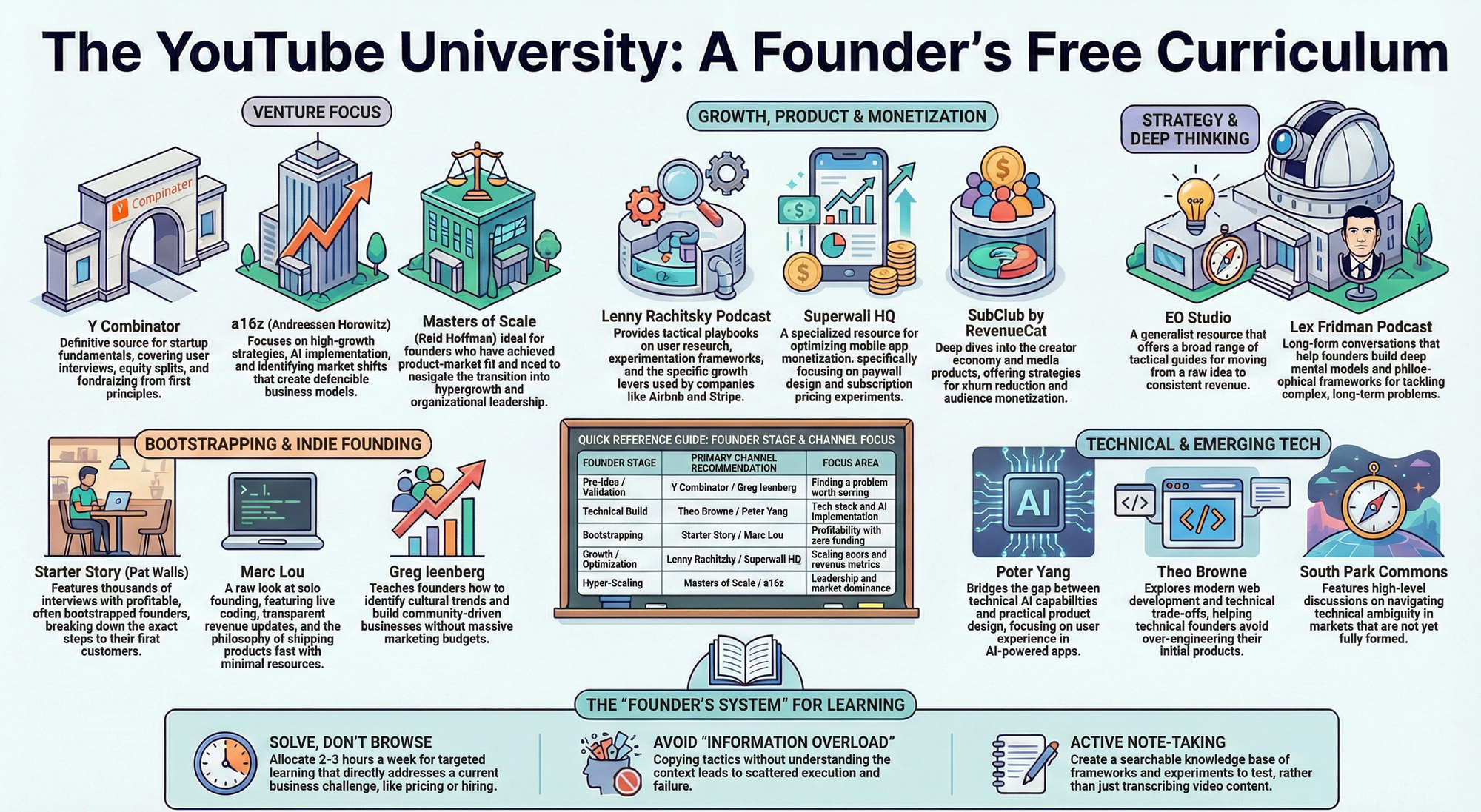

YouTube is the most underrated free university for founders.

These 14 channels cover everything from:

• Validating startup ideas

• Raising capital

• Product-market fit

• Growth & monetization

• AI and modern startup execution

The insights from these channels helped us validate our idea, gain early traction, and raise a $2.8M pre-seed round at Rork.

A few highlights you shouldn’t miss 👇

🎯 a16z – Tech trends, AI, and startup strategy

🎯 Y Combinator – Raw advice from billion-dollar founders

🎯 Greg Isenberg – Internet businesses & community-led growth

🎯 Lenny’s Podcast – Tactical product & growth playbooks

🎯 Lex Fridman Podcast – Deep conversations on AI, startups & first principles

…and 9 more channels every early-stage founder should follow.

📌 If you’re building a startup in 2026, this list can save you years of trial and error.

Read the full blog here 👇

💰 Massive Fundings You Shouldn’t Miss

💰 Massive Fundings You Shouldn’t Miss (Startup & AI Edition)

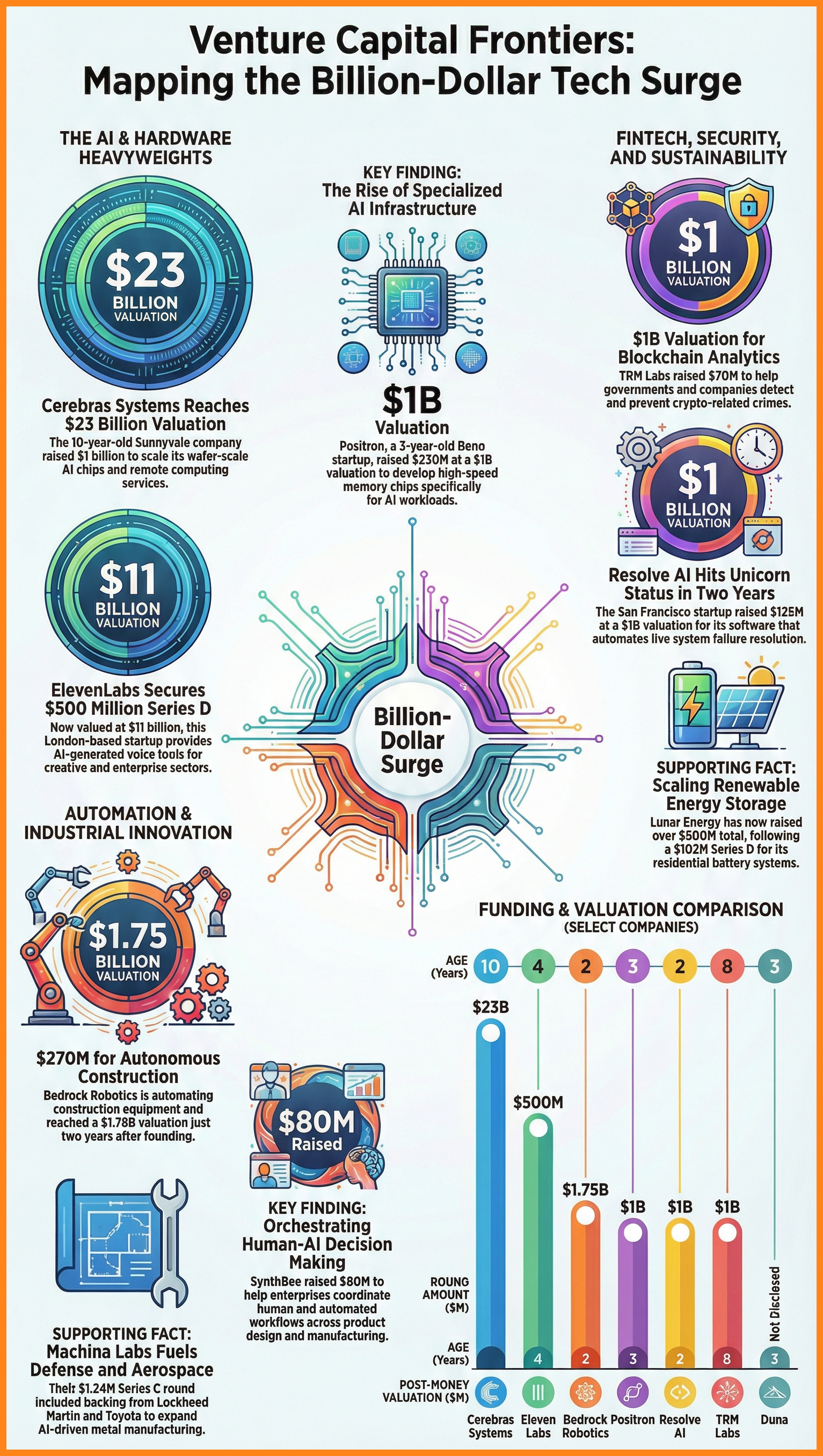

Big capital is flowing into AI, robotics, fintech, energy, and deep tech. Here are the latest mega funding rounds every founder and investor should know 👇

• Bedrock Robotics — raised $270M Series B at a $1.75B post-money valuation.

The round was co-led by CapitalG and Valor Atreides AI Fund.

Total capital raised now exceeds $350M.

• Cerebras Systems — secured $1B at a $23B valuation.

The round was led by Tiger Global, with participation from Benchmark, Fidelity, and Advanced Micro Devices.

• Duna — raised $35.4M Series A led by CapitalG, alongside Index Ventures and Puzzle Ventures.

• ElevenLabs — closed a $500M Series D at an $11B valuation.

The round was led by Sequoia Capital, with Andreessen Horowitz and Iconiq participating.

• Kindred — raised $85M Series C led by Index Ventures.

The company also disclosed a prior $40M Series B, co-led by New Enterprise Associates and Dylan Field.

• Lunar Energy — secured $102M Series D, co-led by B Capital and Prelude Ventures.

Total funding now exceeds $500M.

• Machina Labs — raised $124M Series C, backed by Woven Capital, Lockheed Martin Ventures, and Toyota-affiliated investors.

• Positron — closed $230M Series B at a $1B valuation.

The round was co-led by Arena Private Wealth, Jump Trading, and Unless.

Total capital raised exceeds $300M.

• Resolve AI — raised $125M at a $1B valuation, led by Lightspeed Venture Partners, with participation from Greylock Partners.

• SynthBee — raised $80M in a round led by Crosspoint Capital Partners.

• TRM Labs — closed a $70M Series C at a $1B valuation, led by Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Thoma Bravo, and Citi Ventures.

Large rounds are increasingly concentrated in AI infrastructure, compliance, energy, and advanced manufacturing — signaling where institutional conviction is strongest right now.

👉 Curious who’s leading the biggest bets right now? Click below to explore deeper investor signals, valuation moves, and funding context. 👇

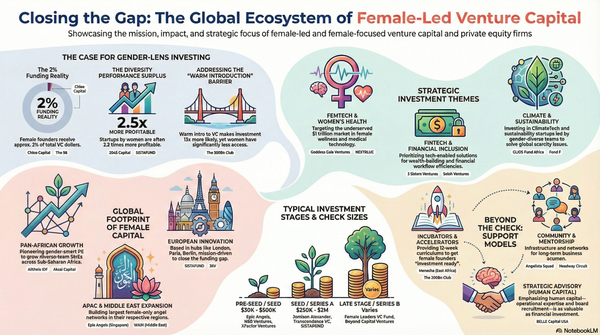

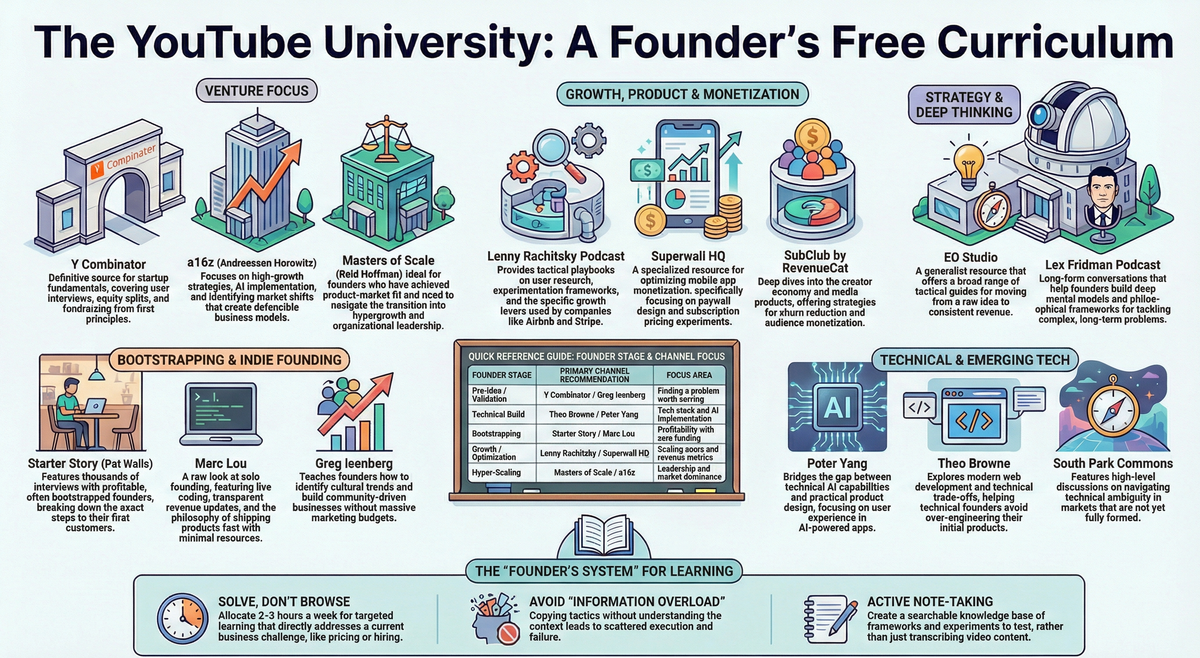

🔥500+ Angels + 530+ Networks (One Pack)

Fundraising shouldn’t feel like walking into a VC maze without a map.

Yet most founders still waste months pitching the wrong rooms, the wrong investors, at the wrong time.

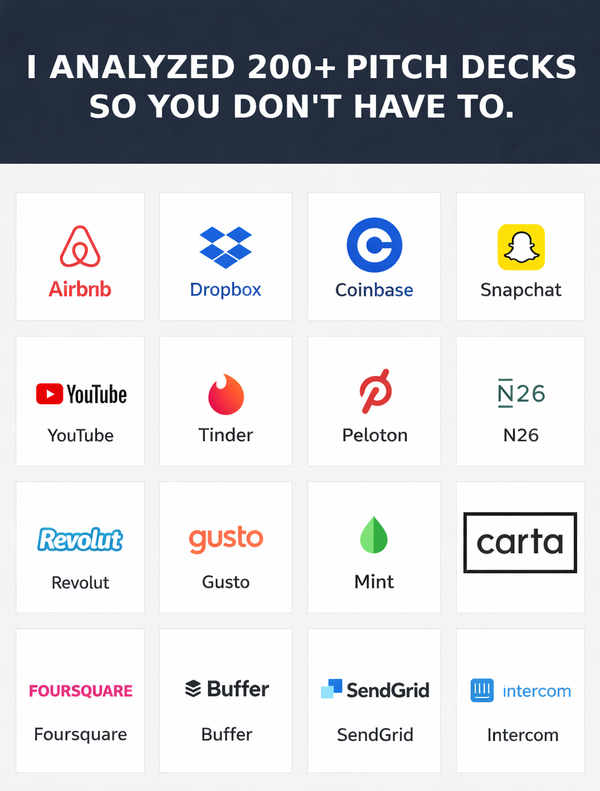

This new Investor Pack for 2026 removes the guesswork with curated, founder-friendly lists across the categories actually getting funded right now: AI, SaaS, Fintech, Deep Tech, Blockchain, and more.

Inside the pack:

- Stage + category-matched investor lists (so outreach starts targeted)

- 49 AI startups that raised $100M+ (to reverse-engineer positioning + timing)

- 500+ active angels + 530+ angel networks (all in one place)

- 50+ real pitch decks that worked (to model structure + storytelling)

It’s not just data. It’s fundraising leverage—compressed into one playbook.

🚀 Startup Programs Helping Founders Win in 2026

🚀 Startup Programs Quietly Powering the Best Founders in 2026

Some of the strongest startups in 2026 won’t come from hype — they’ll come from the right accelerators.

Programs like a16z speedrun, Y Combinator, South Park Commons, Antler, and Techstars are backing founders earlier than ever — often before traction, sometimes before the team is fully formed.

The real edge isn’t just the capital.

It’s signal, speed, and unfair access.

We mapped 30+ global programs actively funding founders across AI, fintech, biotech, SaaS, and healthcare — including how much they invest and who they’re best for.

👉 Curious which programs founders are quietly using to move faster in 2026? 🔍 See the full accelerator breakdown.

🔥Build Where Others See Nothing

🚀 From $0 Market to Global Giant

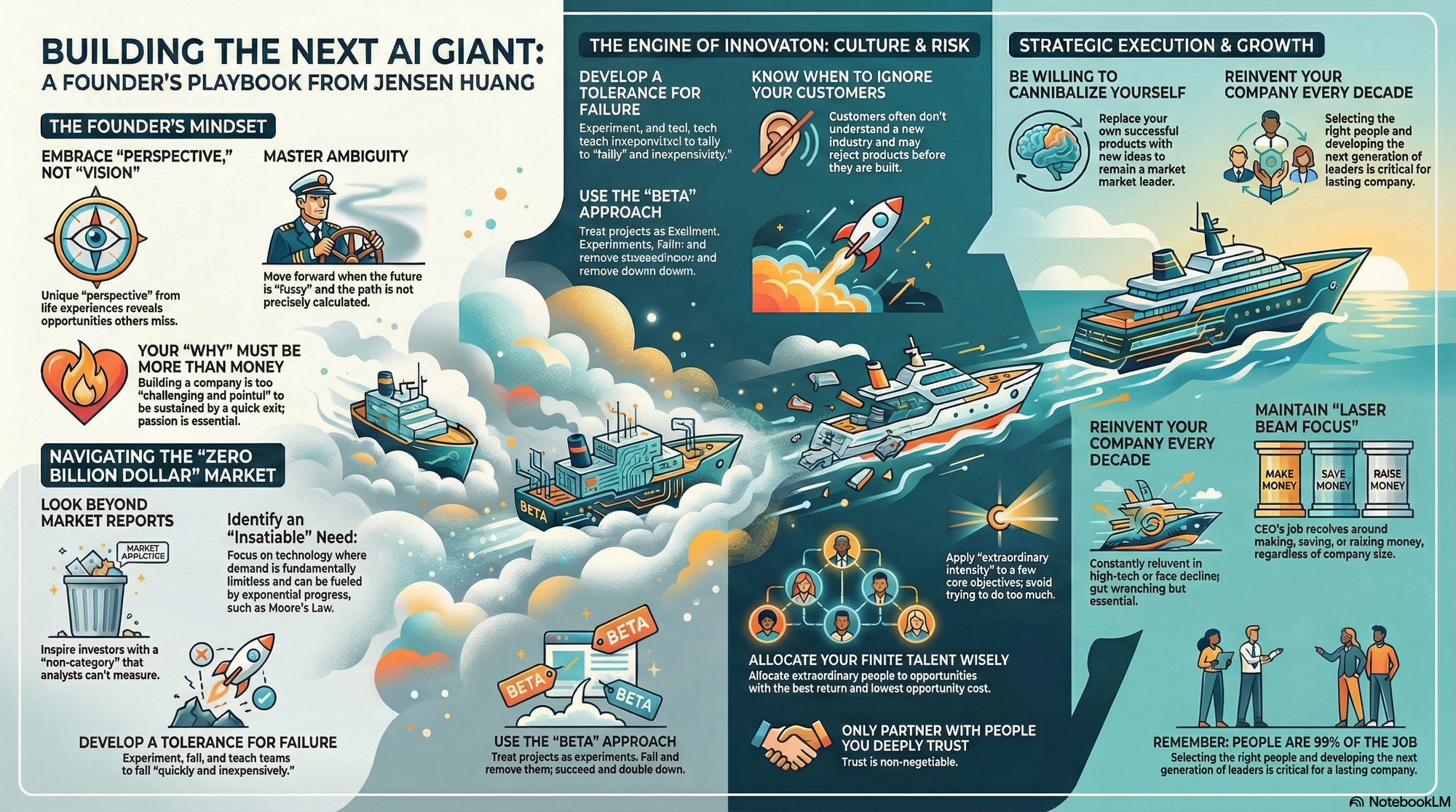

What does it really take to build a company that lasts decades in AI?

From Jensen Huang’s Stanford lecture, one message is clear: category-defining companies aren’t built on hype—they’re built on perspective, courage, and comfort with uncertainty.

🔑 Key Takeaways (Short & Sharp)

- Perspective > Vision

You don’t need grand predictions—just a unique way of seeing problems others ignore. - Build for the $0 Market

Breakthroughs often start where demand doesn’t exist yet. Ignore analysts early. - Radical Intellectual Honesty

Innovation requires fast, cheap failure—and teams that admit mistakes quickly. - Cannibalize Yourself First

If you don’t kill your best product, a competitor will. - Move Through the Fog

Great founders act decisively even when the future is unclear.

🧠 Founder Analogy

Building a startup is like finding water in a desert.

Others see nothing. You trust your perspective—and keep digging.

⚡ Most founders play it safe. The great ones don’t.

Re-read this and ask yourself: Am I building for today’s market—or tomorrow’s inevitability?

Build where others see nothing. That’s where giants begin.

🧠 How to Actually Win YC (X26 Edition)

Getting into Y Combinator isn’t about having the coolest product—it’s about showing clarity, momentum, and inevitability.

Acceptance rates are brutal (<1%), but YC patterns are surprisingly consistent if you know what to look for.

Here’s what strong founders should focus on before hitting “Apply”:

- Momentum > Ideas

YC cares deeply about what you’ve done in the last 60–100 days. Progress beats polish. - Clear, Sharp Answers

Every YC question is a filter. Rambling kills applications. Precision wins. - Founder-Market Fit Matters

Why you? Why now? YC optimizes for conviction and urgency. - Referrals Are a Force Multiplier

Warm intros from partners or recent alumni significantly increase surface area. It’s not unfair—it’s how signal works. - Study What Worked Before

Reading real accepted applications (old + recent) reveals patterns no blog post explains. - YC Tells You What They Want

Their “Request for Startups” list is an underrated roadmap of where capital attention is heading.

Bottom line:

YC isn’t random. It’s a game of signal, speed, and storytelling.

Build momentum. Increase your luck surface area. Then apply. 🚀

✨ ICYMI

Founders were scrambling for these drops—each one unlocked deal flow, investor access, or tactical fundraising shortcuts. If you missed them the first time, this is your chance to catch up before everyone else does.

Don’t wait. These are the kind of links founders bookmark—and competitors quietly use.

🔥 The Most Clicked Founder Resources

📚 The Ultimate Fundraising Resource Stack

A vault of tools most founders don’t know exists.

🔑 The Most Overlooked Key to Fundraising Success

YC founders swear by this — yet most ignore it.

🔥 Paul Graham’s ‘Small, Intense Fire’

The mindset shift that separates funded from forgotten.

🧠 What Sam Altman Wants Every Founder to Know

The blunt guidance founders rarely hear early enough.

📊 Venture Math Demystified

Why VCs say no — even when your pitch feels strong.

🚀 The Pre-Seed Playbook Every Founder Needs

A practical guide to nailing your first raise.

💡Fundraising Mistakes From a $13M Raise

Avoid the painful errors most founders repeat.

Don’t just save these—use them. The founders who act fastest raise fastest. Want these in a searchable Notion library?

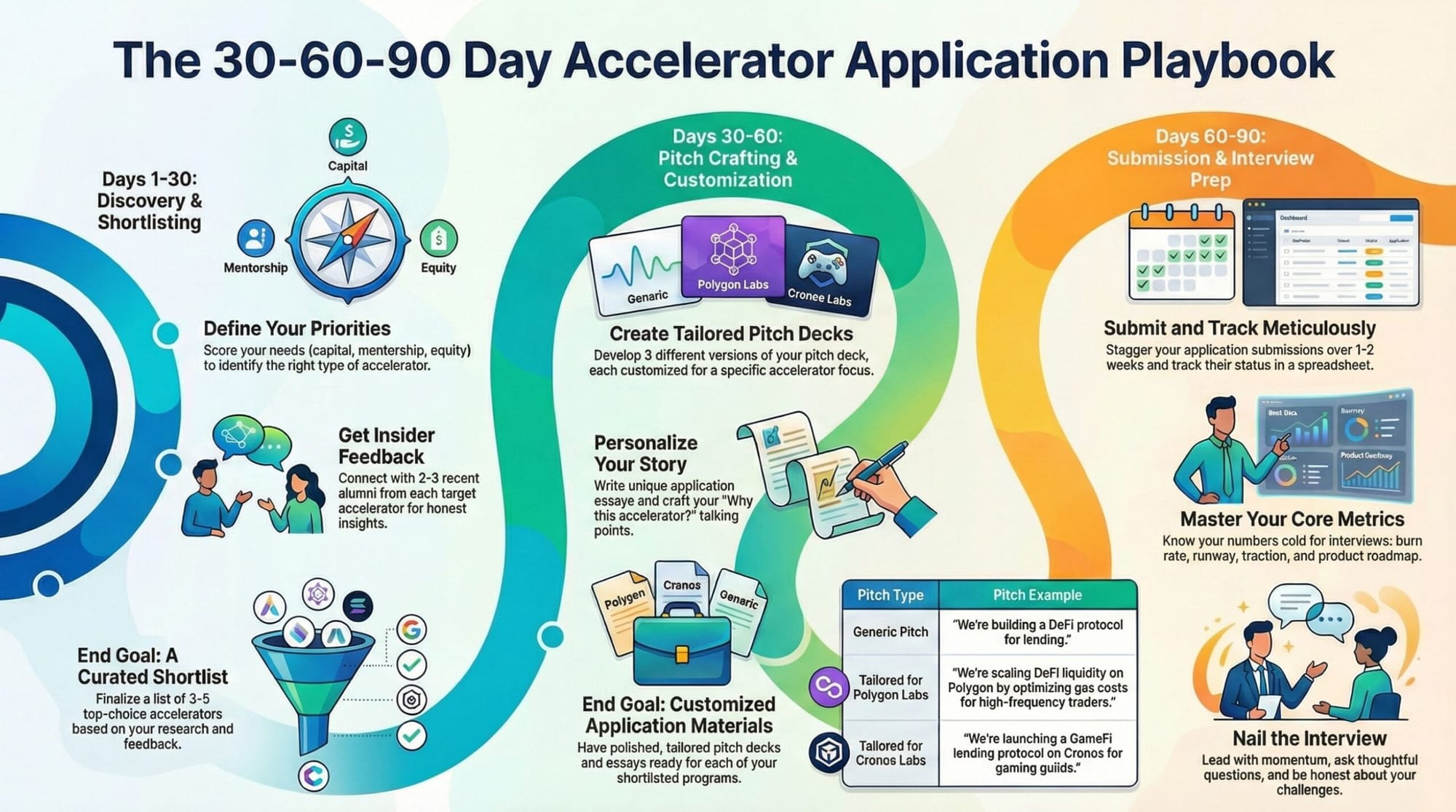

🔑 How One Wrong Accelerator Burns $35M

🚀 What a16z-Backed Founders Do Differently

If you’re building a Web3 startup in 2026, your accelerator decision can quietly become a $10M+ outcome lever—or a costly distraction.

This playbook distills 20 active Web3 accelerators, real founder outcomes, and 2025 market data into a clear, stage-by-stage decision system so founders don’t waste months, momentum, or equity.

🚀 Why This Matters

- $18B flowed into Web3 startups in 2025

- Founders coming out of top accelerators raise 4–7× more capital

- Wrong accelerator = 3 months lost + 5–7% equity gone + missed fundraising momentum

Big winners like Phantom, Flashbots, and Goldfinch didn’t get lucky—they chose the right accelerator for their stage.

❌ The 3 Accelerator Mistakes That Kill Momentum

- Apply to Everything → Generic pitches, weak signal, higher rejection

- Chase Brand Over Fit → Prestige ≠ outcomes (YC/a16z aren’t for everyone)

- Ignore Equity Math → Early dilution can cost $25–35M at exit

🧭 The Accelerator Selection Framework (Founder-Tested)

Step 1: Be Honest About Your Stage

- Pre-Seed (idea / no MVP) → Antler, XFounders, Celo Camp

- Early MVP / Validation → Alliance DAO, Outlier Ventures, Techstars Web3

- PMF / Growth → a16z Crypto Startup School, Y Combinator, Colosseum

- Ecosystem-Specific → Starknet, Polygon, TON, Cronos, ChainGPT Labs

Quick self-test: If asked about revenue, are you excited—or ashamed?

Step 2: Score What Actually Matters (1–10)

Founders should rank accelerators across 9 factors, including:

- Capital amount

- Equity cost

- Mentorship depth

- Investor access

- Ecosystem fit

- Timeline & intensity

- Prestige value

- Geography

- Vertical focus

This avoids “hype decisions” and forces rational trade-offs.

Step 3: Use the 3-Accelerator Strategy

Apply to:

- 1 Reach (2–5% acceptance) → YC, a16z, Outlier

- 1 Target (10–25%) → Alliance, CV Labs, Techstars, Colosseum

- 1 Safety (25%+) → Ecosystem or non-dilutive programs

This gives leverage, optionality, and faster outcomes.

⚠️ 6 Red Flags to Avoid

- Paid application fees

- “Guaranteed” investor intros

- No post-demo-day support

- 100% acceptance rates

- Celebrity mentors who never show up

- No alumni transparency

📈 The Accelerator Truth Most Founders Miss

Your outcome is 60% founder execution, 40% program quality.

Winning founders:

- Ship relentlessly

- Use mentors weekly

- Fundraise during the program

- Network intentionally

- Treat demo day as the start, not the finish

An accelerator won’t build your startup—but it can compress 24 months into 12 weeks if you pick the right one and show up all-in.

The difference between a $5M Series A and a $25M Series A often starts here.

👉 Download the 30-60-90 Accelerator Application Playbook

(Includes scoring matrix + decision tree for founders)